ENRICHING LIVES EXPANDING HORIZONS - Maxis

ENRICHING LIVES EXPANDING HORIZONS - Maxis

ENRICHING LIVES EXPANDING HORIZONS - Maxis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

171<br />

30 PROVISIONS FOR LIABILITIES AND CHARGES (CONTINUED)<br />

Site rectification and decommissioning works<br />

In the current financial year, a provision of RM103,788,000 (2010: RM137,063,000) has been recognised for dismantlement,<br />

removal and site restoration costs. The provision is estimated using the assumption that decommissioning will only take<br />

place upon the expiry of the lease terms (inclusive of secondary terms) of 15 to 30 years (2010: 15 to 30 years). The provision<br />

has been estimated based on the current conditions of the sites, at the estimated costs to be incurred upon the expiry of<br />

lease terms and discounted at the current market interest rate available to the Group. The provisions will be utilised over the<br />

remaining lease periods which range from 1 to 16 years (2010: 1 to 16 years).<br />

During the financial year, the Group revised the provision for decommissioning works based on the current estimated<br />

cost of dismantling and restoration works. The revision was accounted as a change in accounting estimate and as a result,<br />

the provision for site rectification and decommissioning works has decreased by RM46,955,000 with corresponding<br />

decreases in finance costs and carrying amount of property, plant and equipment by RM36,213,000 and RM10,742,000<br />

respectively in the current financial year.<br />

Network construction cost and settlements<br />

In the Directors’ opinion, the outcome of the notices of termination, legal claims, negotiations for settlements and costs in respect<br />

of obligations under network construction contracts will not give rise to any significant loss beyond the amounts provided at the<br />

reporting date.<br />

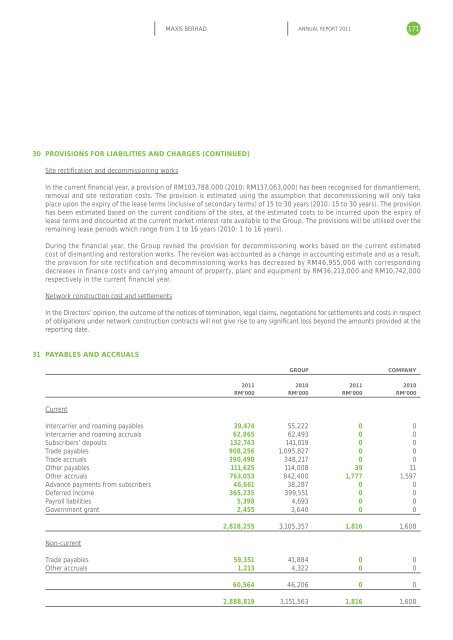

31 PAYABLES AND ACCRUALS<br />

GROUP<br />

COMPANY<br />

2011 2010 2011 2010<br />

RM’000 RM’000 RM’000 RM’000<br />

Current<br />

Intercarrier and roaming payables 39,474 55,222 0 0<br />

Intercarrier and roaming accruals 62,865 62,493 0 0<br />

Subscribers’ deposits 132,743 141,019 0 0<br />

Trade payables 908,256 1,095,827 0 0<br />

Trade accruals 390,490 348,217 0 0<br />

Other payables 111,625 114,008 39 11<br />

Other accruals 763,053 842,400 1,777 1,597<br />

Advance payments from subscribers 46,661 38,287 0 0<br />

Deferred income 365,235 399,551 0 0<br />

Payroll liabilities 5,398 4,693 0 0<br />

Government grant 2,455 3,640 0 0<br />

Non-current<br />

2,828,255 3,105,357 1,816 1,608<br />

Trade payables 59,351 41,884 0 0<br />

Other accruals 1,213 4,322 0 0<br />

60,564 46,206 0 0<br />

2,888,819 3,151,563 1,816 1,608