Salz Review - Wall Street Journal

Salz Review - Wall Street Journal

Salz Review - Wall Street Journal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

53<br />

<strong>Salz</strong> <strong>Review</strong><br />

An Independent <strong>Review</strong> of Barclays’ Business Practices<br />

Figure 6.1 – Values and Number of FSA Fines Imposed by the FSA, per<br />

annum (2002-March 2013)<br />

Value, £m<br />

Number of fines<br />

400<br />

+1,274%<br />

100<br />

+4%<br />

300<br />

200<br />

100<br />

0<br />

7<br />

11<br />

-28%<br />

25<br />

17<br />

13<br />

5<br />

23<br />

35<br />

89<br />

66<br />

312<br />

102<br />

50<br />

0<br />

9<br />

17<br />

+156%<br />

32<br />

20<br />

27<br />

23<br />

51<br />

42<br />

80<br />

59<br />

53<br />

10<br />

% Difference between two years (in %)<br />

Note: 2013 data is as of 11 March<br />

Source: FSA website: www.fsa.gove.uk<br />

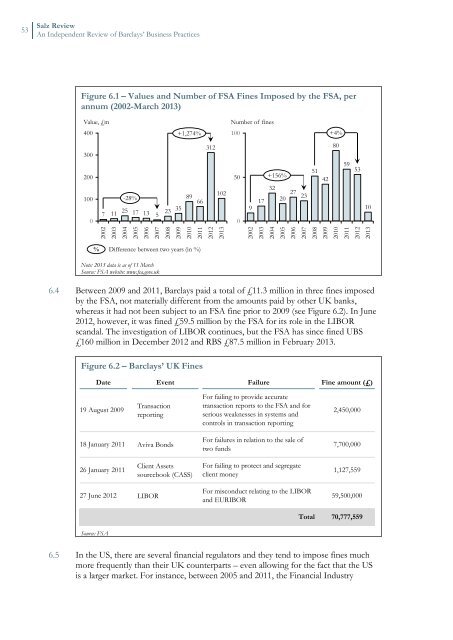

6.4 Between 2009 and 2011, Barclays paid a total of £11.3 million in three fines imposed<br />

by the FSA, not materially different from the amounts paid by other UK banks,<br />

whereas it had not been subject to an FSA fine prior to 2009 (see Figure 6.2). In June<br />

2012, however, it was fined £59.5 million by the FSA for its role in the LIBOR<br />

scandal. The investigation of LIBOR continues, but the FSA has since fined UBS<br />

£160 million in December 2012 and RBS £87.5 million in February 2013.<br />

Figure 6.2 – Barclays’ UK Fines<br />

Date Event Failure Fine amount (£)<br />

19 August 2009<br />

Transaction<br />

reporting<br />

For failing to provide accurate<br />

transaction reports to the FSA and for<br />

serious weaknesses in systems and<br />

controls in transaction reporting<br />

2,450,000<br />

18 January 2011 Aviva Bonds<br />

For failures in relation to the sale of<br />

two funds<br />

7,700,000<br />

26 January 2011<br />

Client Assets<br />

sourcebook (CASS)<br />

For failing to protect and segregate<br />

client money<br />

1,127,559<br />

27 June 2012 LIBOR<br />

For misconduct relating to the LIBOR<br />

and EURIBOR<br />

59,500,000<br />

Total 70,777,559<br />

Source: FSA<br />

6.5 In the US, there are several financial regulators and they tend to impose fines much<br />

more frequently than their UK counterparts – even allowing for the fact that the US<br />

is a larger market. For instance, between 2005 and 2011, the Financial Industry