Transaction Express User Guide - Merchant Service Group

Transaction Express User Guide - Merchant Service Group

Transaction Express User Guide - Merchant Service Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

[<strong>Transaction</strong> <strong>Express</strong> <strong>User</strong> <strong>Guide</strong>]<br />

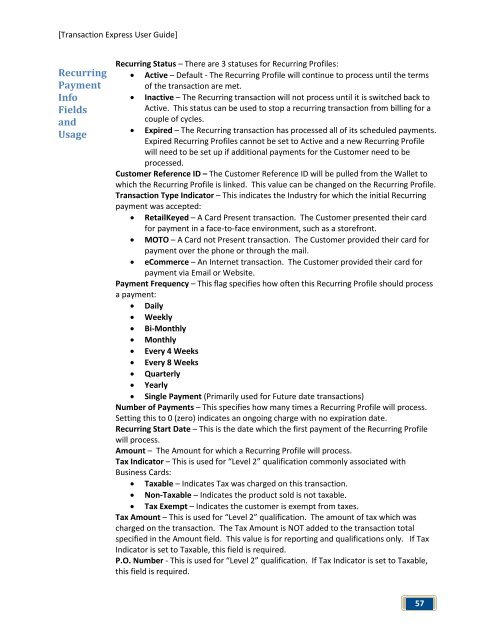

Recurring<br />

Payment<br />

Info<br />

Fields<br />

and<br />

Usage<br />

Recurring Status – There are 3 statuses for Recurring Profiles:<br />

• Active – Default - The Recurring Profile will continue to process until the terms<br />

of the transaction are met.<br />

• Inactive – The Recurring transaction will not process until it is switched back to<br />

Active. This status can be used to stop a recurring transaction from billing for a<br />

couple of cycles.<br />

• Expired – The Recurring transaction has processed all of its scheduled payments.<br />

Expired Recurring Profiles cannot be set to Active and a new Recurring Profile<br />

will need to be set up if additional payments for the Customer need to be<br />

processed.<br />

Customer Reference ID – The Customer Reference ID will be pulled from the Wallet to<br />

which the Recurring Profile is linked. This value can be changed on the Recurring Profile.<br />

<strong>Transaction</strong> Type Indicator – This indicates the Industry for which the initial Recurring<br />

payment was accepted:<br />

• RetailKeyed – A Card Present transaction. The Customer presented their card<br />

for payment in a face-to-face environment, such as a storefront.<br />

• MOTO – A Card not Present transaction. The Customer provided their card for<br />

payment over the phone or through the mail.<br />

• eCommerce – An Internet transaction. The Customer provided their card for<br />

payment via Email or Website.<br />

Payment Frequency – This flag specifies how often this Recurring Profile should process<br />

a payment:<br />

• Daily<br />

• Weekly<br />

• Bi-Monthly<br />

• Monthly<br />

• Every 4 Weeks<br />

• Every 8 Weeks<br />

• Quarterly<br />

• Yearly<br />

• Single Payment (Primarily used for Future date transactions)<br />

Number of Payments – This specifies how many times a Recurring Profile will process.<br />

Setting this to 0 (zero) indicates an ongoing charge with no expiration date.<br />

Recurring Start Date – This is the date which the first payment of the Recurring Profile<br />

will process.<br />

Amount – The Amount for which a Recurring Profile will process.<br />

Tax Indicator – This is used for “Level 2” qualification commonly associated with<br />

Business Cards:<br />

• Taxable – Indicates Tax was charged on this transaction.<br />

• Non-Taxable – Indicates the product sold is not taxable.<br />

• Tax Exempt – Indicates the customer is exempt from taxes.<br />

Tax Amount – This is used for “Level 2” qualification. The amount of tax which was<br />

charged on the transaction. The Tax Amount is NOT added to the transaction total<br />

specified in the Amount field. This value is for reporting and qualifications only. If Tax<br />

Indicator is set to Taxable, this field is required.<br />

P.O. Number - This is used for “Level 2” qualification. If Tax Indicator is set to Taxable,<br />

this field is required.<br />

57