- Page 1:

USCC 2016 ANNUAL REPORT

- Page 5 and 6:

1 2016 REPORT TO CONGRESS of the U.

- Page 7 and 8:

U.S.-CHINA ECONOMIC AND SECURITY RE

- Page 9 and 10:

• The safety of food, drug, and o

- Page 11 and 12:

CONTENTS Page TRANSMITTAL LETTER TO

- Page 13:

IX Page Recommendations ...........

- Page 16 and 17:

2 ernment’s “going out” strat

- Page 18 and 19:

4 economically and politically stra

- Page 20 and 21:

6 wage rates are determined by free

- Page 22 and 23:

8 while allowing a greater role for

- Page 24 and 25:

10 began construction on its first

- Page 26 and 27:

12 from—the People’s Republic o

- Page 28 and 29: 14 cluding cyber and human intellig

- Page 30 and 31: 16 exporter of manufactured goods,

- Page 32 and 33: 18 Pakistan’s economic and securi

- Page 34 and 35: 20 Beijing appears to remain skepti

- Page 36 and 37: 22 trends in Hong Kong with regard

- Page 38 and 39: 24 UNSCR 2270. However, in May and

- Page 40 and 41: 26 Korea, designating Dandong Hongx

- Page 42 and 43: 28 tional order—both before and a

- Page 44 and 45: 30 to examine China’s economic an

- Page 46 and 47: 32 debt, and jeopardizing long-term

- Page 49 and 50: Introduction CHAPTER 1 U.S.-CHINA E

- Page 51 and 52: 37 Statistics with Chinese Characte

- Page 53 and 54: 39 up from 52.3 percent in the seco

- Page 55 and 56: 41 Early signs suggest President Xi

- Page 57 and 58: 43 Figure 4: China’s Total Debt b

- Page 59 and 60: 45 reserves to defend the RMB. 75 I

- Page 61 and 62: 47 The pace of U.S. export growth t

- Page 63 and 64: 49 The United States continued to r

- Page 65 and 66: 51 commitments, China has only take

- Page 67 and 68: 53 Table 3: Top Five Business Chall

- Page 69 and 70: 55 U.S. Tech Firms and Their Chines

- Page 71 and 72: 57 ment of Justice’s May 2014 ind

- Page 73 and 74: 59 Internet Censorship As a result

- Page 75 and 76: 61 on the future of U.S.-China rela

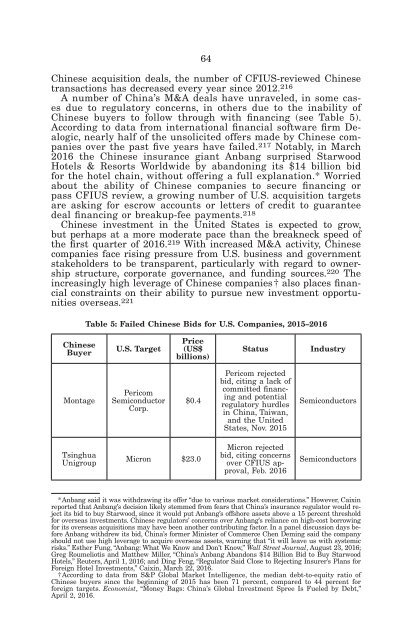

- Page 77: 63 Chapter 1, Section 2, “State-O

- Page 81 and 82: 67 • Accelerating Bilateral Inves

- Page 83 and 84: 69 cess capacity, which will share

- Page 85 and 86: 71 United States Challenges Chinese

- Page 87 and 88: 73 rulings of the DSB [Dispute Sett

- Page 89 and 90: 75 Conclusions • In 2015, the U.S

- Page 91 and 92: 77 Addendum I: WTO Cases Recent and

- Page 93 and 94: 79 ENDNOTES FOR SECTION 1 1. Lucy H

- Page 95 and 96: 81 55. Gabriel Wildau and Don Weinl

- Page 97 and 98: 83 119. American Chamber of Commerc

- Page 99 and 100: 85 and Espionage Operations, oral t

- Page 101 and 102: 87 217. Kane Wu, “Chinese Compani

- Page 103 and 104: 89 271. Office of the U.S. Trade Re

- Page 105 and 106: dkrause on DSKHT7XVN1PROD with USCC

- Page 107 and 108: 93 Lardy, senior fellow at the Pete

- Page 109 and 110: dkrause on DSKHT7XVN1PROD with USCC

- Page 111 and 112: dkrause on DSKHT7XVN1PROD with USCC

- Page 113 and 114: 99 pany competitiveness and stimula

- Page 115 and 116: dkrause on DSKHT7XVN1PROD with USCC

- Page 117 and 118: dkrause on DSKHT7XVN1PROD with USCC

- Page 119 and 120: 105 Table 2: Select Chinese Overcap

- Page 121 and 122: 107 levels. 135 The situation is on

- Page 123 and 124: 109 Figure 5: China’s Monthly Cru

- Page 125 and 126: 111 Figure 6: U.S. Steel Industry Q

- Page 127 and 128: dkrause on DSKHT7XVN1PROD with USCC

- Page 129 and 130:

dkrause on DSKHT7XVN1PROD with USCC

- Page 131 and 132:

dkrause on DSKHT7XVN1PROD with USCC

- Page 133 and 134:

dkrause on DSKHT7XVN1PROD with USCC

- Page 135 and 136:

dkrause on DSKHT7XVN1PROD with USCC

- Page 137 and 138:

123 Addendum I: Section 15 of China

- Page 139 and 140:

125 Addendum II: AD and CVD Investi

- Page 141 and 142:

dkrause on DSKHT7XVN1PROD with USCC

- Page 143 and 144:

dkrause on DSKHT7XVN1PROD with USCC

- Page 145 and 146:

dkrause on DSKHT7XVN1PROD with USCC

- Page 147 and 148:

dkrause on DSKHT7XVN1PROD with USCC

- Page 149 and 150:

dkrause on DSKHT7XVN1PROD with USCC

- Page 151 and 152:

dkrause on DSKHT7XVN1PROD with USCC

- Page 153 and 154:

dkrause on DSKHT7XVN1PROD with USCC

- Page 155 and 156:

141 dkrause on DSKHT7XVN1PROD with

- Page 157 and 158:

143 lifetime cost of bringing the e

- Page 159 and 160:

145 gets achieved). 57 Using satell

- Page 161 and 162:

147 cost of compliance,’’ and p

- Page 163 and 164:

dkrause on DSKHT7XVN1PROD with USCC

- Page 165 and 166:

151 boost the efficiency of China

- Page 167 and 168:

dkrause on DSKHT7XVN1PROD with USCC

- Page 169 and 170:

dkrause on DSKHT7XVN1PROD with USCC

- Page 171 and 172:

Table 1: 157 Chinese Attempted and

- Page 173 and 174:

Table 1: 159 Chinese Attempted and

- Page 175 and 176:

dkrause on DSKHT7XVN1PROD with USCC

- Page 177 and 178:

163 Figure 4: China’s Total Debt-

- Page 179 and 180:

dkrause on DSKHT7XVN1PROD with USCC

- Page 181 and 182:

dkrause on DSKHT7XVN1PROD with USCC

- Page 183 and 184:

dkrause on DSKHT7XVN1PROD with USCC

- Page 185 and 186:

dkrause on DSKHT7XVN1PROD with USCC

- Page 187 and 188:

173 weapons, opens the U.S. militar

- Page 189 and 190:

175 ests, and allow for greater vol

- Page 191 and 192:

177 Addendum I: Key Targets in Chin

- Page 193 and 194:

179 Addendum I: Key Targets in Chin

- Page 195 and 196:

dkrause on DSKHT7XVN1PROD with USCC

- Page 197 and 198:

dkrause on DSKHT7XVN1PROD with USCC

- Page 199 and 200:

dkrause on DSKHT7XVN1PROD with USCC

- Page 201 and 202:

dkrause on DSKHT7XVN1PROD with USCC

- Page 203 and 204:

dkrause on DSKHT7XVN1PROD with USCC

- Page 205 and 206:

dkrause on DSKHT7XVN1PROD with USCC

- Page 207 and 208:

dkrause on DSKHT7XVN1PROD with USCC

- Page 209 and 210:

195 The ultimate impact of the ruli

- Page 211 and 212:

197 Environmental Impact of China

- Page 213 and 214:

dkrause on DSKHT7XVN1PROD with USCC

- Page 215 and 216:

201 China’s Maritime Disputes in

- Page 217 and 218:

203 Reform and Reorganization of th

- Page 219 and 220:

dkrause on DSKHT7XVN1PROD with USCC

- Page 221 and 222:

207 • PLA Army Headquarters: Chin

- Page 223 and 224:

dkrause on DSKHT7XVN1PROD with USCC

- Page 225 and 226:

211 Figure 5: Type 072A Tank Landin

- Page 227 and 228:

dkrause on DSKHT7XVN1PROD with USCC

- Page 229 and 230:

215 Figure 7: JL-2 Missile Range Co

- Page 231 and 232:

dkrause on DSKHT7XVN1PROD with USCC

- Page 233 and 234:

dkrause on DSKHT7XVN1PROD with USCC

- Page 235 and 236:

221 Space-Tracking Facility in Arge

- Page 237 and 238:

223 Table 1: Significant PLA Bilate

- Page 239 and 240:

dkrause on DSKHT7XVN1PROD with USCC

- Page 241 and 242:

227 Nigeria will be the first expor

- Page 243 and 244:

dkrause on DSKHT7XVN1PROD with USCC

- Page 245 and 246:

231 tional annexes to the 2014 Noti

- Page 247 and 248:

233 Select U.S.-China Security-Rela

- Page 249 and 250:

dkrause on DSKHT7XVN1PROD with USCC

- Page 251 and 252:

dkrause on DSKHT7XVN1PROD with USCC

- Page 253 and 254:

dkrause on DSKHT7XVN1PROD with USCC

- Page 255 and 256:

dkrause on DSKHT7XVN1PROD with USCC

- Page 257 and 258:

dkrause on DSKHT7XVN1PROD with USCC

- Page 259 and 260:

dkrause on DSKHT7XVN1PROD with USCC

- Page 261 and 262:

dkrause on DSKHT7XVN1PROD with USCC

- Page 263 and 264:

dkrause on DSKHT7XVN1PROD with USCC

- Page 265 and 266:

dkrause on DSKHT7XVN1PROD with USCC

- Page 267 and 268:

dkrause on DSKHT7XVN1PROD with USCC

- Page 269 and 270:

dkrause on DSKHT7XVN1PROD with USCC

- Page 271 and 272:

257 China’s Core Interests—Cont

- Page 273 and 274:

259 guerrillas in Colombia and held

- Page 275 and 276:

dkrause on DSKHT7XVN1PROD with USCC

- Page 277 and 278:

dkrause on DSKHT7XVN1PROD with USCC

- Page 279 and 280:

dkrause on DSKHT7XVN1PROD with USCC

- Page 281 and 282:

dkrause on DSKHT7XVN1PROD with USCC

- Page 283 and 284:

dkrause on DSKHT7XVN1PROD with USCC

- Page 285 and 286:

271 stan. 109 In 2014, the PLA Air

- Page 287 and 288:

dkrause on DSKHT7XVN1PROD with USCC

- Page 289 and 290:

275 conflict Chinese expeditionary

- Page 291 and 292:

dkrause on DSKHT7XVN1PROD with USCC

- Page 293 and 294:

279 RECOMMENDATIONS Developments in

- Page 295 and 296:

dkrause on DSKHT7XVN1PROD with USCC

- Page 297 and 298:

dkrause on DSKHT7XVN1PROD with USCC

- Page 299 and 300:

dkrause on DSKHT7XVN1PROD with USCC

- Page 301 and 302:

dkrause on DSKHT7XVN1PROD with USCC

- Page 303 and 304:

SECTION 3: CHINESE INTELLIGENCE SER

- Page 305 and 306:

291 Strategic Support Force In Dece

- Page 307 and 308:

293 of advanced intelligence, surve

- Page 309 and 310:

295 tives, and sexual entrapment. 4

- Page 311 and 312:

297 information to a Chinese intell

- Page 313 and 314:

299 such as power transmission grid

- Page 315 and 316:

301 for transferring trade secrets

- Page 317 and 318:

303 nal U.S. discussions of issues

- Page 319 and 320:

305 ENDNOTES FOR SECTION 3 1. U.S.-

- Page 321 and 322:

307 29. U.S. Department of Justice,

- Page 323 and 324:

309 63. U.S. Department of Justice,

- Page 325:

311 106. Eric Holder, “Attorney G

- Page 328 and 329:

314 sure its own ambitions in South

- Page 330 and 331:

316 Chinese foreign direct investme

- Page 332 and 333:

318 • Pakistan: In 2015, China an

- Page 334 and 335:

320 India “Acts East” and Puts

- Page 336 and 337:

322 Counter Terrorism and Religious

- Page 338 and 339:

324 tivities of the Dalai Lama and

- Page 340 and 341:

326 incursions across the border fr

- Page 342 and 343:

328 conducive to sea lane protectio

- Page 344 and 345:

330 Karachi Port, that could eventu

- Page 346 and 347:

332 India and OBOR India has not en

- Page 348 and 349:

334 China’s Arms Sales to Pakista

- Page 350 and 351:

336 For China, the goals of CPEC ar

- Page 352 and 353:

338 according to Mr. Small, “The

- Page 354 and 355:

340 side the Treaty on the Non-Prol

- Page 356 and 357:

342 Facets of U.S.-India Defense Re

- Page 358 and 359:

344 of China, but has advocated for

- Page 360 and 361:

346 • Recent U.S.-China tensions

- Page 362 and 363:

348 24. Debasish Roy Chowdhury, “

- Page 364 and 365:

350 71. Jeff Smith, Cold Peace: Chi

- Page 366 and 367:

352 127. U.S.-China Economic and Se

- Page 368 and 369:

354 2016, 86; Andrew Small, The Chi

- Page 370 and 371:

dkrause on DSKHT7XVN1PROD with USCC

- Page 372 and 373:

358 Taiwan’s Economic Challenges

- Page 374 and 375:

dkrause on DSKHT7XVN1PROD with USCC

- Page 376 and 377:

dkrause on DSKHT7XVN1PROD with USCC

- Page 378 and 379:

364 agreements. 57 Since then, many

- Page 380 and 381:

366 $67.2 billion, comprising 25.4

- Page 382 and 383:

368 Foreign Direct Investment China

- Page 384 and 385:

370 is leading the initiative, have

- Page 386 and 387:

dkrause on DSKHT7XVN1PROD with USCC

- Page 388 and 389:

374 Taiwan and the 11-Dash Line The

- Page 390 and 391:

dkrause on DSKHT7XVN1PROD with USCC

- Page 392 and 393:

dkrause on DSKHT7XVN1PROD with USCC

- Page 394 and 395:

dkrause on DSKHT7XVN1PROD with USCC

- Page 396 and 397:

dkrause on DSKHT7XVN1PROD with USCC

- Page 398 and 399:

384 trade-based partner to an innov

- Page 400 and 401:

dkrause on DSKHT7XVN1PROD with USCC

- Page 402 and 403:

dkrause on DSKHT7XVN1PROD with USCC

- Page 404 and 405:

390 • China’s military moderniz

- Page 406 and 407:

dkrause on DSKHT7XVN1PROD with USCC

- Page 408 and 409:

dkrause on DSKHT7XVN1PROD with USCC

- Page 410 and 411:

dkrause on DSKHT7XVN1PROD with USCC

- Page 412 and 413:

dkrause on DSKHT7XVN1PROD with USCC

- Page 414 and 415:

dkrause on DSKHT7XVN1PROD with USCC

- Page 416 and 417:

dkrause on DSKHT7XVN1PROD with USCC

- Page 418 and 419:

dkrause on DSKHT7XVN1PROD with USCC

- Page 420 and 421:

dkrause on DSKHT7XVN1PROD with USCC

- Page 422 and 423:

dkrause on DSKHT7XVN1PROD with USCC

- Page 424 and 425:

410 Hong Kong’s Political Gossip

- Page 426 and 427:

dkrause on DSKHT7XVN1PROD with USCC

- Page 428 and 429:

414 moving up one place compared to

- Page 430 and 431:

dkrause on DSKHT7XVN1PROD with USCC

- Page 432 and 433:

418 Chinese Censorship of Prize-Win

- Page 434 and 435:

420 Hong Kong and the ‘‘Panama

- Page 436 and 437:

dkrause on DSKHT7XVN1PROD with USCC

- Page 438 and 439:

424 Table 1: Select PLA Hong Kong G

- Page 440 and 441:

dkrause on DSKHT7XVN1PROD with USCC

- Page 442 and 443:

428 sitive periods in Hong Kong, le

- Page 444 and 445:

dkrause on DSKHT7XVN1PROD with USCC

- Page 446 and 447:

dkrause on DSKHT7XVN1PROD with USCC

- Page 448 and 449:

dkrause on DSKHT7XVN1PROD with USCC

- Page 450 and 451:

436 150. Commission meeting with Ta

- Page 452 and 453:

dkrause on DSKHT7XVN1PROD with USCC

- Page 454 and 455:

dkrause on DSKHT7XVN1PROD with USCC

- Page 456 and 457:

442 Korea. The resolution also bans

- Page 458 and 459:

444 increase pressure on Pyongyang.

- Page 460 and 461:

446 pand China-South Korea ties. 54

- Page 462 and 463:

448 Technical Details of THAAD The

- Page 464 and 465:

dkrause on DSKHT7XVN1PROD with USCC

- Page 466 and 467:

dkrause on DSKHT7XVN1PROD with USCC

- Page 468 and 469:

dkrause on DSKHT7XVN1PROD with USCC

- Page 470 and 471:

456 Korea runs perpetual merchandis

- Page 472 and 473:

dkrause on DSKHT7XVN1PROD with USCC

- Page 474 and 475:

460 pressure is more likely to brin

- Page 476 and 477:

462 ty for sanctions violations, co

- Page 478 and 479:

dkrause on DSKHT7XVN1PROD with USCC

- Page 480 and 481:

dkrause on DSKHT7XVN1PROD with USCC

- Page 482 and 483:

dkrause on DSKHT7XVN1PROD with USCC

- Page 484 and 485:

dkrause on DSKHT7XVN1PROD with USCC

- Page 486 and 487:

dkrause on DSKHT7XVN1PROD with USCC

- Page 489 and 490:

dkrause on DSKHT7XVN1PROD with USCC

- Page 491 and 492:

dkrause on DSKHT7XVN1PROD with USCC

- Page 493 and 494:

479 sailors would be stationed in J

- Page 495 and 496:

dkrause on DSKHT7XVN1PROD with USCC

- Page 497 and 498:

dkrause on DSKHT7XVN1PROD with USCC

- Page 499 and 500:

485 Table 1: U.S. Goods Trade with

- Page 501 and 502:

dkrause on DSKHT7XVN1PROD with USCC

- Page 503 and 504:

489 basis for President Obama’s c

- Page 505 and 506:

dkrause on DSKHT7XVN1PROD with USCC

- Page 507 and 508:

dkrause on DSKHT7XVN1PROD with USCC

- Page 509 and 510:

dkrause on DSKHT7XVN1PROD with USCC

- Page 511 and 512:

dkrause on DSKHT7XVN1PROD with USCC

- Page 513 and 514:

dkrause on DSKHT7XVN1PROD with USCC

- Page 515 and 516:

dkrause on DSKHT7XVN1PROD with USCC

- Page 517 and 518:

dkrause on DSKHT7XVN1PROD with USCC

- Page 519 and 520:

dkrause on DSKHT7XVN1PROD with USCC

- Page 521 and 522:

dkrause on DSKHT7XVN1PROD with USCC

- Page 523 and 524:

dkrause on DSKHT7XVN1PROD with USCC

- Page 525 and 526:

dkrause on DSKHT7XVN1PROD with USCC

- Page 527 and 528:

dkrause on DSKHT7XVN1PROD with USCC

- Page 529 and 530:

dkrause on DSKHT7XVN1PROD with USCC

- Page 531 and 532:

dkrause on DSKHT7XVN1PROD with USCC

- Page 533 and 534:

dkrause on DSKHT7XVN1PROD with USCC

- Page 535 and 536:

dkrause on DSKHT7XVN1PROD with USCC

- Page 537 and 538:

dkrause on DSKHT7XVN1PROD with USCC

- Page 539 and 540:

APPENDIX II BACKGROUND OF COMMISSIO

- Page 541 and 542:

dkrause on DSKHT7XVN1PROD with USCC

- Page 543 and 544:

dkrause on DSKHT7XVN1PROD with USCC

- Page 545 and 546:

dkrause on DSKHT7XVN1PROD with USCC

- Page 547 and 548:

dkrause on DSKHT7XVN1PROD with USCC

- Page 549 and 550:

APPENDIX III PUBLIC HEARINGS OF THE

- Page 551 and 552:

537 June 9, 2016: Public Hearing on

- Page 553 and 554:

APPENDIX IIIA LIST OF WITNESSES TES

- Page 555 and 556:

541 Alphabetical Listing of Panelis

- Page 557 and 558:

APPENDIX IV LIST OF RESEARCH MATERI

- Page 559 and 560:

dkrause on DSKHT7XVN1PROD with USCC

- Page 561 and 562:

547 China’s Military Agreements w

- Page 563 and 564:

APPENDIX V ACRONYMS AND ABBREVIATIO

- Page 565 and 566:

551 OPM PBOC PLA PMI PPI PPP PRC QD

- Page 567:

553 2016 COMMISSION STAFF MICHAEL R