Long Term Community Plan 2012-2022 - Hurunui District Council

Long Term Community Plan 2012-2022 - Hurunui District Council

Long Term Community Plan 2012-2022 - Hurunui District Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.hurunui.govt.nz<br />

Forecasting Assumptions<br />

1. Inflation<br />

In preparing the LTP, the <strong>Council</strong> is required to use best<br />

estimates in determining the level of costs to be budgeted in<br />

the future. As a result, the <strong>Council</strong> is required to account for<br />

the effect of price changes or inflation that is expected to occur<br />

over the ten year period.<br />

To develop a consistent approach for local government to<br />

account for inflation, the Society of Local Government Managers<br />

(SOLGM) contracted Business and Economic Research Limited<br />

(BERL) to construct forecasts for inflation.<br />

The <strong>Hurunui</strong> <strong>District</strong> <strong>Council</strong> has endorsed the Local<br />

Government Cost Index (LGCI) rates produced by BERL and<br />

have used these rates as the assumption for accounting for<br />

inflation in the preparation of the LTP. In applying the rates, the<br />

<strong>Council</strong> has adopted the split between Operating Expenditure<br />

(Opex) and Capital Expenditure (Capex) as allowed for in<br />

BERL’s analysis.<br />

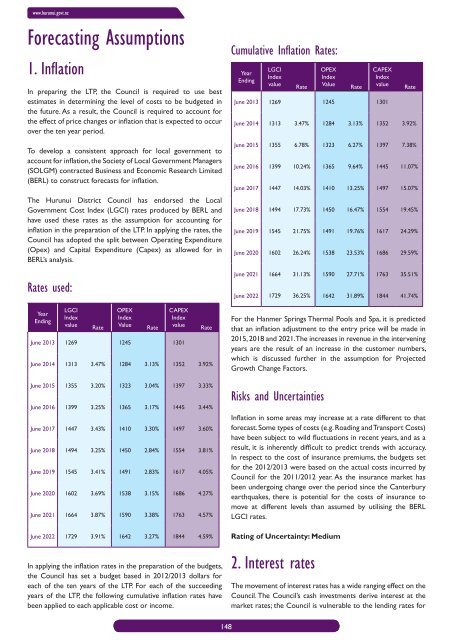

Rates used:<br />

Year<br />

Ending<br />

LGCI<br />

Index<br />

value<br />

Rate<br />

OPEX<br />

Index<br />

Value<br />

Rate<br />

CAPEX<br />

Index<br />

value<br />

June 2013 1269 1245 1301<br />

Rate<br />

June 2014 1313 3.47% 1284 3.13% 1352 3.92%<br />

June 2015 1355 3.20% 1323 3.04% 1397 3.33%<br />

June 2016 1399 3.25% 1365 3.17% 1445 3.44%<br />

June 2017 1447 3.43% 1410 3.30% 1497 3.60%<br />

June 2018 1494 3.25% 1450 2.84% 1554 3.81%<br />

June 2019 1545 3.41% 1491 2.83% 1617 4.05%<br />

June 2020 1602 3.69% 1538 3.15% 1686 4.27%<br />

June 2021 1664 3.87% 1590 3.38% 1763 4.57%<br />

June <strong>2022</strong> 1729 3.91% 1642 3.27% 1844 4.59%<br />

In applying the inflation rates in the preparation of the budgets,<br />

the <strong>Council</strong> has set a budget based in <strong>2012</strong>/2013 dollars for<br />

each of the ten years of the LTP. For each of the succeeding<br />

years of the LTP, the following cumulative inflation rates have<br />

been applied to each applicable cost or income.<br />

Cumulative Inflation Rates:<br />

Year<br />

Ending<br />

LGCI<br />

Index<br />

value<br />

Rate<br />

OPEX<br />

Index<br />

Value<br />

Rate<br />

CAPEX<br />

Index<br />

value<br />

June 2013 1269 1245 1301<br />

Rate<br />

June 2014 1313 3.47% 1284 3.13% 1352 3.92%<br />

June 2015 1355 6.78% 1323 6.27% 1397 7.38%<br />

June 2016 1399 10.24% 1365 9.64% 1445 11.07%<br />

June 2017 1447 14.03% 1410 13.25% 1497 15.07%<br />

June 2018 1494 17.73% 1450 16.47% 1554 19.45%<br />

June 2019 1545 21.75% 1491 19.76% 1617 24.29%<br />

June 2020 1602 26.24% 1538 23.53% 1686 29.59%<br />

June 2021 1664 31.13% 1590 27.71% 1763 35.51%<br />

June <strong>2022</strong> 1729 36.25% 1642 31.89% 1844 41.74%<br />

For the Hanmer Springs Thermal Pools and Spa, it is predicted<br />

that an inflation adjustment to the entry price will be made in<br />

2015, 2018 and 2021. The increases in revenue in the intervening<br />

years are the result of an increase in the customer numbers,<br />

which is discussed further in the assumption for Projected<br />

Growth Change Factors.<br />

Risks and Uncertainties<br />

Inflation in some areas may increase at a rate different to that<br />

forecast. Some types of costs (e.g. Roading and Transport Costs)<br />

have been subject to wild fluctuations in recent years, and as a<br />

result, it is inherently difficult to predict trends with accuracy.<br />

In respect to the cost of insurance premiums, the budgets set<br />

for the <strong>2012</strong>/2013 were based on the actual costs incurred by<br />

<strong>Council</strong> for the 2011/<strong>2012</strong> year. As the insurance market has<br />

been undergoing change over the period since the Canterbury<br />

earthquakes, there is potential for the costs of insurance to<br />

move at different levels than assumed by utilising the BERL<br />

LGCI rates.<br />

Rating of Uncertainty: Medium<br />

2. Interest rates<br />

The movement of interest rates has a wide ranging effect on the<br />

<strong>Council</strong>. The <strong>Council</strong>’s cash investments derive interest at the<br />

market rates; the <strong>Council</strong> is vulnerable to the lending rates for<br />

148