Long Term Community Plan 2012-2022 - Hurunui District Council

Long Term Community Plan 2012-2022 - Hurunui District Council

Long Term Community Plan 2012-2022 - Hurunui District Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Hurunui</strong> <strong>Community</strong> <strong>Long</strong> <strong>Term</strong> <strong>Plan</strong> <strong>2012</strong> - <strong>2022</strong><br />

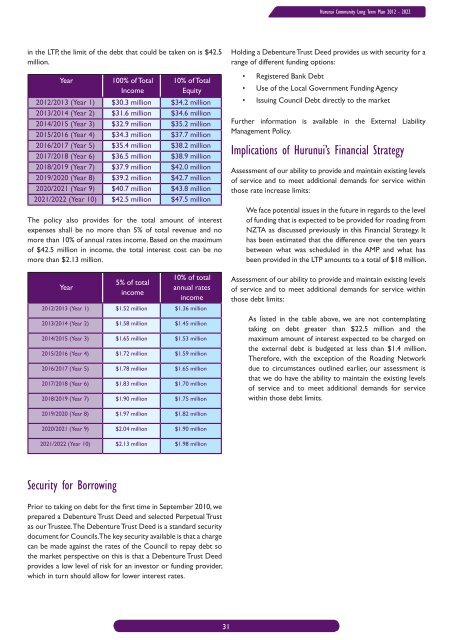

in the LTP, the limit of the debt that could be taken on is $42.5<br />

million.<br />

Year<br />

100% of Total<br />

Income<br />

10% of Total<br />

Equity<br />

<strong>2012</strong>/2013 (Year 1) $30.3 million $34.2 million<br />

2013/2014 (Year 2) $31.6 million $34.6 million<br />

2014/2015 (Year 3) $32.9 million $35.2 million<br />

2015/2016 (Year 4) $34.3 million $37.7 million<br />

2016/2017 (Year 5) $35.4 million $38.2 million<br />

2017/2018 (Year 6) $36.5 million $38.9 million<br />

2018/2019 (Year 7) $37.9 million $42.0 million<br />

2019/2020 (Year 8) $39.2 million $42.7 million<br />

2020/2021 (Year 9) $40.7 million $43.8 million<br />

2021/<strong>2022</strong> (Year 10) $42.5 million $47.5 million<br />

The policy also provides for the total amount of interest<br />

expenses shall be no more than 5% of total revenue and no<br />

more than 10% of annual rates income. Based on the maximum<br />

of $42.5 million in income, the total interest cost can be no<br />

more than $2.13 million.<br />

Year<br />

5% of total<br />

income<br />

10% of total<br />

annual rates<br />

income<br />

<strong>2012</strong>/2013 (Year 1) $1.52 million $1.36 million<br />

2013/2014 (Year 2) $1.58 million $1.45 million<br />

2014/2015 (Year 3) $1.65 million $1.53 million<br />

2015/2016 (Year 4) $1.72 million $1.59 million<br />

2016/2017 (Year 5) $1.78 million $1.65 million<br />

2017/2018 (Year 6) $1.83 million $1.70 million<br />

2018/2019 (Year 7) $1.90 million $1.75 million<br />

Holding a Debenture Trust Deed provides us with security for a<br />

range of different funding options:<br />

• Registered Bank Debt<br />

• Use of the Local Government Funding Agency<br />

• Issuing <strong>Council</strong> Debt directly to the market<br />

Further information is available in the External Liability<br />

Management Policy.<br />

Implications of <strong>Hurunui</strong>’s Financial Strategy<br />

Assessment of our ability to provide and maintain existing levels<br />

of service and to meet additional demands for service within<br />

those rate increase limits:<br />

We face potential issues in the future in regards to the level<br />

of funding that is expected to be provided for roading from<br />

NZTA as discussed previously in this Financial Strategy. It<br />

has been estimated that the difference over the ten years<br />

between what was scheduled in the AMP and what has<br />

been provided in the LTP amounts to a total of $18 million.<br />

Assessment of our ability to provide and maintain existing levels<br />

of service and to meet additional demands for service within<br />

those debt limits:<br />

As listed in the table above, we are not contemplating<br />

taking on debt greater than $22.5 million and the<br />

maximum amount of interest expected to be charged on<br />

the external debt is budgeted at less than $1.4 million.<br />

Therefore, with the exception of the Roading Network<br />

due to circumstances outlined earlier, our assessment is<br />

that we do have the ability to maintain the existing levels<br />

of service and to meet additional demands for service<br />

within those debt limits.<br />

2019/2020 (Year 8) $1.97 million $1.82 million<br />

2020/2021 (Year 9) $2.04 million $1.90 million<br />

2021/<strong>2022</strong> (Year 10) $2.13 million $1.98 million<br />

Security for Borrowing<br />

Prior to taking on debt for the first time in September 2010, we<br />

prepared a Debenture Trust Deed and selected Perpetual Trust<br />

as our Trustee. The Debenture Trust Deed is a standard security<br />

document for <strong>Council</strong>s. The key security available is that a charge<br />

can be made against the rates of the <strong>Council</strong> to repay debt so<br />

the market perspective on this is that a Debenture Trust Deed<br />

provides a low level of risk for an investor or funding provider,<br />

which in turn should allow for lower interest rates.<br />

31