ENRICHING LIVES EXPANDING HORIZONS - Maxis

ENRICHING LIVES EXPANDING HORIZONS - Maxis

ENRICHING LIVES EXPANDING HORIZONS - Maxis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

59<br />

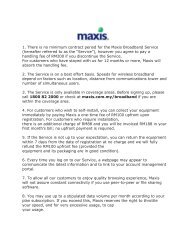

“Our customers are our barometers for service and product<br />

excellence. We constantly work towards giving them the<br />

best value through innovative collaboration. Naturally, we<br />

are building a greater presence in Cyberspace, where our<br />

core customer base spends a lot of time.”<br />

T Kugan<br />

Head of Products, Devices, Innovation and Roaming<br />

On a comparable basis (i.e. excluding the international gateway services) our revenues<br />

grew by 2.1% year on year. Growth was driven by mobile internet, wireless broadband<br />

and device sales, more than compensating for a regulatory reduction in interconnect<br />

revenue, yielding a net revenue increase of RM167 million for the mobile business.<br />

Our non-voice revenues as a percentage of mobile revenues were at 43.5% in<br />

2011 versus 38.1% in 2010, among the highest recorded by operators in Asia.<br />

This came on the back of strong smartphone penetration in our base, superior<br />

network experience and a wide suite of innovative mobile content and applications<br />

from <strong>Maxis</strong> as well as our content ecosystem partners. As of December 2011, our<br />

base of smartphone users grew to 3.7 million of which over a third use “super<br />

smartphones”, i.e. iPhone, BlackBerry, Android or Windows Mobile phones. As we<br />

exited the year, non-voice revenues reached 45.3% of mobile revenues.<br />

Following our decision to rationalise our hubbing business by cutting back on lowmargin<br />

routes, we have scaled down this business significantly from RM405 million<br />

revenue in 2010 to RM156 million in 2011 with an improved EBITDA margin from<br />

5.3% to 11.5% for the international gateway services. As a result, our reported<br />

total revenues were RM8.8 billion for the year, a reduction of RM69 million or 0.8%<br />

compared to last year.<br />

During the year, two significant regulatory policy changes took place – reduction<br />

in Singapore roaming rates and in domestic interconnect rates – which inevitably<br />

impacted <strong>Maxis</strong> the most, being the largest operator. Normalising these factors<br />

our annual revenue growth rate on a comparable basis would have been 3.5%.<br />

In terms of our subscription numbers, in parallel to the existing reporting, we<br />

introduced a stricter subscription definition to move away from inflated numbers<br />

reported in the market given the “use and throw” nature of a significant portion of<br />

the prepaid “SIM business”. We now define customers using the networks actively as<br />

revenue generating subscriptions, which demonstrates a better measure that reflects<br />

real active customers. We are now reporting both the gross numbers based on industry<br />

practice and the RGS figures which are used internally.<br />

NATION’S<br />

PREMIER<br />

INTEGRATED<br />

COMMUNICATIONS<br />

SERVICE<br />

PROVIDER<br />

Our EBITDA margin increased by 0.5% point to 50.3%, which is one of the highest in<br />

the industry globally, through cost management discipline and rationalisation of our<br />

hubbing business by scaling down of low-margin routes.<br />

Profit After Tax was at RM2,531 million compared to RM2,295 million in the preceding<br />

year – a 10.3% increase – as a result of the recognition of tax credits of RM352 million<br />

arising from the investment allowance under the last-mile broadband tax incentive<br />

granted by the Ministry of Finance.