Report

Report

Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

P ROSPECTS FOR THE TELECOMMUNICATION SECTOR UNDER SAFTA 171<br />

India’s telecom renaissance has been remarkable.<br />

After 44 years of government monopoly, market<br />

liberalisation introduced in 1991 has led to a 10-fold<br />

increase in the number of phones in just 15 years. India’s<br />

network is one of the largest in the world and, after<br />

the People’s Republic of China, second largest among<br />

emerging economies. Given the persistent low telephone<br />

penetration rate compared to industrialised countries,<br />

but high levels of overall economic growth, the telecom<br />

sector offers vast potential. The mobile market recently<br />

topped 200 mn customers. It is therefore not surprising<br />

that India is one of the fastest growing telecom markets<br />

with an average annual growth of about 22% for basic<br />

telephony and over 100% for cellular and Internet<br />

services.<br />

Recognising that the telecom sector is one of the<br />

prime-movers of economy, the Government’s regulatory<br />

and policy initiatives have been directed toward establishing<br />

a world-class telecommunications infrastructure.<br />

Capital requirements are considerable. India requires<br />

investments of at least $69 bn by 2010. India’s telecommunications<br />

sector is now among the most<br />

deregulated in the world and presents potentially<br />

lucrative opportunities for service providers and<br />

equipment vendors alike. Companies that have successfully<br />

seized the opportunity are Agilent, AT&T Cisco,<br />

HP, Hughes Network Systems, Lucent Technologies,<br />

MCI Motorola, Qualcomm, Sprint and Tekelec.<br />

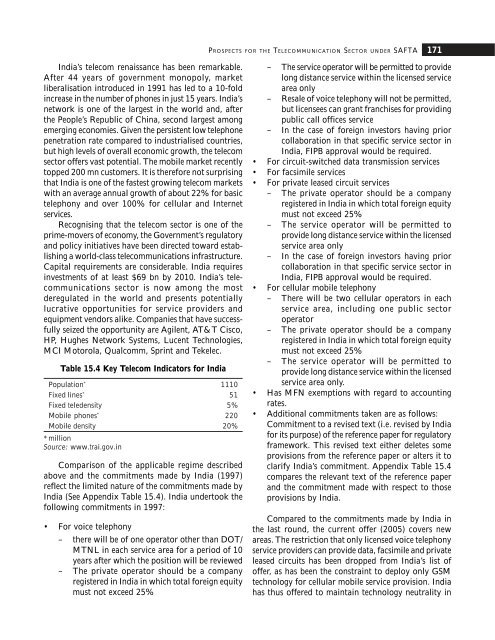

Table 15.4 Key Telecom Indicators for India<br />

Population * 1110<br />

Fixed lines * 51<br />

Fixed teledensity 5%<br />

Mobile phones * 220<br />

Mobile density 20%<br />

* million<br />

Source: www.trai.gov.in<br />

Comparison of the applicable regime described<br />

above and the commitments made by India (1997)<br />

reflect the limited nature of the commitments made by<br />

India (See Appendix Table 15.4). India undertook the<br />

following commitments in 1997:<br />

• For voice telephony<br />

– there will be of one operator other than DOT/<br />

MTNL in each service area for a period of 10<br />

years after which the position will be reviewed<br />

– The private operator should be a company<br />

registered in India in which total foreign equity<br />

must not exceed 25%<br />

– The service operator will be permitted to provide<br />

long distance service within the licensed service<br />

area only<br />

– Resale of voice telephony will not be permitted,<br />

but licensees can grant franchises for providing<br />

public call offices service<br />

– In the case of foreign investors having prior<br />

collaboration in that specific service sector in<br />

India, FIPB approval would be required.<br />

• For circuit-switched data transmission services<br />

• For facsimile services<br />

• For private leased circuit services<br />

– The private operator should be a company<br />

registered in India in which total foreign equity<br />

must not exceed 25%<br />

– The service operator will be permitted to<br />

provide long distance service within the licensed<br />

service area only<br />

– In the case of foreign investors having prior<br />

collaboration in that specific service sector in<br />

India, FIPB approval would be required.<br />

• For cellular mobile telephony<br />

– There will be two cellular operators in each<br />

service area, including one public sector<br />

operator<br />

– The private operator should be a company<br />

registered in India in which total foreign equity<br />

must not exceed 25%<br />

– The service operator will be permitted to<br />

provide long distance service within the licensed<br />

service area only.<br />

• Has MFN exemptions with regard to accounting<br />

rates.<br />

• Additional commitments taken are as follows:<br />

Commitment to a revised text (i.e. revised by India<br />

for its purpose) of the reference paper for regulatory<br />

framework. This revised text either deletes some<br />

provisions from the reference paper or alters it to<br />

clarify India’s commitment. Appendix Table 15.4<br />

compares the relevant text of the reference paper<br />

and the commitment made with respect to those<br />

provisions by India.<br />

Compared to the commitments made by India in<br />

the last round, the current offer (2005) covers new<br />

areas. The restriction that only licensed voice telephony<br />

service providers can provide data, facsimile and private<br />

leased circuits has been dropped from India’s list of<br />

offer, as has been the constraint to deploy only GSM<br />

technology for cellular mobile service provision. India<br />

has thus offered to maintain technology neutrality in