rural-urban dynamics_report.pdf - Khazar University

rural-urban dynamics_report.pdf - Khazar University

rural-urban dynamics_report.pdf - Khazar University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

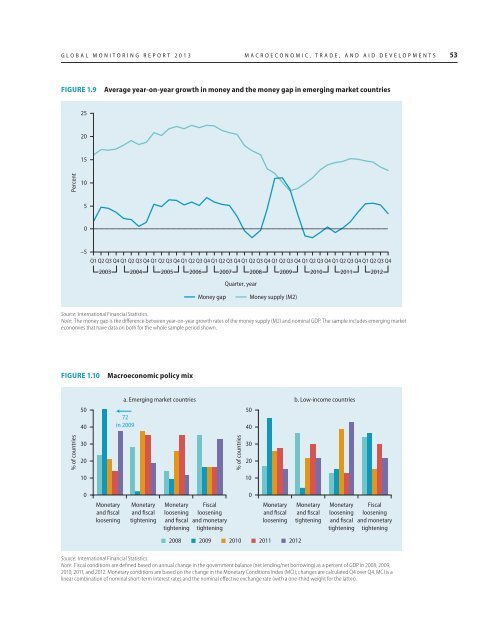

GLOBAL MONITORING REPORT 2013 MACROECONOMIC, TRADE, AND AID DEVELOPMENTS 53<br />

FIGURE 1.9<br />

Average year-on-year growth in money and the money gap in emerging market countries<br />

25<br />

20<br />

15<br />

Percent<br />

10<br />

5<br />

0<br />

–5<br />

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

Quarter, year<br />

Money gap<br />

Money supply (M2)<br />

Source: International Financial Statistics.<br />

Note: The money gap is the difference between year-on-year growth rates of the money supply (M2) and nominal GDP. The sample includes emerging market<br />

economies that have data on both for the whole sample period shown.<br />

FIGURE 1.10<br />

Macroeconomic policy mix<br />

50<br />

40<br />

a. Emerging market countries<br />

72<br />

in 2009<br />

50<br />

40<br />

b. Low-income countries<br />

% of countries<br />

30<br />

20<br />

% of countries<br />

30<br />

20<br />

10<br />

10<br />

0<br />

Monetary<br />

and fiscal<br />

loosening<br />

Monetary<br />

and fiscal<br />

tightening<br />

Monetary Fiscal<br />

loosening loosening<br />

and fiscal and monetary<br />

tightening tightening<br />

0<br />

Monetary<br />

and fiscal<br />

loosening<br />

Monetary<br />

and fiscal<br />

tightening<br />

Monetary Fiscal<br />

loosening loosening<br />

and fiscal and monetary<br />

tightening tightening<br />

2008 2009 2010 2011 2012<br />

Source: International Financial Statistics.<br />

Note: Fiscal conditions are defined based on annual change in the government balance (net lending/net borrowing) as a percent of GDP in 2008, 2009,<br />

2010, 2011, and 2012. Monetary conditions are based on the change in the Monetary Conditions Index (MCI); changes are calculated Q4 over Q4. MCI is a<br />

linear combination of nominal short-term interest rates and the nominal effective exchange rate (with a one-third weight for the latter).