Report

Report

Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EFFECTIVE ADDITIONAL MARKET ACCESS UNDER SAFTA: COUNTRYWISE ANALYSIS 39<br />

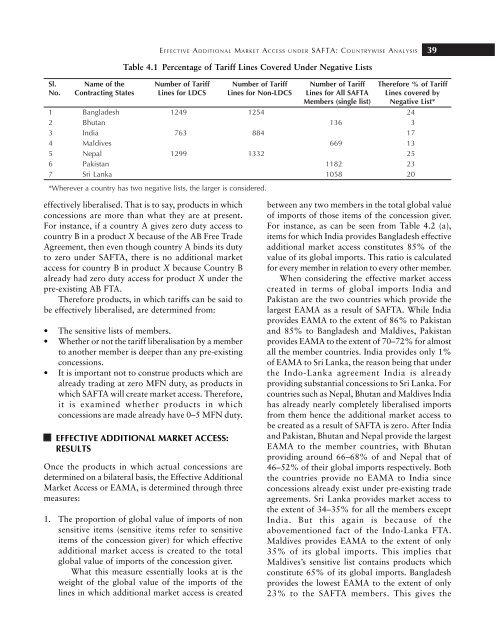

Table 4.1 Percentage of Tariff Lines Covered Under Negative Lists<br />

Sl. Name of the Number of Tariff Number of Tariff Number of Tariff Therefore % of Tariff<br />

No. Contracting States Lines for LDCS Lines for Non-LDCS Lines for All SAFTA Lines covered by<br />

Members (single list) Negative List*<br />

1 Bangladesh 1249 1254 24<br />

2 Bhutan 136 3<br />

3 India 763 884 17<br />

4 Maldives 669 13<br />

5 Nepal 1299 1332 25<br />

6 Pakistan 1182 23<br />

7 Sri Lanka 1058 20<br />

*Wherever a country has two negative lists, the larger is considered.<br />

effectively liberalised. That is to say, products in which<br />

concessions are more than what they are at present.<br />

For instance, if a country A gives zero duty access to<br />

country B in a product X because of the AB Free Trade<br />

Agreement, then even though country A binds its duty<br />

to zero under SAFTA, there is no additional market<br />

access for country B in product X because Country B<br />

already had zero duty access for product X under the<br />

pre-existing AB FTA.<br />

Therefore products, in which tariffs can be said to<br />

be effectively liberalised, are determined from:<br />

• The sensitive lists of members.<br />

• Whether or not the tariff liberalisation by a member<br />

to another member is deeper than any pre-existing<br />

concessions.<br />

• It is important not to construe products which are<br />

already trading at zero MFN duty, as products in<br />

which SAFTA will create market access. Therefore,<br />

it is examined whether products in which<br />

concessions are made already have 0–5 MFN duty.<br />

EFFECTIVE ADDITIONAL MARKET ACCESS:<br />

RESULTS<br />

Once the products in which actual concessions are<br />

determined on a bilateral basis, the Effective Additional<br />

Market Access or EAMA, is determined through three<br />

measures:<br />

1. The proportion of global value of imports of non<br />

sensitive items (sensitive items refer to sensitive<br />

items of the concession giver) for which effective<br />

additional market access is created to the total<br />

global value of imports of the concession giver.<br />

What this measure essentially looks at is the<br />

weight of the global value of the imports of the<br />

lines in which additional market access is created<br />

between any two members in the total global value<br />

of imports of those items of the concession giver.<br />

For instance, as can be seen from Table 4.2 (a),<br />

items for which India provides Bangladesh effective<br />

additional market access constitutes 85% of the<br />

value of its global imports. This ratio is calculated<br />

for every member in relation to every other member.<br />

When considering the effective market access<br />

created in terms of global imports India and<br />

Pakistan are the two countries which provide the<br />

largest EAMA as a result of SAFTA. While India<br />

provides EAMA to the extent of 86% to Pakistan<br />

and 85% to Bangladesh and Maldives, Pakistan<br />

provides EAMA to the extent of 70–72% for almost<br />

all the member countries. India provides only 1%<br />

of EAMA to Sri Lanka, the reason being that under<br />

the Indo-Lanka agreement India is already<br />

providing substantial concessions to Sri Lanka. For<br />

countries such as Nepal, Bhutan and Maldives India<br />

has already nearly completely liberalised imports<br />

from them hence the additional market access to<br />

be created as a result of SAFTA is zero. After India<br />

and Pakistan, Bhutan and Nepal provide the largest<br />

EAMA to the member countries, with Bhutan<br />

providing around 66–68% of and Nepal that of<br />

46–52% of their global imports respectively. Both<br />

the countries provide no EAMA to India since<br />

concessions already exist under pre-existing trade<br />

agreements. Sri Lanka provides market access to<br />

the extent of 34–35% for all the members except<br />

India. But this again is because of the<br />

abovementioned fact of the Indo-Lanka FTA.<br />

Maldives provides EAMA to the extent of only<br />

35% of its global imports. This implies that<br />

Maldives’s sensitive list contains products which<br />

constitute 65% of its global imports. Bangladesh<br />

provides the lowest EAMA to the extent of only<br />

23% to the SAFTA members. This gives the