Report

Report

Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

32 QUANTIFICATION OF BENEFITS FROM ECONOMIC COOPERATION IN SOUTH ASIA<br />

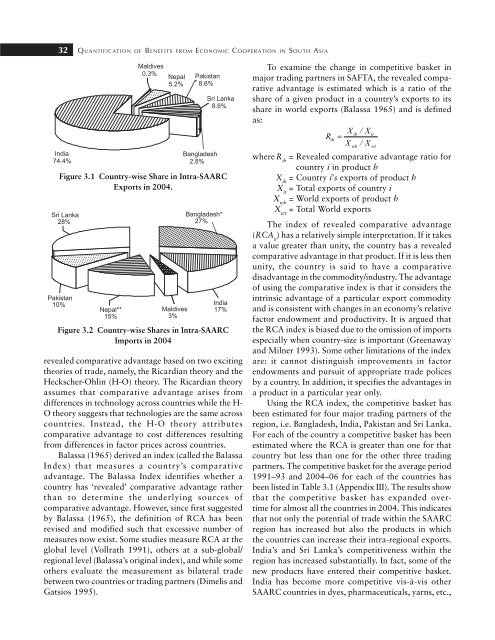

Figure 3.1 Country-wise Share in Intra-SAARC<br />

Exports in 2004.<br />

Figure 3.2 Country-wise Shares in Intra-SAARC<br />

Imports in 2004<br />

revealed comparative advantage based on two exciting<br />

theories of trade, namely, the Ricardian theory and the<br />

Heckscher-Ohlin (H-O) theory. The Ricardian theory<br />

assumes that comparative advantage arises from<br />

differences in technology across countries while the H-<br />

O theory suggests that technologies are the same across<br />

countries. Instead, the H-O theory attributes<br />

comparative advantage to cost differences resulting<br />

from differences in factor prices across countries.<br />

Balassa (1965) derived an index (called the Balassa<br />

Index) that measures a country’s comparative<br />

advantage. The Balassa Index identifies whether a<br />

country has ‘revealed’ comparative advantage rather<br />

than to determine the underlying sources of<br />

comparative advantage. However, since first suggested<br />

by Balassa (1965), the definition of RCA has been<br />

revised and modified such that excessive number of<br />

measures now exist. Some studies measure RCA at the<br />

global level (Vollrath 1991), others at a sub-global/<br />

regional level (Balassa’s original index), and while some<br />

others evaluate the measurement as bilateral trade<br />

between two countries or trading partners (Dimelis and<br />

Gatsios 1995).<br />

To examine the change in competitive basket in<br />

major trading partners in SAFTA, the revealed comparative<br />

advantage is estimated which is a ratio of the<br />

share of a given product in a country’s exports to its<br />

share in world exports (Balassa 1965) and is defined<br />

as:<br />

X<br />

ih<br />

/ Xit<br />

Rih<br />

=<br />

X<br />

wh<br />

/ Xwt<br />

where R ih<br />

= Revealed comparative advantage ratio for<br />

country i in product h<br />

X ih<br />

= Country i’s exports of product h<br />

X it<br />

= Total exports of country i<br />

X wh<br />

= World exports of product h<br />

X wt<br />

= Total World exports<br />

The index of revealed comparative advantage<br />

(RCA ij<br />

) has a relatively simple interpretation. If it takes<br />

a value greater than unity, the country has a revealed<br />

comparative advantage in that product. If it is less then<br />

unity, the country is said to have a comparative<br />

disadvantage in the commodity/industry. The advantage<br />

of using the comparative index is that it considers the<br />

intrinsic advantage of a particular export commodity<br />

and is consistent with changes in an economy’s relative<br />

factor endowment and productivity. It is argued that<br />

the RCA index is biased due to the omission of imports<br />

especially when country-size is important (Greenaway<br />

and Milner 1993). Some other limitations of the index<br />

are: it cannot distinguish improvements in factor<br />

endowments and pursuit of appropriate trade polices<br />

by a country. In addition, it specifies the advantages in<br />

a product in a particular year only.<br />

Using the RCA index, the competitive basket has<br />

been estimated for four major trading partners of the<br />

region, i.e. Bangladesh, India, Pakistan and Sri Lanka.<br />

For each of the country a competitive basket has been<br />

estimated where the RCA is greater than one for that<br />

country but less than one for the other three trading<br />

partners. The competitive basket for the average period<br />

1991–93 and 2004–06 for each of the countries has<br />

been listed in Table 3.1 (Appendix III). The results show<br />

that the competitive basket has expanded overtime<br />

for almost all the countries in 2004. This indicates<br />

that not only the potential of trade within the SAARC<br />

region has increased but also the products in which<br />

the countries can increase their intra-regional exports.<br />

India’s and Sri Lanka’s competitiveness within the<br />

region has increased substantially. In fact, some of the<br />

new products have entered their competitive basket.<br />

India has become more competitive vis-à-vis other<br />

SAARC countries in dyes, pharmaceuticals, yarns, etc.,