Report

Report

Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

120 QUANTIFICATION OF BENEFITS FROM ECONOMIC COOPERATION IN SOUTH ASIA<br />

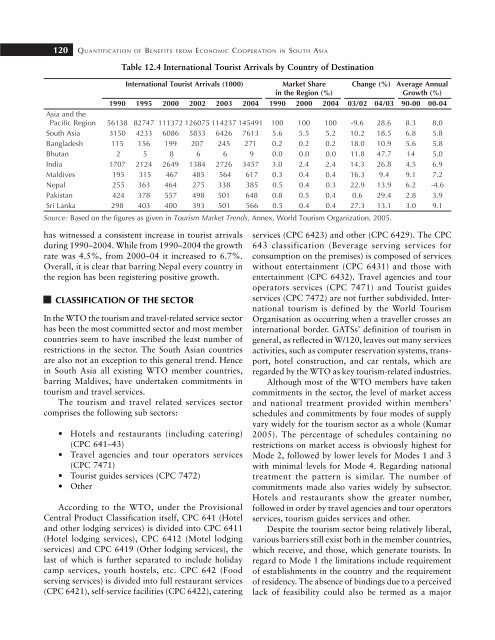

Table 12.4 International Tourist Arrivals by Country of Destination<br />

International Tourist Arrivals (1000) Market Share Change (%) Average Annual<br />

in the Region (%) Growth (%)<br />

1990 1995 2000 2002 2003 2004 1990 2000 2004 03/02 04/03 90-00 00-04<br />

Asia and the<br />

Pacific Region 56138 82747 111372 126075 114237 145491 100 100 100 -9.6 28.6 8.3 8.0<br />

South Asia 3150 4233 6086 5833 6426 7613 5.6 5.5 5.2 10.2 18.5 6.8 5.8<br />

Bangladesh 115 156 199 207 245 271 0.2 0.2 0.2 18.0 10.9 5.6 5.8<br />

Bhutan 2 5 8 6 6 9 0.0 0.0 0.0 11.8 47.7 14 5.0<br />

India 1707 2124 2649 1384 2726 3457 3.0 2.4 2.4 14.3 26.8 4.5 6.9<br />

Maldives 195 315 467 485 564 617 0.3 0.4 0.4 16.3 9.4 9.1 7.2<br />

Nepal 255 363 464 275 338 385 0.5 0.4 0.3 22.9 13.9 6.2 -4.6<br />

Pakistan 424 378 557 498 501 648 0.8 0.5 0.4 0.6 29.4 2.8 3.9<br />

Sri Lanka 298 403 400 393 501 566 0.5 0.4 0.4 27.3 13.1 3.0 9.1<br />

Source: Based on the figures as given in Tourism Market Trends, Annex, World Tourism Organization, 2005.<br />

has witnessed a consistent increase in tourist arrivals<br />

during 1990–2004. While from 1990–2004 the growth<br />

rate was 4.5%, from 2000–04 it increased to 6.7%.<br />

Overall, it is clear that barring Nepal every country in<br />

the region has been registering positive growth.<br />

CLASSIFICATION OF THE SECTOR<br />

In the WTO the tourism and travel-related service sector<br />

has been the most committed sector and most member<br />

countries seem to have inscribed the least number of<br />

restrictions in the sector. The South Asian countries<br />

are also not an exception to this general trend. Hence<br />

in South Asia all existing WTO member countries,<br />

barring Maldives, have undertaken commitments in<br />

tourism and travel services.<br />

The tourism and travel related services sector<br />

comprises the following sub sectors:<br />

• Hotels and restaurants (including catering)<br />

(CPC 641–43)<br />

• Travel agencies and tour operators services<br />

(CPC 7471)<br />

• Tourist guides services (CPC 7472)<br />

• Other<br />

According to the WTO, under the Provisional<br />

Central Product Classification itself, CPC 641 (Hotel<br />

and other lodging services) is divided into CPC 6411<br />

(Hotel lodging services), CPC 6412 (Motel lodging<br />

services) and CPC 6419 (Other lodging services), the<br />

last of which is further separated to include holiday<br />

camp services, youth hostels, etc. CPC 642 (Food<br />

serving services) is divided into full restaurant services<br />

(CPC 6421), self-service facilities (CPC 6422), catering<br />

services (CPC 6423) and other (CPC 6429). The CPC<br />

643 classification (Beverage serving services for<br />

consumption on the premises) is composed of services<br />

without entertainment (CPC 6431) and those with<br />

entertainment (CPC 6432). Travel agencies and tour<br />

operators services (CPC 7471) and Tourist guides<br />

services (CPC 7472) are not further subdivided. International<br />

tourism is defined by the World Tourism<br />

Organisation as occurring when a traveller crosses an<br />

international border. GATSs’ definition of tourism in<br />

general, as reflected in W/120, leaves out many services<br />

activities, such as computer reservation systems, transport,<br />

hotel construction, and car rentals, which are<br />

regarded by the WTO as key tourism-related industries.<br />

Although most of the WTO members have taken<br />

commitments in the sector, the level of market access<br />

and national treatment provided within members’<br />

schedules and commitments by four modes of supply<br />

vary widely for the tourism sector as a whole (Kumar<br />

2005). The percentage of schedules containing no<br />

restrictions on market access is obviously highest for<br />

Mode 2, followed by lower levels for Modes 1 and 3<br />

with minimal levels for Mode 4. Regarding national<br />

treatment the pattern is similar. The number of<br />

commitments made also varies widely by subsector.<br />

Hotels and restaurants show the greater number,<br />

followed in order by travel agencies and tour operators<br />

services, tourism guides services and other.<br />

Despite the tourism sector being relatively liberal,<br />

various barriers still exist both in the member countries,<br />

which receive, and those, which generate tourists. In<br />

regard to Mode 1 the limitations include requirement<br />

of establishments in the country and the requirement<br />

of residency. The absence of bindings due to a perceived<br />

lack of feasibility could also be termed as a major