Report

Report

Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

R EVENUE AND WELFARE IMPLICATIONS OF SAFTA: PARTIAL EQUILIBRIUM ANALYSIS 57<br />

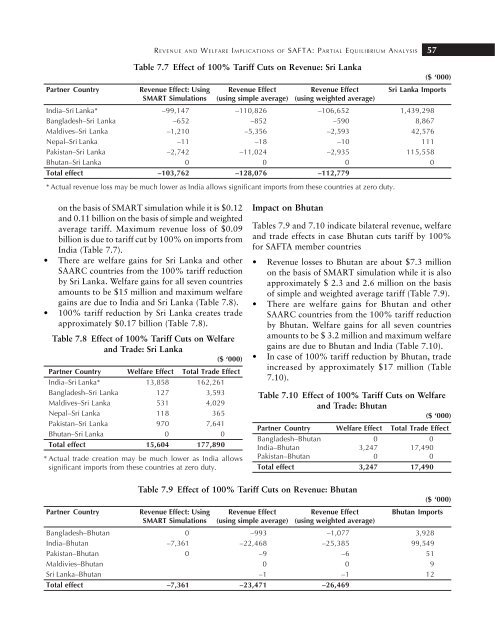

Table 7.7 Effect of 100% Tariff Cuts on Revenue: Sri Lanka<br />

($ ‘000)<br />

Partner Country Revenue Effect: Using Revenue Effect Revenue Effect Sri Lanka Imports<br />

SMART Simulations (using simple average) (using weighted average)<br />

India–Sri Lanka* –99,147 –110,826 –106,652 1,439,298<br />

Bangladesh–Sri Lanka –652 –852 –590 8,867<br />

Maldives–Sri Lanka –1,210 –5,356 –2,593 42,576<br />

Nepal–Sri Lanka –11 –18 –10 111<br />

Pakistan–Sri Lanka –2,742 –11,024 –2,935 115,558<br />

Bhutan–Sri Lanka 0 0 0 0<br />

Total effect –103,762 –128,076 –112,779<br />

* Actual revenue loss may be much lower as India allows significant imports from these countries at zero duty.<br />

on the basis of SMART simulation while it is $0.12<br />

and 0.11 billion on the basis of simple and weighted<br />

average tariff. Maximum revenue loss of $0.09<br />

billion is due to tariff cut by 100% on imports from<br />

India (Table 7.7).<br />

• There are welfare gains for Sri Lanka and other<br />

SAARC countries from the 100% tariff reduction<br />

by Sri Lanka. Welfare gains for all seven countries<br />

amounts to be $15 million and maximum welfare<br />

gains are due to India and Sri Lanka (Table 7.8).<br />

• 100% tariff reduction by Sri Lanka creates trade<br />

approximately $0.17 billion (Table 7.8).<br />

Table 7.8 Effect of 100% Tariff Cuts on Welfare<br />

and Trade: Sri Lanka<br />

($ ‘000)<br />

Partner Country Welfare Effect Total Trade Effect<br />

India–Sri Lanka* 13,858 162,261<br />

Bangladesh–Sri Lanka 127 3,593<br />

Maldives–Sri Lanka 531 4,029<br />

Nepal–Sri Lanka 118 365<br />

Pakistan–Sri Lanka 970 7,641<br />

Bhutan–Sri Lanka 0 0<br />

Total effect 15,604 177,890<br />

* Actual trade creation may be much lower as India allows<br />

significant imports from these countries at zero duty.<br />

Impact on Bhutan<br />

Tables 7.9 and 7.10 indicate bilateral revenue, welfare<br />

and trade effects in case Bhutan cuts tariff by 100%<br />

for SAFTA member countries<br />

• Revenue losses to Bhutan are about $7.3 million<br />

on the basis of SMART simulation while it is also<br />

approximately $ 2.3 and 2.6 million on the basis<br />

of simple and weighted average tariff (Table 7.9).<br />

• There are welfare gains for Bhutan and other<br />

SAARC countries from the 100% tariff reduction<br />

by Bhutan. Welfare gains for all seven countries<br />

amounts to be $ 3.2 million and maximum welfare<br />

gains are due to Bhutan and India (Table 7.10).<br />

• In case of 100% tariff reduction by Bhutan, trade<br />

increased by approximately $17 million (Table<br />

7.10).<br />

Table 7.10 Effect of 100% Tariff Cuts on Welfare<br />

and Trade: Bhutan<br />

($ ‘000)<br />

Partner Country Welfare Effect Total Trade Effect<br />

Bangladesh–Bhutan 0 0<br />

India–Bhutan 3,247 17,490<br />

Pakistan–Bhutan 0 0<br />

Total effect 3,247 17,490<br />

Table 7.9 Effect of 100% Tariff Cuts on Revenue: Bhutan<br />

($ ‘000)<br />

Partner Country Revenue Effect: Using Revenue Effect Revenue Effect Bhutan Imports<br />

SMART Simulations (using simple average) (using weighted average)<br />

Bangladesh–Bhutan 0 –993 –1,077 3,928<br />

India–Bhutan –7,361 –22,468 –25,385 99,549<br />

Pakistan–Bhutan 0 –9 –6 51<br />

Maldivies–Bhutan 0 0 9<br />

Sri Lanka–Bhutan –1 –1 12<br />

Total effect –7,361 –23,471 –26,469