The Benefits to Taxpayers from Increases in Students - RAND ...

The Benefits to Taxpayers from Increases in Students - RAND ...

The Benefits to Taxpayers from Increases in Students - RAND ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76 <strong>The</strong> <strong>Benefits</strong> <strong>to</strong> <strong>Taxpayers</strong> <strong>from</strong> <strong>Increases</strong> <strong>in</strong> <strong>Students</strong>’ Educational Atta<strong>in</strong>ment<br />

the benefit <strong>to</strong> taxpayers if a student achieves a high school diploma rather than dropp<strong>in</strong>g<br />

out, the benefit is the difference <strong>in</strong> expected tax payments, social program costs,<br />

and the costs of <strong>in</strong>carceration between the average high school graduate and the average<br />

high school dropout, and not simply the expected values for high school graduates<br />

per se. We apply a similar logic <strong>to</strong> all costs and benefits.<br />

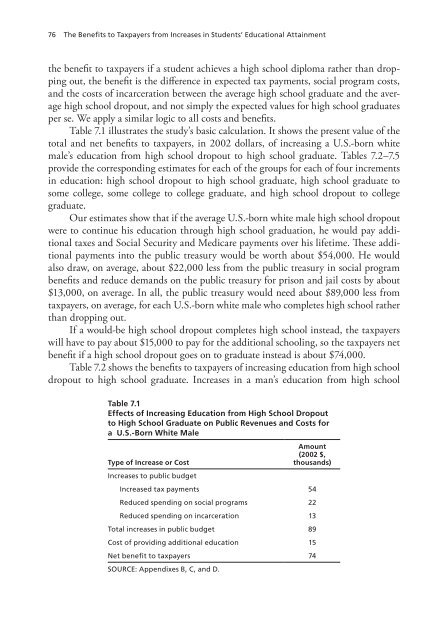

Table 7.1 illustrates the study’s basic calculation. It shows the present value of the<br />

<strong>to</strong>tal and net benefits <strong>to</strong> taxpayers, <strong>in</strong> 2002 dollars, of <strong>in</strong>creas<strong>in</strong>g a U.S.-born white<br />

male’s education <strong>from</strong> high school dropout <strong>to</strong> high school graduate. Tables 7.2–7.5<br />

provide the correspond<strong>in</strong>g estimates for each of the groups for each of four <strong>in</strong>crements<br />

<strong>in</strong> education: high school dropout <strong>to</strong> high school graduate, high school graduate <strong>to</strong><br />

some college, some college <strong>to</strong> college graduate, and high school dropout <strong>to</strong> college<br />

graduate.<br />

Our estimates show that if the average U.S.-born white male high school dropout<br />

were <strong>to</strong> cont<strong>in</strong>ue his education through high school graduation, he would pay additional<br />

taxes and Social Security and Medicare payments over his lifetime. <strong>The</strong>se additional<br />

payments <strong>in</strong><strong>to</strong> the public treasury would be worth about $54,000. He would<br />

also draw, on average, about $22,000 less <strong>from</strong> the public treasury <strong>in</strong> social program<br />

benefits and reduce demands on the public treasury for prison and jail costs by about<br />

$13,000, on average. In all, the public treasury would need about $89,000 less <strong>from</strong><br />

taxpayers, on average, for each U.S.-born white male who completes high school rather<br />

than dropp<strong>in</strong>g out.<br />

If a would-be high school dropout completes high school <strong>in</strong>stead, the taxpayers<br />

will have <strong>to</strong> pay about $15,000 <strong>to</strong> pay for the additional school<strong>in</strong>g, so the taxpayers net<br />

benefit if a high school dropout goes on <strong>to</strong> graduate <strong>in</strong>stead is about $74,000.<br />

Table 7.2 shows the benefits <strong>to</strong> taxpayers of <strong>in</strong>creas<strong>in</strong>g education <strong>from</strong> high school<br />

dropout <strong>to</strong> high school graduate. <strong>Increases</strong> <strong>in</strong> a man’s education <strong>from</strong> high school<br />

Table 7.1<br />

Effects of Increas<strong>in</strong>g Education <strong>from</strong> High School Dropout<br />

<strong>to</strong> High School Graduate on Public Revenues and Costs for<br />

a U.S.-Born White Male<br />

Type of Increase or Cost<br />

<strong>Increases</strong> <strong>to</strong> public budget<br />

Amount<br />

(2002 $,<br />

thousands)<br />

Increased tax payments 54<br />

Reduced spend<strong>in</strong>g on social programs 22<br />

Reduced spend<strong>in</strong>g on <strong>in</strong>carceration 13<br />

Total <strong>in</strong>creases <strong>in</strong> public budget 89<br />

Cost of provid<strong>in</strong>g additional education 15<br />

Net benefit <strong>to</strong> taxpayers 74<br />

SOURCE: Appendixes B, C, and D.