bQNs7mR

bQNs7mR

bQNs7mR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

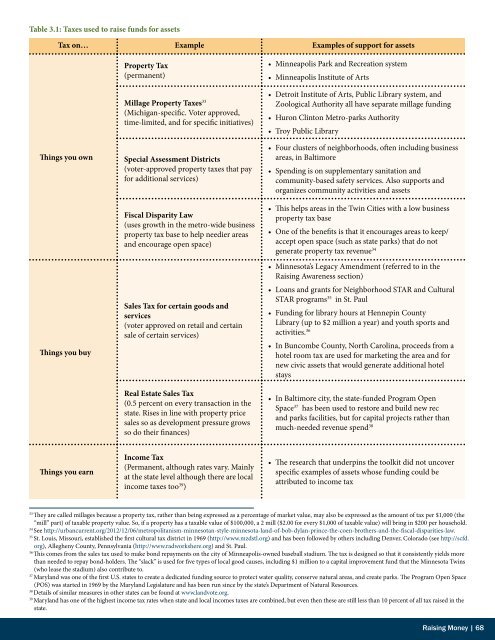

Table 3.1: Taxes used to raise funds for assets<br />

Tax on… Example Examples of support for assets<br />

Things you own<br />

Things you buy<br />

Property Tax<br />

(permanent)<br />

Millage Property Taxes 33<br />

(Michigan-specific. Voter approved,<br />

time-limited, and for specific initiatives)<br />

Special Assessment Districts<br />

(voter-approved property taxes that pay<br />

for additional services)<br />

Fiscal Disparity Law<br />

(uses growth in the metro-wide business<br />

property tax base to help needier areas<br />

and encourage open space)<br />

Sales Tax for certain goods and<br />

services<br />

(voter approved on retail and certain<br />

sale of certain services)<br />

Real Estate Sales Tax<br />

(0.5 percent on every transaction in the<br />

state. Rises in line with property price<br />

sales so as development pressure grows<br />

so do their finances)<br />

• Minneapolis Park and Recreation system<br />

• Minneapolis Institute of Arts<br />

• Detroit Institute of Arts, Public Library system, and<br />

Zoological Authority all have separate millage funding<br />

• Huron Clinton Metro-parks Authority<br />

• Troy Public Library<br />

• Four clusters of neighborhoods, often including business<br />

areas, in Baltimore<br />

• Spending is on supplementary sanitation and<br />

community-based safety services. Also supports and<br />

organizes community activities and assets<br />

• This helps areas in the Twin Cities with a low business<br />

property tax base<br />

• One of the benefits is that it encourages areas to keep/<br />

accept open space (such as state parks) that do not<br />

generate property tax revenue 34<br />

• Minnesota’s Legacy Amendment (referred to in the<br />

Raising Awareness section)<br />

• Loans and grants for Neighborhood STAR and Cultural<br />

STAR programs 35 in St. Paul<br />

• Funding for library hours at Hennepin County<br />

Library (up to $2 million a year) and youth sports and<br />

activities. 36<br />

• In Buncombe County, North Carolina, proceeds from a<br />

hotel room tax are used for marketing the area and for<br />

new civic assets that would generate additional hotel<br />

stays<br />

• In Baltimore city, the state-funded Program Open<br />

Space 37 has been used to restore and build new rec<br />

and parks facilities, but for capital projects rather than<br />

much-needed revenue spend 38<br />

Things you earn<br />

Income Tax<br />

(Permanent, although rates vary. Mainly<br />

at the state level although there are local<br />

income taxes too 39 )<br />

• The research that underpins the toolkit did not uncover<br />

specific examples of assets whose funding could be<br />

attributed to income tax<br />

33<br />

They are called millages because a property tax, rather than being expressed as a percentage of market value, may also be expressed as the amount of tax per $1,000 (the<br />

“mill” part) of taxable property value. So, if a property has a taxable value of $100,000, a 2 mill ($2.00 for every $1,000 of taxable value) will bring in $200 per household.<br />

34<br />

See http://urbancurrent.org/2012/12/06/metropolitanism-minnesotan-style-minnesota-land-of-bob-dylan-prince-the-coen-brothers-and-the-fiscal-disparities-law.<br />

35<br />

St. Louis, Missouri, established the first cultural tax district in 1969 (http://www.mzdstl.org) and has been followed by others including Denver, Colorado (see http://scfd.<br />

org), Allegheny County, Pennsylvania (http://www.radworkshere.org) and St. Paul.<br />

36<br />

This comes from the sales tax used to make bond repayments on the city of Minneapolis-owned baseball stadium. The tax is designed so that it consistently yields more<br />

than needed to repay bond-holders. The “slack” is used for five types of local good causes, including $1 million to a capital improvement fund that the Minnesota Twins<br />

(who lease the stadium) also contribute to.<br />

37<br />

Maryland was one of the first U.S. states to create a dedicated funding source to protect water quality, conserve natural areas, and create parks. The Program Open Space<br />

(POS) was started in 1969 by the Maryland Legislature and has been run since by the state’s Department of Natural Resources.<br />

38<br />

Details of similar measures in other states can be found at www.landvote.org.<br />

39<br />

Maryland has one of the highest income tax rates when state and local incomes taxes are combined, but even then these are still less than 10 percent of all tax raised in the<br />

state.<br />

Raising Money | 68