The international economics of resources and resource ... - Index of

The international economics of resources and resource ... - Index of

The international economics of resources and resource ... - Index of

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

How to increase global <strong>resource</strong> productivity? 353<br />

90<br />

80<br />

70<br />

60<br />

50<br />

BH<br />

S1H<br />

S3H<br />

2000 2005 2010 2015 2020<br />

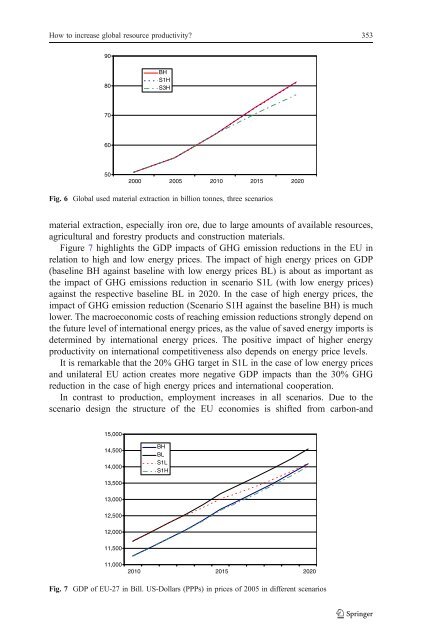

Fig. 6 Global used material extraction in billion tonnes, three scenarios<br />

material extraction, especially iron ore, due to large amounts <strong>of</strong> available <strong><strong>resource</strong>s</strong>,<br />

agricultural <strong>and</strong> forestry products <strong>and</strong> construction materials.<br />

Figure 7 highlights the GDP impacts <strong>of</strong> GHG emission reductions in the EU in<br />

relation to high <strong>and</strong> low energy prices. <strong>The</strong> impact <strong>of</strong> high energy prices on GDP<br />

(baseline BH against baseline with low energy prices BL) is about as important as<br />

the impact <strong>of</strong> GHG emissions reduction in scenario S1L (with low energy prices)<br />

against the respective baseline BL in 2020. In the case <strong>of</strong> high energy prices, the<br />

impact <strong>of</strong> GHG emission reduction (Scenario S1H against the baseline BH) is much<br />

lower. <strong>The</strong> macroeconomic costs <strong>of</strong> reaching emission reductions strongly depend on<br />

the future level <strong>of</strong> <strong>international</strong> energy prices, as the value <strong>of</strong> saved energy imports is<br />

determined by <strong>international</strong> energy prices. <strong>The</strong> positive impact <strong>of</strong> higher energy<br />

productivity on <strong>international</strong> competitiveness also depends on energy price levels.<br />

It is remarkable that the 20% GHG target in S1L in the case <strong>of</strong> low energy prices<br />

<strong>and</strong> unilateral EU action creates more negative GDP impacts than the 30% GHG<br />

reduction in the case <strong>of</strong> high energy prices <strong>and</strong> <strong>international</strong> cooperation.<br />

In contrast to production, employment increases in all scenarios. Due to the<br />

scenario design the structure <strong>of</strong> the EU economies is shifted from carbon-<strong>and</strong><br />

15,000<br />

14,500<br />

14,000<br />

13,500<br />

13,000<br />

12,500<br />

12,000<br />

11,500<br />

11,000<br />

BH<br />

BL<br />

S1L<br />

S1H<br />

2010 2015 2020<br />

Fig. 7 GDP <strong>of</strong> EU-27 in Bill. US-Dollars (PPPs) in prices <strong>of</strong> 2005 in different scenarios