- Page 1 and 2:

University of Scranton 2003-2004 Ca

- Page 3 and 4:

2003-04 Academic Calendar FALL 2003

- Page 5 and 6:

2 Rights Reserved The President and

- Page 7 and 8:

4 A COMMUNITY OF SCHOLARS • JESUI

- Page 9 and 10:

6 A Community of Scholars • Jesui

- Page 11 and 12:

8 A Community of Scholars • Jesui

- Page 13 and 14:

10 A Community of Scholars • Jesu

- Page 15 and 16:

12 UNDERGRADUATE ADMISSION AND EXPE

- Page 17 and 18:

14 Undergraduate Admission and Expe

- Page 19 and 20:

16 Undergraduate Admission and Expe

- Page 21 and 22:

18 Undergraduate Admission and Expe

- Page 23 and 24:

20 Undergraduate Admission and Expe

- Page 25 and 26:

22 Scholarships and Financial Aid P

- Page 27 and 28:

24 Scholarships and Financial Aid S

- Page 29 and 30:

26 Scholarships and Financial Aid s

- Page 31 and 32:

28 Scholarships and Financial Aid T

- Page 33 and 34:

30 Scholarships and Financial Aid s

- Page 35 and 36:

32 Scholarships and Financial Aid t

- Page 37 and 38:

34 Scholarships and Financial Aid i

- Page 39 and 40:

36 Scholarships and Financial Aid p

- Page 41 and 42:

38 Life on Campus Student Services

- Page 43 and 44:

40 Life on Campus faculty, staff an

- Page 45 and 46:

42 Life on Campus Student Governmen

- Page 47 and 48:

44 Life on Campus sand volleyball c

- Page 49 and 50:

46 Life on Campus The Campus The Un

- Page 51 and 52:

48 Academics Academic Honor Societi

- Page 53 and 54:

50 Academics organization of nurse

- Page 55 and 56:

52 Academics The Center for Teachin

- Page 57 and 58:

54 Academics ___80 - ___81 Practicu

- Page 59 and 60:

56 Academics Audit Entry of the aud

- Page 61 and 62:

58 Academics graduation must make f

- Page 63 and 64:

60 Academics ten authorization on f

- Page 65 and 66:

62 Academics Computer Science Couns

- Page 67 and 68:

64 Academics and scholars including

- Page 69 and 70:

66 Academics SJLA Curriculum Depart

- Page 71 and 72:

68 Academics Honors Program Schedul

- Page 73 and 74:

70 Academics to many prestigious la

- Page 75 and 76:

72 Academics Many medical schools r

- Page 77 and 78:

74 Academics of organizing many gen

- Page 79 and 80:

76 Academics 5. PSYC 360: Clinical

- Page 81 and 82:

78 Academics The Peace and Justice

- Page 83 and 84:

80 Academics Aerospace Studies (Air

- Page 85 and 86:

82 Academics The University of Scra

- Page 87 and 88:

84 Academics Electives Four courses

- Page 89 and 90:

THE COLLEGE OF ARTS AND SCIENCES k

- Page 91 and 92:

Baroque, and 18th-century Europe. I

- Page 93 and 94:

Great emphasis will be placed on in

- Page 95 and 96:

as indicated in the Pre-Medical sec

- Page 97 and 98:

BIOL 202 3 cr. (E) The ABC’s of G

- Page 99 and 100:

BIOL 358 3 cr. Cellular and Molecul

- Page 101 and 102:

Minor in Chemistry The minor in Che

- Page 103 and 104:

CHEM 110-111 6 cr. (E) Introductory

- Page 105 and 106:

CHEM 232-233 6 cr. (E) Organic Chem

- Page 107 and 108:

CHEM 350 3 cr. General Biochemistry

- Page 109 and 110:

CHEM 451 3 cr. Biochemistry II (Pre

- Page 111 and 112:

COMM 110 3 cr. Interpersonal Commun

- Page 113 and 114:

tising, antitrust and monopoly, tax

- Page 115 and 116:

COMM 433 3 cr. Television Criticism

- Page 117 and 118:

the requirements of CMPS or CIS. Ma

- Page 119 and 120:

including a survey of logic and des

- Page 121 and 122:

S/CJ 210 3 cr. (S) Law and Society

- Page 123 and 124:

S/CJ 284 3 cr. Special Topics in Cr

- Page 125 and 126:

ENGINEERING Robert A. Spalletta, Ph

- Page 127 and 128:

hoff’s Laws, resistive networks,

- Page 129 and 130:

algorithms. Analysis and design tec

- Page 131 and 132:

EE 484 3 cr. Superconductivity Devi

- Page 133 and 134:

ENLT 111 3 cr. The Art of Cinema Th

- Page 135 and 136:

ENLT 221 3 cr. (W) Woody Allen This

- Page 137 and 138:

ENLT 343 3 cr. Milton and 17th-cent

- Page 139 and 140:

ENLT 458 3 cr. Joyce This course ex

- Page 141 and 142:

work and strict adherence to deadli

- Page 143 and 144:

assignments that encourage students

- Page 145 and 146:

ESCI 493-494 3 cr. Research in Envi

- Page 147 and 148:

FREN 423 3 cr. Seventeenth-Century

- Page 149 and 150:

FREN 437 3 cr. Francophone African

- Page 151 and 152:

the 18th century. It focuses on sig

- Page 153 and 154:

SPAN 331 3 cr. (CL,D) Survey of Spa

- Page 155 and 156:

LIT 206 3 cr. Travelers and Their T

- Page 157 and 158:

international affairs including the

- Page 159 and 160:

HIST 222 3 cr. History of American

- Page 161 and 162:

characteristics of immigration. Exp

- Page 163 and 164:

Minor in Mathematics The Mathematic

- Page 165 and 166:

MATH 184-284-384-484 1-4 cr. Specia

- Page 167 and 168:

MATH 447 3 cr. Real Analysis II (Pr

- Page 169 and 170:

MIT 310 E-Research: Informationseek

- Page 171 and 172:

the instructor of record, the Profe

- Page 173 and 174:

Cognate in Neuroscience 31-37 credi

- Page 175 and 176:

nary language, deduction and induct

- Page 177 and 178:

PHIL 320 3 cr. (P) Aesthetics The m

- Page 179 and 180:

Course Descriptions PHYS 100 3 cr.

- Page 181 and 182:

PHYS 201 3 cr. (E) Stellar Evolutio

- Page 183 and 184:

elated to ongoing research projects

- Page 185 and 186:

The future prospects of women’s r

- Page 187 and 188:

PS 327 3 cr. U.S. Congress Reading

- Page 189 and 190:

PSYC 110 3 cr. (S) Fundamentals of

- Page 191 and 192:

PSYC 330 5 cr. Research Methods in

- Page 193 and 194:

the medical, psychiatric, family an

- Page 195 and 196:

SOC 229 3 cr. Crisis in Population

- Page 197 and 198:

and implementation of social servic

- Page 199 and 200:

T/RS 215 3 cr. (P,W) The History of

- Page 201 and 202:

of “the problem of evil” will b

- Page 203 and 204:

T/RS 329 3 cr. (P) Signs and Symbol

- Page 205 and 206:

THE KANIA SCHOOL OF MANAGEMENT k Th

- Page 207 and 208:

approval of his or her advisor, the

- Page 209 and 210:

ACC 363 3 cr. Federal Taxes (Prereq

- Page 211 and 212:

ACC 462 3 cr. Advanced Managerial A

- Page 213 and 214:

Kania School/Accounting Information

- Page 215 and 216:

national corporations. Internationa

- Page 217 and 218:

economic theory is used to analyze

- Page 219 and 220:

EC 473 3 cr. Business Applications

- Page 221 and 222:

hour administration, government reg

- Page 223 and 224:

FIN 473 3 cr. Financial Institution

- Page 225 and 226:

the U.S. and Japan, China, Korea an

- Page 227 and 228:

ment, and pollution control. Tort,

- Page 229 and 230:

MGT 473 3 cr. Organizational Social

- Page 231 and 232:

MKT 370 3 cr. Interactive Marketing

- Page 233 and 234:

in Supply Chain Management. Compute

- Page 235 and 236:

THE PANUSKA COLLEGE OF PROFESSIONAL

- Page 237 and 238:

includes interdisciplinary team-tau

- Page 239 and 240:

apply relaxation, cognitive restruc

- Page 241 and 242:

lum components include learning med

- Page 243 and 244:

to assess each individual student

- Page 245 and 246:

Panuska College/Education 243 Early

- Page 247 and 248:

EDUC 226 3 cr. Secondary, Transitio

- Page 249 and 250:

group study. Course is offered in a

- Page 251 and 252:

Secondary Education (Chemistry) Cur

- Page 253 and 254:

ment and appropriate learning strat

- Page 255 and 256:

Panuska College/Education 253 Secon

- Page 257 and 258:

Secondary Education (English) Curri

- Page 259 and 260:

Secondary Education (Latin) Curricu

- Page 261 and 262: Secondary Education (Modern Languag

- Page 263 and 264: Panuska College/Education 261 Speci

- Page 265 and 266: le to be excused from Physical Educ

- Page 267 and 268: ance as related to sport and exerci

- Page 269 and 270: Panuska College/Health Administrati

- Page 271 and 272: HADM 293 3 cr. (W) Research in Heal

- Page 273 and 274: Panuska College/Human Resources Stu

- Page 275 and 276: e on the basis of S, Satisfactory (

- Page 277 and 278: NURS 114 3 cr. Cardiopulmonary Crit

- Page 279 and 280: teacher in promoting and restoring

- Page 281 and 282: fessional behaviors and interperson

- Page 283 and 284: emphasis on normal and abnormal mov

- Page 285 and 286: OT 582 6 cr. OT Level II Internship

- Page 287 and 288: Education may petition to be exempt

- Page 289 and 290: ment therapeutic exercise regimens.

- Page 291 and 292: PT majors with graduate status: PT

- Page 293 and 294: 292 Dexter Hanley College Mission S

- Page 295 and 296: 294 Dexter Hanley College will noti

- Page 297 and 298: 296 Dexter Hanley College College-L

- Page 299 and 300: 298 Dexter Hanley College Alumni Di

- Page 301 and 302: 300 Dexter Hanley College/RN to B.S

- Page 303 and 304: 302 Dexter Hanley College/LPN to B.

- Page 305 and 306: 304 Dexter Hanley College/Associate

- Page 307 and 308: 306 Dexter Hanley College/Associate

- Page 309 and 310: 308 Dexter Hanley College/Associate

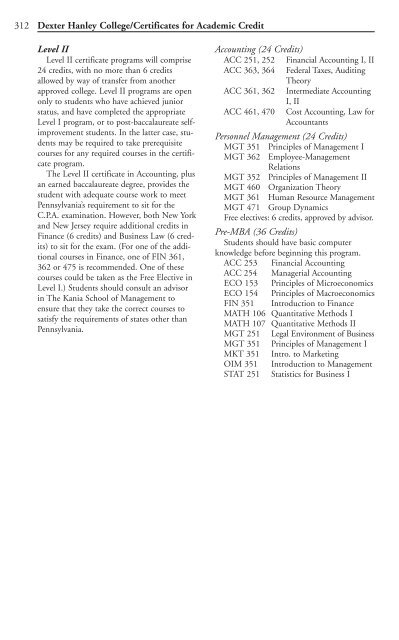

- Page 311: 310 Dexter Hanley College/Certifica

- Page 315 and 316: 314 The Graduate School The Graduat

- Page 317 and 318: UNIVERSITY DIRECTORY k 317

- Page 319 and 320: James J. Pallante (1991) Dean, Panu

- Page 321 and 322: J. Brian Benestad, D. et U.* (1976)

- Page 323 and 324: Curt Dixon (2001) Assistant Profess

- Page 325 and 326: Moses N. Ikiugu (1999) Assistant Pr

- Page 327 and 328: Linda S. Neyer (2000) Assistant Pro

- Page 329 and 330: J. Michael Strong, D. et U.* (1972)

- Page 331 and 332: Ray E. Burd (1989) Director of Prin

- Page 333 and 334: Larry J. Hickernell (1984) Web Tech

- Page 335 and 336: Darlene A. Miller-Lanning (1991) Di

- Page 337 and 338: Bonnie Strohl (1985) Associate Dire

- Page 339 and 340: Association of Jesuit Colleges and

- Page 341 and 342: 342 Index A Academic Advising Cente

- Page 343: 344 Index O Occupational Therapy, 2