The Benefits to Taxpayers from Increases in Students - RAND ...

The Benefits to Taxpayers from Increases in Students - RAND ...

The Benefits to Taxpayers from Increases in Students - RAND ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

32 <strong>The</strong> <strong>Benefits</strong> <strong>to</strong> <strong>Taxpayers</strong> <strong>from</strong> <strong>Increases</strong> <strong>in</strong> <strong>Students</strong>’ Educational Atta<strong>in</strong>ment<br />

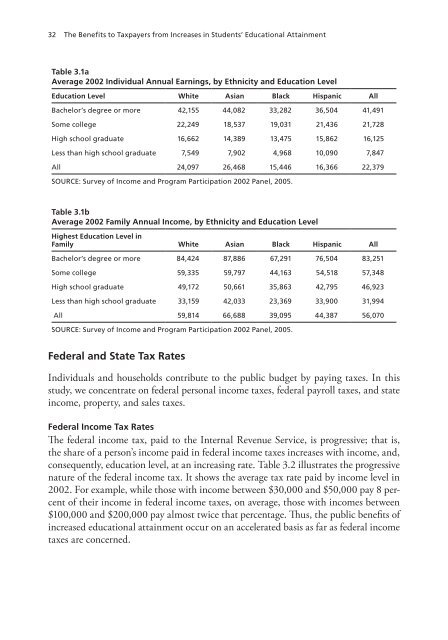

Table 3.1a<br />

Average 2002 Individual Annual Earn<strong>in</strong>gs, by Ethnicity and Education Level<br />

Education Level White Asian Black Hispanic All<br />

Bachelor’s degree or more 42,155 44,082 33,282 36,504 41,491<br />

Some college 22,249 18,537 19,031 21,436 21,728<br />

High school graduate 16,662 14,389 13,475 15,862 16,125<br />

Less than high school graduate 7,549 7,902 4,968 10,090 7,847<br />

All 24,097 26,468 15,446 16,366 22,379<br />

SOURCE: Survey of Income and Program Participation 2002 Panel, 2005.<br />

Table 3.1b<br />

Average 2002 Family Annual Income, by Ethnicity and Education Level<br />

Highest Education Level <strong>in</strong><br />

Family White Asian Black Hispanic All<br />

Bachelor’s degree or more 84,424 87,886 67,291 76,504 83,251<br />

Some college 59,335 59,797 44,163 54,518 57,348<br />

High school graduate 49,172 50,661 35,863 42,795 46,923<br />

Less than high school graduate 33,159 42,033 23,369 33,900 31,994<br />

All 59,814 66,688 39,095 44,387 56,070<br />

SOURCE: Survey of Income and Program Participation 2002 Panel, 2005.<br />

Federal and State Tax Rates<br />

Individuals and households contribute <strong>to</strong> the public budget by pay<strong>in</strong>g taxes. In this<br />

study, we concentrate on federal personal <strong>in</strong>come taxes, federal payroll taxes, and state<br />

<strong>in</strong>come, property, and sales taxes.<br />

Federal Income Tax Rates<br />

<strong>The</strong> federal <strong>in</strong>come tax, paid <strong>to</strong> the Internal Revenue Service, is progressive; that is,<br />

the share of a person’s <strong>in</strong>come paid <strong>in</strong> federal <strong>in</strong>come taxes <strong>in</strong>creases with <strong>in</strong>come, and,<br />

consequently, education level, at an <strong>in</strong>creas<strong>in</strong>g rate. Table 3.2 illustrates the progressive<br />

nature of the federal <strong>in</strong>come tax. It shows the average tax rate paid by <strong>in</strong>come level <strong>in</strong><br />

2002. For example, while those with <strong>in</strong>come between $30,000 and $50,000 pay 8 percent<br />

of their <strong>in</strong>come <strong>in</strong> federal <strong>in</strong>come taxes, on average, those with <strong>in</strong>comes between<br />

$100,000 and $200,000 pay almost twice that percentage. Thus, the public benefits of<br />

<strong>in</strong>creased educational atta<strong>in</strong>ment occur on an accelerated basis as far as federal <strong>in</strong>come<br />

taxes are concerned.