ALHOSN University Catalogue Global Knowledge with Local Vision ...

ALHOSN University Catalogue Global Knowledge with Local Vision ...

ALHOSN University Catalogue Global Knowledge with Local Vision ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

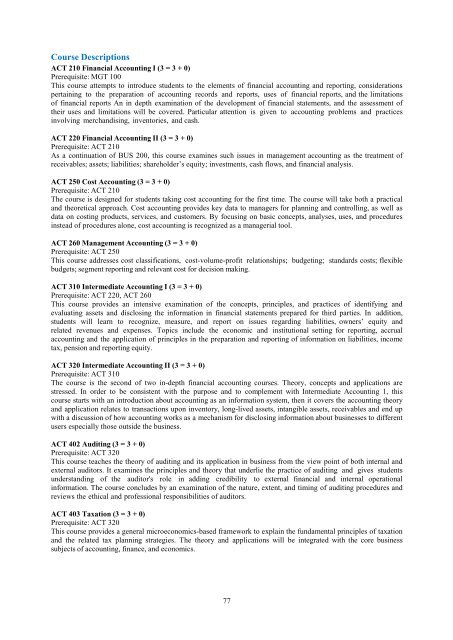

Course Descriptions<br />

ACT 210 Financial Accounting I (3 = 3 + 0)<br />

Prerequisite: MGT 100<br />

This course attempts to introduce students to the elements of financial accounting and reporting, considerations<br />

pertaining to the preparation of accounting records and reports, uses of financial reports, and the limitations<br />

of financial reports An in depth examination of the development of financial statements, and the assessment of<br />

their uses and limitations will be covered. Particular attention is given to accounting problems and practices<br />

involving merchandising, inventories, and cash.<br />

ACT 220 Financial Accounting II (3 = 3 + 0)<br />

Prerequisite: ACT 210<br />

As a continuation of BUS 200, this course examines such issues in management accounting as the treatment of<br />

receivables; assets; liabilities; shareholder’s equity; investments, cash flows, and financial analysis.<br />

ACT 250 Cost Accounting (3 = 3 + 0)<br />

Prerequisite: ACT 210<br />

The course is designed for students taking cost accounting for the first time. The course will take both a practical<br />

and theoretical approach. Cost accounting provides key data to managers for planning and controlling, as well as<br />

data on costing products, services, and customers. By focusing on basic concepts, analyses, uses, and procedures<br />

instead of procedures alone, cost accounting is recognized as a managerial tool.<br />

ACT 260 Management Accounting (3 = 3 + 0)<br />

Prerequisite: ACT 250<br />

This course addresses cost classifications, cost-volume-profit relationships; budgeting; standards costs; flexible<br />

budgets; segment reporting and relevant cost for decision making.<br />

ACT 310 Intermediate Accounting I (3 = 3 + 0)<br />

Prerequisite: ACT 220, ACT 260<br />

This course provides an intensive examination of the concepts, principles, and practices of identifying and<br />

evaluating assets and disclosing the information in financial statements prepared for third parties. In addition,<br />

students will learn to recognize, measure, and report on issues regarding liabilities, owners’ equity and<br />

related revenues and expenses. Topics include the economic and institutional setting for reporting, accrual<br />

accounting and the application of principles in the preparation and reporting of information on liabilities, income<br />

tax, pension and reporting equity.<br />

ACT 320 Intermediate Accounting II (3 = 3 + 0)<br />

Prerequisite: ACT 310<br />

The course is the second of two in-depth financial accounting courses. Theory, concepts and applications are<br />

stressed. In order to be consistent <strong>with</strong> the purpose and to complement <strong>with</strong> Intermediate Accounting 1, this<br />

course starts <strong>with</strong> an introduction about accounting as an information system, then it covers the accounting theory<br />

and application relates to transactions upon inventory, long-lived assets, intangible assets, receivables and end up<br />

<strong>with</strong> a discussion of how accounting works as a mechanism for disclosing information about businesses to different<br />

users especially those outside the business.<br />

ACT 402 Auditing (3 = 3 + 0)<br />

Prerequisite: ACT 320<br />

This course teaches the theory of auditing and its application in business from the view point of both internal and<br />

external auditors. It examines the principles and theory that underlie the practice of auditing and gives students<br />

understanding of the auditor's role in adding credibility to external financial and internal operational<br />

information. The course concludes by an examination of the nature, extent, and timing of auditing procedures and<br />

reviews the ethical and professional responsibilities of auditors.<br />

ACT 403 Taxation (3 = 3 + 0)<br />

Prerequisite: ACT 320<br />

This course provides a general microeconomics-based framework to explain the fundamental principles of taxation<br />

and the related tax planning strategies. The theory and applications will be integrated <strong>with</strong> the core business<br />

subjects of accounting, finance, and economics.<br />

77