Long Term Community Plan 2012-2022 - Hurunui District Council

Long Term Community Plan 2012-2022 - Hurunui District Council

Long Term Community Plan 2012-2022 - Hurunui District Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Hurunui</strong> <strong>Community</strong> <strong>Long</strong> <strong>Term</strong> <strong>Plan</strong> <strong>2012</strong> - <strong>2022</strong><br />

• Setting a percentage increase.<br />

• Setting an increase based on known factors and<br />

assumptions.<br />

We felt that setting rate increase limits based on an arbitrary<br />

rate of inflation was not consistent to the assessment of the<br />

proposed costs outlined in the LTP. This is because it did not<br />

take into account items such as new capital expenditure, which<br />

could result in a necessary increase in rates to fund the work,<br />

which could exceed the overall increase in rates.<br />

Setting a percentage increase per annum again did not reflect<br />

the assessment of the proposed costs in the long term.<br />

Furthermore, as the rates for individual communities can<br />

increases at varying amounts due to various factors, it was<br />

difficult to set a percentage increase that reflected these factors<br />

adequately.<br />

As a result, we decided that the limit to be placed on rate<br />

increases is to be set as a percentage of the overall rates<br />

increases predicted in the LTP.<br />

Limits<br />

The percentage on top of the predicted rates increases will be<br />

2%. In determining this percentage, we that felt 2% provides<br />

sufficient flexibility, particularly if there is significant cost<br />

increases (on top of what has been allowed for using the BERL<br />

cost price increase projections) imposed on us as a result of the<br />

on-going effects of the Canterbury Earthquakes.<br />

As a result, the limits will be as follows<br />

Year<br />

Overall<br />

Increase<br />

Overall<br />

Increase Limit<br />

<strong>2012</strong>/2013 (Year 1) 5.83% 7.83%<br />

2013/2014 (Year 2) 5.77% 7.77%<br />

2014/2015 (Year 3) 5.37% 7.37%<br />

2015/2016 (Year 4) 3.17% 5.17%<br />

2016/2017 (Year 5) 3.82% 5.82%<br />

2017/2018 (Year 6) 3.13% 5.15%<br />

2018/2019 (Year 7) 2.61% 4.61%<br />

2019/2020 (Year 8) 4.01% 6.01%<br />

2020/2021 (Year 9) 3.74% 5.74%<br />

2021/<strong>2022</strong> (Year 10) 3.33% 5.33%<br />

Again, because of the nature of the targeted rate structure,<br />

the increase (or decrease) in rates for any year for individual<br />

properties can vary markedly.<br />

Non-Rates Income<br />

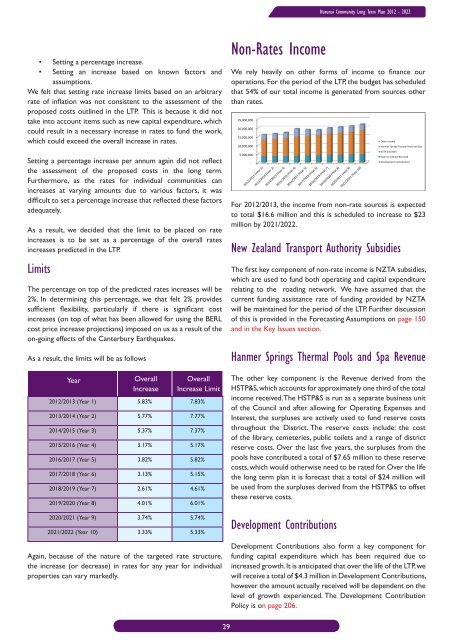

We rely heavily on other forms of income to finance our<br />

operations. For the period of the LTP, the budget has scheduled<br />

that 54% of our total income is generated from sources other<br />

than rates.<br />

25,000,000<br />

20,000,000<br />

15,000,000<br />

10,000,000<br />

5,000,000<br />

-<br />

For <strong>2012</strong>/2013, the income from non-rate sources is expected<br />

to total $16.6 million and this is scheduled to increase to $23<br />

million by 2021/<strong>2022</strong>.<br />

New Zealand Transport Authority Subsidies<br />

The first key component of non-rate income is NZTA subsidies,<br />

which are used to fund both operating and capital expenditure<br />

relating to the roading network. We have assumed that the<br />

current funding assistance rate of funding provided by NZTA<br />

will be maintained for the period of the LTP. Further discussion<br />

of this is provided in the Forecasting Assumptions on page 150<br />

and in the Key Issues section.<br />

Hanmer Springs Thermal Pools and Spa Revenue<br />

The other key component is the Revenue derived from the<br />

HSTP&S, which accounts for approximately one third of the total<br />

income received. The HSTP&S is run as a separate business unit<br />

of the <strong>Council</strong> and after allowing for Operating Expenses and<br />

Interest, the surpluses are actively used to fund reserve costs<br />

throughout the <strong>District</strong>. The reserve costs include: the cost<br />

of the library, cemeteries, public toilets and a range of district<br />

reserve costs. Over the last five years, the surpluses from the<br />

pools have contributed a total of $7.65 million to these reserve<br />

costs, which would otherwise need to be rated for. Over the life<br />

the long term plan it is forecast that a total of $24 million will<br />

be used from the surpluses derived from the HSTP&S to offset<br />

these reserve costs.<br />

Development Contributions<br />

Other Income<br />

Hanmer Springs Thermal Pools and Spa<br />

NZTA Subsidies<br />

External Interest Received<br />

Development Contributions<br />

Development Contributions also form a key component for<br />

funding capital expenditure which has been required due to<br />

increased growth. It is anticipated that over the life of the LTP, we<br />

will receive a total of $4.3 million in Development Contributions,<br />

however the amount actually received will be dependent on the<br />

level of growth experienced. The Development Contribution<br />

Policy is on page 206.<br />

29