"Life Cycle" Hypothesis of Saving: Aggregate ... - Arabictrader.com

"Life Cycle" Hypothesis of Saving: Aggregate ... - Arabictrader.com

"Life Cycle" Hypothesis of Saving: Aggregate ... - Arabictrader.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

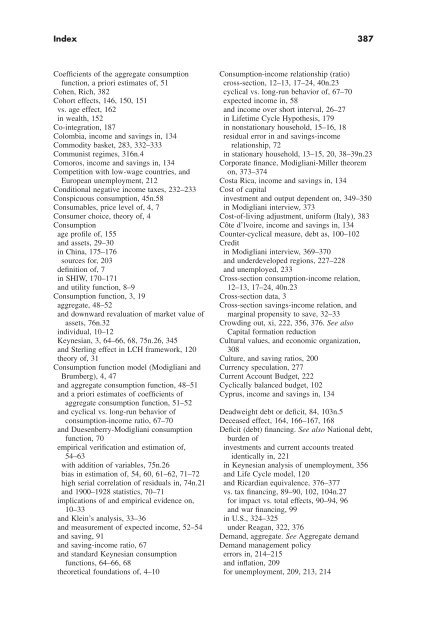

Index 387<br />

Coefficients <strong>of</strong> the aggregate consumption<br />

function, a priori estimates <strong>of</strong>, 51<br />

Cohen, Rich, 382<br />

Cohort effects, 146, 150, 151<br />

vs. age effect, 162<br />

in wealth, 152<br />

Co-integration, 187<br />

Colombia, in<strong>com</strong>e and savings in, 134<br />

Commodity basket, 283, 332–333<br />

Communist regimes, 316n.4<br />

Comoros, in<strong>com</strong>e and savings in, 134<br />

Competition with low-wage countries, and<br />

European unemployment, 212<br />

Conditional negative in<strong>com</strong>e taxes, 232–233<br />

Conspicuous consumption, 45n.58<br />

Consumables, price level <strong>of</strong>, 4, 7<br />

Consumer choice, theory <strong>of</strong>, 4<br />

Consumption<br />

age pr<strong>of</strong>ile <strong>of</strong>, 155<br />

and assets, 29–30<br />

in China, 175–176<br />

sources for, 203<br />

definition <strong>of</strong>, 7<br />

in SHIW, 170–171<br />

and utility function, 8–9<br />

Consumption function, 3, 19<br />

aggregate, 48–52<br />

and downward revaluation <strong>of</strong> market value <strong>of</strong><br />

assets, 76n.32<br />

individual, 10–12<br />

Keynesian, 3, 64–66, 68, 75n.26, 345<br />

and Sterling effect in LCH framework, 120<br />

theory <strong>of</strong>, 31<br />

Consumption function model (Modigliani and<br />

Brumberg), 4, 47<br />

and aggregate consumption function, 48–51<br />

and a priori estimates <strong>of</strong> coefficients <strong>of</strong><br />

aggregate consumption function, 51–52<br />

and cyclical vs. long-run behavior <strong>of</strong><br />

consumption-in<strong>com</strong>e ratio, 67–70<br />

and Duesenberry-Modigliani consumption<br />

function, 70<br />

empirical verification and estimation <strong>of</strong>,<br />

54–63<br />

with addition <strong>of</strong> variables, 75n.26<br />

bias in estimation <strong>of</strong>, 54, 60, 61–62, 71–72<br />

high serial correlation <strong>of</strong> residuals in, 74n.21<br />

and 1900–1928 statistics, 70–71<br />

implications <strong>of</strong> and empirical evidence on,<br />

10–33<br />

and Klein’s analysis, 33–36<br />

and measurement <strong>of</strong> expected in<strong>com</strong>e, 52–54<br />

and saving, 91<br />

and saving-in<strong>com</strong>e ratio, 67<br />

and standard Keynesian consumption<br />

functions, 64–66, 68<br />

theoretical foundations <strong>of</strong>, 4–10<br />

Consumption-in<strong>com</strong>e relationship (ratio)<br />

cross-section, 12–13, 17–24, 40n.23<br />

cyclical vs. long-run behavior <strong>of</strong>, 67–70<br />

expected in<strong>com</strong>e in, 58<br />

and in<strong>com</strong>e over short interval, 26–27<br />

in <strong>Life</strong>time Cycle <strong>Hypothesis</strong>, 179<br />

in nonstationary household, 15–16, 18<br />

residual error in and savings-in<strong>com</strong>e<br />

relationship, 72<br />

in stationary household, 13–15, 20, 38–39n.23<br />

Corporate finance, Modigliani-Miller theorem<br />

on, 373–374<br />

Costa Rica, in<strong>com</strong>e and savings in, 134<br />

Cost <strong>of</strong> capital<br />

investment and output dependent on, 349–350<br />

in Modigliani interview, 373<br />

Cost-<strong>of</strong>-living adjustment, uniform (Italy), 383<br />

Côte d’lvoire, in<strong>com</strong>e and savings in, 134<br />

Counter-cyclical measure, debt as, 100–102<br />

Credit<br />

in Modigliani interview, 369–370<br />

and underdeveloped regions, 227–228<br />

and unemployed, 233<br />

Cross-section consumption-in<strong>com</strong>e relation,<br />

12–13, 17–24, 40n.23<br />

Cross-section data, 3<br />

Cross-section savings-in<strong>com</strong>e relation, and<br />

marginal propensity to save, 32–33<br />

Crowding out, xi, 222, 356, 376. See also<br />

Capital formation reduction<br />

Cultural values, and economic organization,<br />

308<br />

Culture, and saving ratios, 200<br />

Currency speculation, 277<br />

Current Account Budget, 222<br />

Cyclically balanced budget, 102<br />

Cyprus, in<strong>com</strong>e and savings in, 134<br />

Deadweight debt or deficit, 84, 103n.5<br />

Deceased effect, 164, 166–167, 168<br />

Deficit (debt) financing. See also National debt,<br />

burden <strong>of</strong><br />

investments and current accounts treated<br />

identically in, 221<br />

in Keynesian analysis <strong>of</strong> unemployment, 356<br />

and <strong>Life</strong> Cycle model, 120<br />

and Ricardian equivalence, 376–377<br />

vs. tax financing, 89–90, 102, 104n.27<br />

for impact vs. total effects, 90–94, 96<br />

and war financing, 99<br />

in U.S., 324–325<br />

under Reagan, 322, 376<br />

Demand, aggregate. See <strong>Aggregate</strong> demand<br />

Demand management policy<br />

errors in, 214–215<br />

and inflation, 209<br />

for unemployment, 209, 213, 214