Catalog 73 - National University

Catalog 73 - National University

Catalog 73 - National University

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

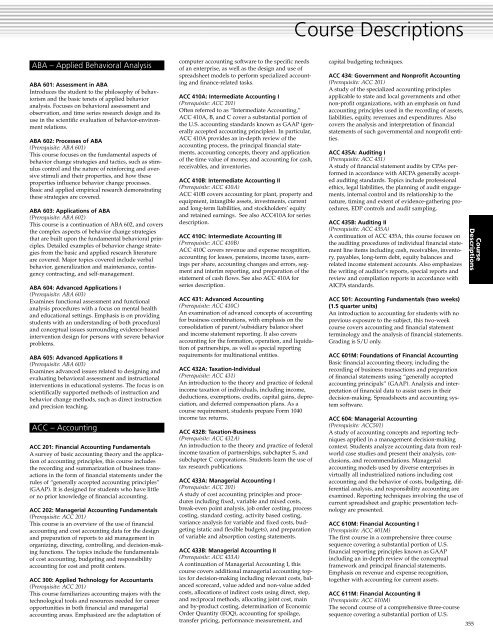

Course DescriptionsABA – Applied Behavioral AnalysisABA 601: Assessment in ABAIntroduces the student to the philosophy of behaviorismand the basic tenets of applied behavioranalysis. Focuses on behavioral assessment andobservation, and time series research design and itsuse in the scientific evaluation of behavior-environmentrelations.ABA 602: Processes of ABA(Prerequisite: ABA 601)This course focuses on the fundamental aspects ofbehavior change strategies and tactics, such as stimuluscontrol and the nature of reinforcing and aversivestimuli and their properties, and how theseproperties influence behavior change processes.Basic and applied empirical research demonstratingthese strategies are covered.ABA 603: Applications of ABA(Prerequisite: ABA 602)This course is a continuation of ABA 602, and coversthe complex aspects of behavior change strategiesthat are built upon the fundamental behavioral principles.Detailed examples of behavior change strategiesfrom the basic and applied research literatureare covered. Major topics covered include verbalbehavior, generalization and maintenance, contingencycontracting, and self-management.ABA 604: Advanced Applications I(Prerequisite: ABA 603)Examines functional assessment and functionalanalysis procedures with a focus on mental healthand educational settings. Emphasis is on providingstudents with an understanding of both proceduraland conceptual issues surrounding evidence-basedintervention design for persons with severe behaviorproblems.ABA 605: Advanced Applications II(Prerequisite: ABA 603)Examines advanced issues related to designing andevaluating behavioral assessment and instructionalinterventions in educational systems. The focus is onscientifically supported methods of instruction andbehavior change methods, such as direct instructionand precision teaching.ACC – AccountingACC 201: Financial Accounting FundamentalsA survey of basic accounting theory and the applicationof accounting principles, this course includesthe recording and summarization of business transactionsin the form of financial statements under therules of “generally accepted accounting principles”(GAAP). It is designed for students who have littleor no prior knowledge of financial accounting.ACC 202: Managerial Accounting Fundamentals(Prerequisite: ACC 201)This course is an overview of the use of financialaccounting and cost accounting data for the designand preparation of reports to aid management inorganizing, directing, controlling, and decision-makingfunctions. The topics include the fundamentalsof cost accounting, budgeting and responsibilityaccounting for cost and profit centers.ACC 300: Applied Technology for Accountants(Prerequisite: ACC 201)This course familiarizes accounting majors with thetechnological tools and resources needed for careeropportunities in both financial and managerialaccounting areas. Emphasized are the adaptation ofcomputer accounting software to the specific needsof an enterprise, as well as the design and use ofspreadsheet models to perform specialized accountingand finance-related tasks.ACC 410A: Intermediate Accounting I(Prerequisite: ACC 201)Often referred to as “Intermediate Accounting,”ACC 410A, B, and C cover a substantial portion ofthe U.S. accounting standards known as GAAP (generallyaccepted accounting principles). In particular,ACC 410A provides an in-depth review of theaccounting process, the principal financial statements,accounting concepts, theory and applicationof the time value of money, and accounting for cash,receivables, and inventories.ACC 410B: Intermediate Accounting II(Prerequisite: ACC 410A)ACC 410B covers accounting for plant, property andequipment, intangible assets, investments, currentand long-term liabilities, and stockholders’ equityand retained earnings. See also ACC410A for seriesdescription.ACC 410C: Intermediate Accounting III(Prerequisite: ACC 410B)ACC 410C covers revenue and expense recognition,accounting for leases, pensions, income taxes, earningsper share, accounting changes and errors, segmentand interim reporting, and preparation of thestatement of cash flows. See also ACC 410A forseries description.ACC 431: Advanced Accounting(Prerequisite: ACC 410C)An examination of advanced concepts of accountingfor business combinations, with emphasis on theconsolidation of parent/subsidiary balance sheetand income statement reporting. It also coversaccounting for the formation, operation, and liquidationof partnerships, as well as special reportingrequirements for multinational entities.ACC 432A: Taxation-Individual(Prerequisite: ACC 431)An introduction to the theory and practice of federalincome taxation of individuals, including income,deductions, exemptions, credits, capital gains, depreciation,and deferred compensation plans. As acourse requirement, students prepare Form 1040income tax returns.ACC 432B: Taxation-Business(Prerequisite: ACC 432A)An introduction to the theory and practice of federalincome taxation of partnerships, subchapter S, andsubchapter C corporations. Students learn the use oftax research publications.ACC 433A: Managerial Accounting I(Prerequisite: ACC 201)A study of cost accounting principles and proceduresincluding fixed, variable and mixed costs,break-even point analysis, job order costing, processcosting, standard costing, activity based costing,variance analysis for variable and fixed costs, budgeting(static and flexible budgets), and preparationof variable and absorption costing statements.ACC 433B: Managerial Accounting II(Prerequisite: ACC 433A)A continuation of Managerial Accounting I, thiscourse covers additional managerial accounting topicsfor decision-making including relevant costs, balancedscorecard, value added and non-value addedcosts, allocations of indirect costs using direct, step,and reciprocal methods, allocating joint cost, mainand by-product costing, determination of EconomicOrder Quantity (EOQ), accounting for spoilage,transfer pricing, performance measurement, andcapital budgeting techniques.ACC 434: Government and Nonprofit Accounting(Prerequisite: ACC 201)A study of the specialized accounting principlesapplicable to state and local governments and othernon-profit organizations, with an emphasis on fundaccounting principles used in the recording of assets,liabilities, equity, revenues and expenditures. Alsocovers the analysis and interpretation of financialstatements of such governmental and nonprofit entities.ACC 435A: Auditing I(Prerequisite: ACC 431)A study of financial statement audits by CPAs performedin accordance with AICPA generally acceptedauditing standards. Topics include professionalethics, legal liabilities, the planning of audit engagements,internal control and its relationship to thenature, timing and extent of evidence-gathering procedures,EDP controls and audit sampling.ACC 435B: Auditing II(Prerequisite: ACC 435A)A continuation of ACC 435A, this course focuses onthe auditing procedures of individual financial statementline items including cash, receivables, inventory,payables, long-term debt, equity balances andrelated income statement accounts. Also emphasizesthe writing of auditor’s reports, special reports andreview and compilation reports in accordance withAICPA standards.ACC 501: Accounting Fundamentals (two weeks)(1.5 quarter units)An introduction to accounting for students with noprevious exposure to the subject, this two-weekcourse covers accounting and financial statementterminology and the analysis of financial statements.Grading is S/U only.ACC 601M: Foundations of Financial AccountingBasic financial accounting theory, including therecording of business transactions and preparationof financial statements using “generally acceptedaccounting principals” (GAAP). Analysis and interpretationof financial data to assist users in theirdecision-making. Spreadsheets and accounting systemsoftware.ACC 604: Managerial Accounting(Prerequisite: ACC501)A study of accounting concepts and reporting techniquesapplied in a management decision-makingcontext. Students analyze accounting data from realworldcase studies and present their analysis, conclusions,and recommendations. Managerialaccounting models used by diverse enterprises invirtually all industrialized nations including costaccounting and the behavior of costs, budgeting, differentialanalysis, and responsibility accounting areexamined. Reporting techniques involving the use ofcurrent spreadsheet and graphic presentation technologyare presented.ACC 610M: Financial Accounting I(Prerequisite: ACC 601M)The first course in a comprehensive three coursesequence covering a substantial portion of U.S.financial reporting principles known as GAAPincluding an in-depth review of the conceptualframework and principal financial statements.Emphasis on revenue and expense recognition,together with accounting for current assets.ACC 611M: Financial Accounting II(Prerequisite: ACC 610M)The second course of a comprehensive three-coursesequence covering a substantial portion of U.S.CourseDescriptions355