Report

Report

Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

90 QUANTIFICATION OF BENEFITS FROM ECONOMIC COOPERATION IN SOUTH ASIA<br />

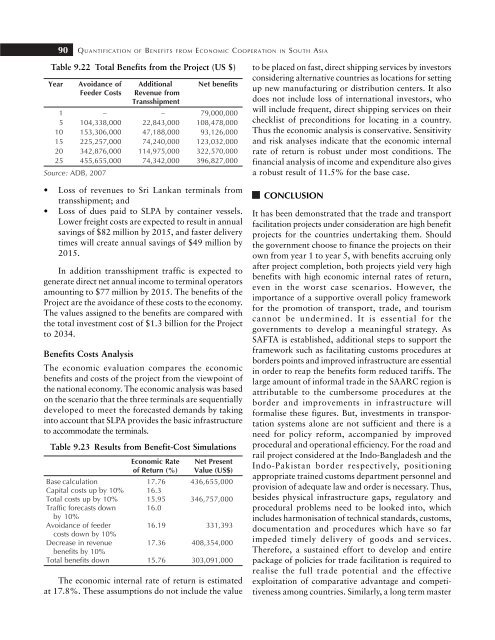

Table 9.22 Total Benefits from the Project (US $)<br />

Year Avoidance of Additional Net benefits<br />

Feeder Costs Revenue from<br />

Transshipment<br />

1 – – 79,000,000<br />

5 104,338,000 22,843,000 108,478,000<br />

10 153,306,000 47,188,000 93,126,000<br />

15 225,257,000 74,240,000 123,032,000<br />

20 342,876,000 114,975,000 322,570,000<br />

25 455,655,000 74,342,000 396,827,000<br />

Source: ADB, 2007<br />

• Loss of revenues to Sri Lankan terminals from<br />

transshipment; and<br />

• Loss of dues paid to SLPA by container vessels.<br />

Lower freight costs are expected to result in annual<br />

savings of $82 million by 2015, and faster delivery<br />

times will create annual savings of $49 million by<br />

2015.<br />

In addition transshipment traffic is expected to<br />

generate direct net annual income to terminal operators<br />

amounting to $77 million by 2015. The benefits of the<br />

Project are the avoidance of these costs to the economy.<br />

The values assigned to the benefits are compared with<br />

the total investment cost of $1.3 billion for the Project<br />

to 2034.<br />

Benefits Costs Analysis<br />

The economic evaluation compares the economic<br />

benefits and costs of the project from the viewpoint of<br />

the national economy. The economic analysis was based<br />

on the scenario that the three terminals are sequentially<br />

developed to meet the forecasted demands by taking<br />

into account that SLPA provides the basic infrastructure<br />

to accommodate the terminals.<br />

Table 9.23 Results from Benefit-Cost Simulations<br />

Economic Rate Net Present<br />

of Return (%) Value (US$)<br />

Base calculation 17.76 436,655,000<br />

Capital costs up by 10% 16.3<br />

Total costs up by 10% 15.95 346,757,000<br />

Traffic forecasts down 16.0<br />

by 10%<br />

Avoidance of feeder 16.19 331,393<br />

costs down by 10%<br />

Decrease in revenue 17.36 408,354,000<br />

benefits by 10%<br />

Total benefits down 15.76 303,091,000<br />

The economic internal rate of return is estimated<br />

at 17.8%. These assumptions do not include the value<br />

to be placed on fast, direct shipping services by investors<br />

considering alternative countries as locations for setting<br />

up new manufacturing or distribution centers. It also<br />

does not include loss of international investors, who<br />

will include frequent, direct shipping services on their<br />

checklist of preconditions for locating in a country.<br />

Thus the economic analysis is conservative. Sensitivity<br />

and risk analyses indicate that the economic internal<br />

rate of return is robust under most conditions. The<br />

financial analysis of income and expenditure also gives<br />

a robust result of 11.5% for the base case.<br />

CONCLUSION<br />

It has been demonstrated that the trade and transport<br />

facilitation projects under consideration are high benefit<br />

projects for the countries undertaking them. Should<br />

the government choose to finance the projects on their<br />

own from year 1 to year 5, with benefits accruing only<br />

after project completion, both projects yield very high<br />

benefits with high economic internal rates of return,<br />

even in the worst case scenarios. However, the<br />

importance of a supportive overall policy framework<br />

for the promotion of transport, trade, and tourism<br />

cannot be undermined. It is essential for the<br />

governments to develop a meaningful strategy. As<br />

SAFTA is established, additional steps to support the<br />

framework such as facilitating customs procedures at<br />

borders points and improved infrastructure are essential<br />

in order to reap the benefits form reduced tariffs. The<br />

large amount of informal trade in the SAARC region is<br />

attributable to the cumbersome procedures at the<br />

border and improvements in infrastructure will<br />

formalise these figures. But, investments in transportation<br />

systems alone are not sufficient and there is a<br />

need for policy reform, accompanied by improved<br />

procedural and operational efficiency. For the road and<br />

rail project considered at the Indo-Bangladesh and the<br />

Indo-Pakistan border respectively, positioning<br />

appropriate trained customs department personnel and<br />

provision of adequate law and order is necessary. Thus,<br />

besides physical infrastructure gaps, regulatory and<br />

procedural problems need to be looked into, which<br />

includes harmonisation of technical standards, customs,<br />

documentation and procedures which have so far<br />

impeded timely delivery of goods and services.<br />

Therefore, a sustained effort to develop and entire<br />

package of policies for trade facilitation is required to<br />

realise the full trade potential and the effective<br />

exploitation of comparative advantage and competitiveness<br />

among countries. Similarly, a long term master