rural-urban dynamics_report.pdf - Khazar University

rural-urban dynamics_report.pdf - Khazar University

rural-urban dynamics_report.pdf - Khazar University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

136 URBANIZATION AND THE MDGS GLOBAL MONITORING REPORT 2013<br />

government officials assessed the market<br />

value and replacement costs of assets for land<br />

acquisition purposes. In 1972, the government<br />

introduced the Basic Land Prices system<br />

to improve assessments. In this new system,<br />

land and buildings had to be assessed by certified<br />

private appraisers rather than government<br />

officials. Two appraisers had to provide<br />

estimated values for the property, and the<br />

final value was calculated as the average of<br />

the two values. If the two appraisals differed<br />

by more than 10 percent, a third appraiser<br />

was selected and the average recalculated.<br />

Since 2003, a third appraiser may be recommended<br />

by affected individuals as well<br />

(World Bank 2013a ).<br />

Developing countries often lack the systems<br />

to record and manage information on<br />

land transactions. The data may not reflect<br />

the true price of land because of black market<br />

transactions to save on duties, for example,<br />

or because of heavy public subsidies on housing<br />

and land use. Land registries are often<br />

archaic and lack the dynamic functions that<br />

allow them to be searched or updated quickly.<br />

These deficiencies translate into a dearth<br />

of data on real estate prices, preventing the<br />

critical analysis necessary for appraising land<br />

values. That, in turn, has heavy implications<br />

for local revenue generation, such as property<br />

tax collection and land sales or leases, that is<br />

based on real estate values.<br />

Take India, where such information systems<br />

are in their infancy and the government<br />

often acquires land for industrial and<br />

infrastructure development. Farmers and<br />

other landowners are compensated with payments<br />

benchmarked to the stamp duties, a<br />

land transaction tax. But because the marginal<br />

rate for stamp duties has been as high<br />

as 12 percent historically, land and property<br />

values have long been under<strong>report</strong>ed (World<br />

Bank 2013b). 1 Now, as India’s policy makers<br />

amend the rules for changes in land use, the<br />

lack of independent and reliable land valuations<br />

is likely to result in public discontent<br />

and conflicts over land.<br />

In Vietnam, too, official land prices fail to<br />

reflect demand. The country has two prices<br />

for land transactions—a market price, and<br />

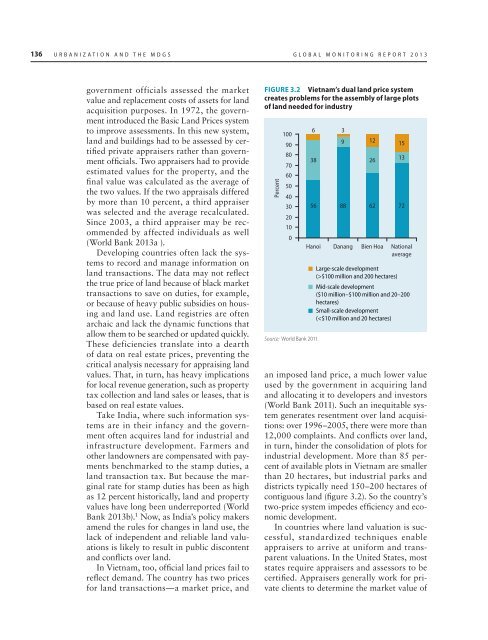

FIGURE 3.2 Vietnam’s dual land price system<br />

creates problems for the assembly of large plots<br />

of land needed for industry<br />

Percent<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

6<br />

38<br />

56<br />

Source: World Bank 2011.<br />

3<br />

9<br />

88<br />

Hanoi Danang Bien Hoa<br />

62 72<br />

Large-scale development<br />

(>$100 million and 200 hectares)<br />

Mid-scale development<br />

($10 million–$100 million and 20–200<br />

hectares)<br />

Small-scale development<br />

(