Report

Report

Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

62 QUANTIFICATION OF BENEFITS FROM ECONOMIC COOPERATION IN SOUTH ASIA<br />

and skill difference between the home and the host<br />

economies. As trade cost increases in the host country,<br />

firms with vertical FDI will have to import goods from<br />

the host country at a higher cost (Joon 2007). If the<br />

difference in skill between the home and host countries<br />

increases however, relative wages for low skilled labor<br />

will decrease, thereby increasing the incentive for firms<br />

to exploit this lower production cost by producing in<br />

the low wage economy. Consequently, vertical FDI will<br />

increase as trade costs decrease and skill difference<br />

increases (Yeyati, Stein and Daude, 2003 and Lesher<br />

and Miroudot 2006). Based on the above, the<br />

Knowledge-Capital model, analyses the impact of the<br />

given factors (market size, trade costs and skill difference<br />

between the two countries) and their intersections.<br />

The Knowledge-Capital model was empirically<br />

tested by Carr et al. (2001), and one of the important<br />

results obtained was that trade costs positively impact<br />

FDI when the skill difference between home and host<br />

country is small and negatively impact FDI when large<br />

skill differences exist between the two countries. From<br />

their study one can infer that in the presence of small<br />

skill differences between parent and host economies, a<br />

rise in trade cost will result in the impact of an increase<br />

in horizontal FDI dominating the decrease in vertical<br />

FDI. In the presence of large skill differences. On the<br />

other hand, decrease in vertical FDI is larger than the<br />

increase in horizontal FDI, when trade costs rise.<br />

Jang (2007) defines decreased trade costs as an FTA<br />

and tries to test this relationship. According to the<br />

Knowledge-Capital model, one may expect the decrease<br />

in horizontal FDI to be greater than the increase in<br />

vertical FDI when trade costs declines in the presence<br />

of small skill differences between the parent and the<br />

host countries, and vice versa in the presence of large<br />

skill differences. Since vertical FDI dominates horizontal<br />

FDI in countries where skill difference is large, one<br />

should expect an FTA involving member countries with<br />

large differences in skill levels to have a positive impact<br />

on FDI. Similarly, reduced trade costs act as a disincentive<br />

for building plants in the host economy, which in<br />

the presence of small skill differences, causes a decrease<br />

in horizontal FDI to dominate the increase in vertical<br />

FDI. Therefore, FTAs with member countries with small<br />

skill differences can be expected to discourage FDI<br />

between those economies.<br />

Many empirical studies have tried to study the<br />

impact FTAs have on intra-regional and extra-regional<br />

FDI. Yeyati et al. (2003) find that regional integration<br />

on the whole contributes to attracting FDI. A study by<br />

Velde and Bezemer on the other hand, established that<br />

the impact on FDI would be different for different types<br />

of regions and the position of countries within a region<br />

would be pivotal for attracting FDI. In the context of<br />

Korea–US FTA, Kang and Park found that FTA<br />

increased FDI by 14–35% from member countries and<br />

by 28–35% from non-member countries. Baltagi et al.<br />

(2005) conducted a study on bilateral outward FDI<br />

stocks into Europe over 1989–2001 and found that an<br />

RTA increases FDI up to 78% among European<br />

countries.<br />

With respect to South Asia, very few studies have<br />

estimated the impact of intra-regional trade on inward<br />

and intra-regional FDI. One of the reasons for this is<br />

lack of bilateral data on FDI over time. This chapter<br />

attempts to estimate the impact of intra-regional trade<br />

on inward FDI into member countries of SAFTA and<br />

domestic investments in the member countries.<br />

TRENDS IN INWARD AND INTRA-REGIONAL<br />

FDI IN SOUTH ASIA<br />

Trends in Inward FDI in South Asia<br />

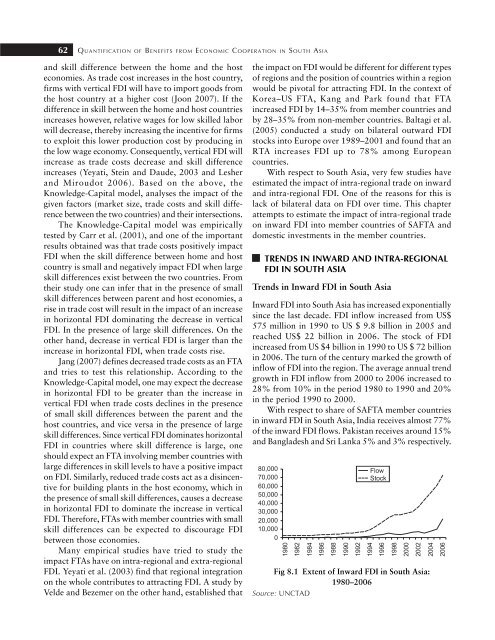

Inward FDI into South Asia has increased exponentially<br />

since the last decade. FDI inflow increased from US$<br />

575 million in 1990 to US $ 9.8 billion in 2005 and<br />

reached US$ 22 billion in 2006. The stock of FDI<br />

increased from US $4 billion in 1990 to US $ 72 billion<br />

in 2006. The turn of the century marked the growth of<br />

inflow of FDI into the region. The average annual trend<br />

growth in FDI inflow from 2000 to 2006 increased to<br />

28% from 10% in the period 1980 to 1990 and 20%<br />

in the period 1990 to 2000.<br />

With respect to share of SAFTA member countries<br />

in inward FDI in South Asia, India receives almost 77%<br />

of the inward FDI flows. Pakistan receives around 15%<br />

and Bangladesh and Sri Lanka 5% and 3% respectively.<br />

Fig 8.1 Extent of Inward FDI in South Asia:<br />

1980–2006<br />

Source: UNCTAD