Report

Report

Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

I NTRODUCTION 7<br />

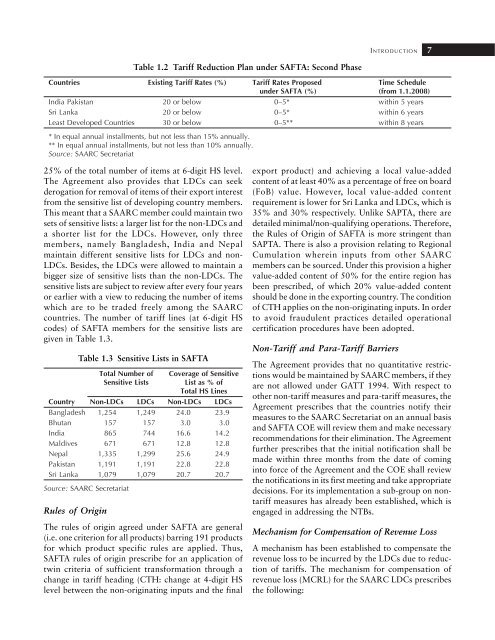

Table 1.2 Tariff Reduction Plan under SAFTA: Second Phase<br />

Countries Existing Tariff Rates (%) Tariff Rates Proposed Time Schedule<br />

under SAFTA (%) (from 1.1.2008)<br />

India Pakistan 20 or below 0–5* within 5 years<br />

Sri Lanka 20 or below 0–5* within 6 years<br />

Least Developed Countries 30 or below 0–5** within 8 years<br />

* In equal annual installments, but not less than 15% annually.<br />

** In equal annual installments, but not less than 10% annually.<br />

Source: SAARC Secretariat<br />

25% of the total number of items at 6-digit HS level.<br />

The Agreement also provides that LDCs can seek<br />

derogation for removal of items of their export interest<br />

from the sensitive list of developing country members.<br />

This meant that a SAARC member could maintain two<br />

sets of sensitive lists: a larger list for the non-LDCs and<br />

a shorter list for the LDCs. However, only three<br />

members, namely Bangladesh, India and Nepal<br />

maintain different sensitive lists for LDCs and non-<br />

LDCs. Besides, the LDCs were allowed to maintain a<br />

bigger size of sensitive lists than the non-LDCs. The<br />

sensitive lists are subject to review after every four years<br />

or earlier with a view to reducing the number of items<br />

which are to be traded freely among the SAARC<br />

countries. The number of tariff lines (at 6-digit HS<br />

codes) of SAFTA members for the sensitive lists are<br />

given in Table 1.3.<br />

Table 1.3 Sensitive Lists in SAFTA<br />

Total Number of Coverage of Sensitive<br />

Sensitive Lists List as % of<br />

Total HS Lines<br />

Country Non-LDCs LDCs Non-LDCs LDCs<br />

Bangladesh 1,254 1,249 24.0 23.9<br />

Bhutan 157 157 3.0 3.0<br />

India 865 744 16.6 14.2<br />

Maldives 671 671 12.8 12.8<br />

Nepal 1,335 1,299 25.6 24.9<br />

Pakistan 1,191 1,191 22.8 22.8<br />

Sri Lanka 1,079 1,079 20.7 20.7<br />

Source: SAARC Secretariat<br />

Rules of Origin<br />

The rules of origin agreed under SAFTA are general<br />

(i.e. one criterion for all products) barring 191 products<br />

for which product specific rules are applied. Thus,<br />

SAFTA rules of origin prescribe for an application of<br />

twin criteria of sufficient transformation through a<br />

change in tariff heading (CTH: change at 4-digit HS<br />

level between the non-originating inputs and the final<br />

export product) and achieving a local value-added<br />

content of at least 40% as a percentage of free on board<br />

(FoB) value. However, local value-added content<br />

requirement is lower for Sri Lanka and LDCs, which is<br />

35% and 30% respectively. Unlike SAPTA, there are<br />

detailed minimal/non-qualifying operations. Therefore,<br />

the Rules of Origin of SAFTA is more stringent than<br />

SAPTA. There is also a provision relating to Regional<br />

Cumulation wherein inputs from other SAARC<br />

members can be sourced. Under this provision a higher<br />

value-added content of 50% for the entire region has<br />

been prescribed, of which 20% value-added content<br />

should be done in the exporting country. The condition<br />

of CTH applies on the non-originating inputs. In order<br />

to avoid fraudulent practices detailed operational<br />

certification procedures have been adopted.<br />

Non-Tariff and Para-Tariff Barriers<br />

The Agreement provides that no quantitative restrictions<br />

would be maintained by SAARC members, if they<br />

are not allowed under GATT 1994. With respect to<br />

other non-tariff measures and para-tariff measures, the<br />

Agreement prescribes that the countries notify their<br />

measures to the SAARC Secretariat on an annual basis<br />

and SAFTA COE will review them and make necessary<br />

recommendations for their elimination. The Agreement<br />

further prescribes that the initial notification shall be<br />

made within three months from the date of coming<br />

into force of the Agreement and the COE shall review<br />

the notifications in its first meeting and take appropriate<br />

decisions. For its implementation a sub-group on nontariff<br />

measures has already been established, which is<br />

engaged in addressing the NTBs.<br />

Mechanism for Compensation of Revenue Loss<br />

A mechanism has been established to compensate the<br />

revenue loss to be incurred by the LDCs due to reduction<br />

of tariffs. The mechanism for compensation of<br />

revenue loss (MCRL) for the SAARC LDCs prescribes<br />

the following: