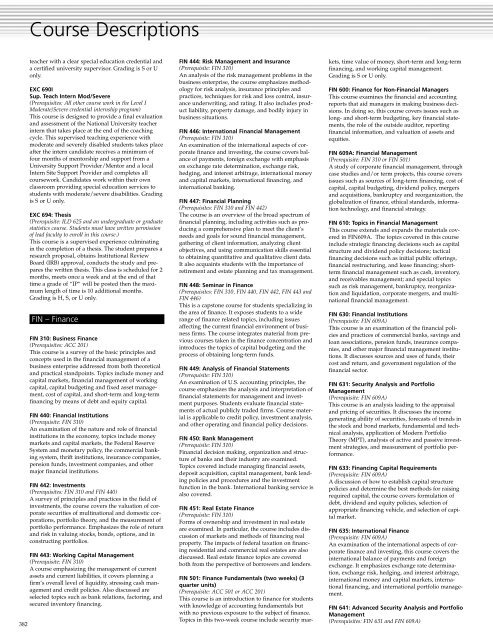

Course Descriptions382teacher with a clear special education credential anda certified university supervisor. Grading is S or Uonly.EXC 690ISup. Teach Intern Mod/Severe(Prerequisites: All other course work in the Level IModerate/Severe credential internship program)This course is designed to provide a final evaluationand assessment of the <strong>National</strong> <strong>University</strong> teacherintern that takes place at the end of the coachingcycle. This supervised teaching experience withmoderate and severely disabled students takes placeafter the intern candidate receives a minimum offour months of mentorship and support from a<strong>University</strong> Support Provider/Mentor and a localIntern Site Support Provider and completes allcoursework. Candidates work within their ownclassroom providing special education services tostudents with moderate/severe disabilities. Gradingis S or U only.EXC 694: Thesis(Prerequisite: ILD 625 and an undergraduate or graduatestatistics course. Students must have written permissionof lead faculty to enroll in this course.)This course is a supervised experience culminatingin the completion of a thesis. The student prepares aresearch proposal, obtains Institutional ReviewBoard (IRB) approval, conducts the study and preparesthe written thesis. This class is scheduled for 2months, meets once a week and at the end of thattime a grade of “IP” will be posted then the maximumlength of time is 10 additional months.Grading is H, S, or U only.FIN – FinanceFIN 310: Business Finance(Prerequisites: ACC 201)This course is a survey of the basic principles andconcepts used in the financial management of abusiness enterprise addressed from both theoreticaland practical standpoints. Topics include money andcapital markets, financial management of workingcapital, capital budgeting and fixed asset management,cost of capital, and short-term and long-termfinancing by means of debt and equity capital.FIN 440: Financial Institutions(Prerequisite: FIN 310)An examination of the nature and role of financialinstitutions in the economy, topics include moneymarkets and capital markets, the Federal ReserveSystem and monetary policy, the commercial bankingsystem, thrift institutions, insurance companies,pension funds, investment companies, and othermajor financial institutions.FIN 442: Investments(Prerequisites: FIN 310 and FIN 440)A survey of principles and practices in the field ofinvestments, the course covers the valuation of corporatesecurities of multinational and domestic corporations,portfolio theory, and the measurement ofportfolio performance. Emphasizes the role of returnand risk in valuing stocks, bonds, options, and inconstructing portfolios.FIN 443: Working Capital Management(Prerequisite: FIN 310)A course emphasizing the management of currentassets and current liabilities, it covers planning afirm’s overall level of liquidity, stressing cash managementand credit policies. Also discussed areselected topics such as bank relations, factoring, andsecured inventory financing.FIN 444: Risk Management and Insurance(Prerequisite: FIN 310)An analysis of the risk management problems in thebusiness enterprise, the course emphasizes methodologyfor risk analysis, insurance principles andpractices, techniques for risk and loss control, insuranceunderwriting, and rating. It also includes productliability, property damage, and bodily injury inbusiness situations.FIN 446: International Financial Management(Prerequisite: FIN 310)An examination of the international aspects of corporatefinance and investing, the course covers balanceof payments, foreign exchange with emphasison exchange rate determination, exchange risk,hedging, and interest arbitrage, international moneyand capital markets, international financing, andinternational banking.FIN 447: Financial Planning(Prerequisites: FIN 310 and FIN 442)The course is an overview of the broad spectrum offinancial planning, including activities such as producinga comprehensive plan to meet the client’sneeds and goals for sound financial management,gathering of client information, analyzing clientobjectives, and using communication skills essentialto obtaining quantitative and qualitative client data.It also acquaints students with the importance ofretirement and estate planning and tax management.FIN 448: Seminar in Finance(Prerequisites: FIN 310, FIN 440, FIN 442, FIN 443 andFIN 446)This is a capstone course for students specializing inthe area of finance. It exposes students to a widerange of finance related topics, including issuesaffecting the current financial environment of businessfirms. The course integrates material from previouscourses taken in the finance concentration andintroduces the topics of capital budgeting and theprocess of obtaining long-term funds.FIN 449: Analysis of Financial Statements(Prerequisite: FIN 310)An examination of U.S. accounting principles, thecourse emphasizes the analysis and interpretation offinancial statements for management and investmentpurposes. Students evaluate financial statementsof actual publicly traded firms. Course materialis applicable to credit policy, investment analysis,and other operating and financial policy decisions.FIN 450: Bank Management(Prerequisite: FIN 310)Financial decision making, organization and structureof banks and their industry are examined.Topics covered include managing financial assets,deposit acquisition, capital management, bank lendingpolicies and procedures and the investmentfunction in the bank. International banking service isalso covered.FIN 451: Real Estate Finance(Prerequisite: FIN 310)Forms of ownership and investment in real estateare examined. In particular, the course includes discussionof markets and methods of financing realproperty. The impacts of federal taxation on financingresidential and commercial real estates are alsodiscussed. Real estate finance topics are coveredboth from the perspective of borrowers and lenders.FIN 501: Finance Fundamentals (two weeks) (3quarter units)(Prerequisite: ACC 501 or ACC 201)This course is an introduction to finance for studentswith knowledge of accounting fundamentals butwith no previous exposure to the subject of finance.Topics in this two-week course include security markets,time value of money, short-term and long-termfinancing, and working capital management.Grading is S or U only.FIN 600: Finance for Non-Financial ManagersThis course examines the financial and accountingreports that aid managers in making business decisions.In doing so, this course covers issues such aslong- and short-term budgeting, key financial statements,the role of the outside auditor, reportingfinancial information, and valuation of assets andequities.FIN 609A: Financial Management(Prerequisite: FIN 310 or FIN 501)A study of corporate financial management, throughcase studies and/or term projects, this course coversissues such as sources of long-term financing, cost ofcapital, capital budgeting, dividend policy, mergersand acquisitions, bankruptcy and reorganization, theglobalization of finance, ethical standards, informationtechnology, and financial strategy.FIN 610: Topics in Financial ManagementThis course extends and expands the materials coveredin FIN609A. The topics covered in this courseinclude strategic financing decisions such as capitalstructure and dividend policy decisions; tacticalfinancing decisions such as initial public offerings,financial restructuring, and lease financing; shorttermfinancial management such as cash, inventory,and receivables management; and special topicssuch as risk management, bankruptcy, reorganizationand liquidation, corporate mergers, and multinationalfinancial management.FIN 630: Financial Institutions(Prerequisite: FIN 609A)This course is an examination of the financial policiesand practices of commercial banks, savings andloan associations, pension funds, insurance companies,and other major financial management institutions.It discusses sources and uses of funds, theircost and return, and government regulation of thefinancial sector.FIN 631: Security Analysis and PortfolioManagement(Prerequisite: FIN 609A)This course is an analysis leading to the appraisaland pricing of securities. It discusses the incomegenerating ability of securities, forecasts of trends inthe stock and bond markets, fundamental and technicalanalysis, application of Modern PortfolioTheory (MPT), analysis of active and passive investmentstrategies, and measurement of portfolio performance.FIN 633: Financing Capital Requirements(Prerequisite: FIN 609A)A discussion of how to establish capital structurepolicies and determine the best methods for raisingrequired capital, the course covers formulation ofdebt, dividend and equity policies, selection ofappropriate financing vehicle, and selection of capitalmarket.FIN 635: International Finance(Prerequisite: FIN 609A)An examination of the international aspects of corporatefinance and investing, this course covers theinternational balance of payments and foreignexchange. It emphasizes exchange rate determination,exchange risk, hedging, and interest arbitrage,international money and capital markets, internationalfinancing, and international portfolio management.FIN 641: Advanced Security Analysis and PortfolioManagement(Prerequisites: FIN 631 and FIN 609A)

Course DescriptionsAn in-depth look at several of the advanced topicssurveyed in FIN 631, this course includes bond portfoliomanagement strategies, bond betas and theirportfolio impact, option valuation models and hedging,practical use of portfolio insurance and hedging,problems with model-dependent hedging, and theuse of futures contracts and their objectives. It coversproblems faced by corporate and professionalinvestment managers in their effort to hedge portfoliorisks and improve portfolio returns.FIN 650: Global Financing for TradeAn examination of the basic financial problems facingan internationally oriented company, this courseincludes the structure and operations of theinternational financial system, foreign exchangerates, foreign exchange risks and their management,international sources of funds, international cashmanagement, and basic instruments of internationalfinancial transactions (e.g., letters of credit, foreigncurrency contracts, foreign currency accounts, andbanking facilities). Note: Students specializing infinancial management may not take this course.FIN 651: Commercial Bank ManagementThis course is a detailed analysis of the functionalareas of banking including the management ofdeposits, cash, loans, and other asset accounts.Current problem areas in banking such as liquidity,capital adequacy, and problem loans are explored, aswell as bank investment accounts and their relationshipto profitability and liquidity.FIN 652: Real Estate Finance(Prerequisite: FIN609A)This course presents Real Estate Finance andInvestment issues from a portfolio perspective. Itprovides a complete analysis of real estate partnerships,secondary mortgage markets, adjustable ratemortgages. It also includes the applied topics of corporatereal estate, including lease versus own analysis,sale and leaseback decisions, and the role of realestate in corporate restructuring.FIN 653: Financial Engineering and DerivativesThis course provides an introduction to futures andoptions markets and outlines the different ways inwhich they can be used. It covers futures and forwardcontracts, pricing of forward and futures,hedging techniques, swaps, options markets, tradingstrategies, option pricing models, volatility smiles,and a detailed treatment of hedge parameters suchas delta, gamma, and vega. Also discussed is portfolioinsurance, value-at-risk measure, multi-step binomialtrees to value American options, interest rateoptions, and other exotic options.FIN 654: Cases in Financial StudiesReflecting the fact the Finance has gone through dramaticchanges in the last 20 years, this case studycourse will expose students to the revolutionarytransformation in markets and organization we haveseen the financial industry milieu.FIN 655: Finance Research Project (CapstoneCourse)(Prerequisites: completion of FIN 609A and at least 36quarter units of core courses)Students, under the guidance of their assigned facultyadvisor, clarify topics, identify sources fromwhich data will be gathered, and complete and presenttheir research in written form. Grading is H, S,or U only. Course is eligible for an In Progress (IP)grade.FIN 670: Finance and Accounting for ExecutivesThis course covers major topics in finance andaccounting, with emphasis on current theory andconcepts rather than on procedure. Topics includefinancial statement interpretation and analysis, internalcontrol structure, operating and capital budgeting,capital structure theory, and issues in financeand accounting for U.S. companies with foreignoperations.FIN 671: Credit Management(Prerequisite: FIN 609A)This course is an analysis of credit policy leading tothe development of strategic and higher level technicalskills appropriate for credit managers. Thecourse will also analyze specific topics like the roleof credit in the economy, credit management functions,retail credit, types of consumer credit, regulationof consumer credit, the consumer credit investigation,decision making in credit operation, responsibilitiesof the credit manager, international tradecredit and collection policies and practices.FIN 6<strong>73</strong>: Valuation: Measuring and Managing theValue of a Corporation(Prerequisite: FIN 609A)Valuation is designed to explain the theories of valuinga corporation. Topics include: foundations ofvalue, core valuation techniques, how to createvalue, estimating continuing value, valuing multinationalcompanies, and cross-border and emergingmarkets valuation.FIN 674: Managing Financial Institutions andBanking(Prerequisite: FIN 609A)This course presents an overview of FinancialSystem, Financial Markets, and Commercial Bankingin the 1990s to the 21st century in the US and globalsetting. It covers asset and liability managementproblems for depository institutions including managementissues, and performance analysis of nondepositoryentities. In addition, emphasis is placedon interest rates and interest rate risk management.International Bond Markets and new IssueProcedures in the Bond Market, digital money, andalternative electronic payment systems will also bediscussed.FIN 675: The World Economy, Trade, and Finance(Prerequisite: FIN 609A)This course emphasizes microeconomic conceptsrelated to managerial decision-making. Students willlearn to analyze the global business environment ofindustrialized and developing countries, and tothink strategically, using micro and macroeconomicsprinciples. Markets, consumers, producers, trade,distribution, welfare, tariffs, non-tariffs barriers, andmonetary and macroeconomics issues of developmentand transitions will be discussed.FIN 676: International Banking(Prerequisite: FIN 609A)This course examines both the theory and the practiceof international banking. It covers the creation ofcredit and credit rationing; internationalization ofbanking, the risks and benefits from financial innovation,central banking, bank regulation, depositprotection, capital adequacy and free banking, andselective institutional aspects of international banking.It also reviews the principle of Islamic Banking.FIN 677: Financial Derivatives(Prerequisite: FIN 609A)This course presents and analyzes derivatives, suchas forwards, futures, swaps, and options. It comparesmajor types of derivatives, shows how theyare used to achieve various hedging and speculatingobjectives, introduces a framework for pricing derivatives,and studies several applications of derivative-pricingtechniques outside derivative markets.Topics also include traditional and exotic derivatives,market risk, credit issuer risk, stressed correlationmaterials, fat tails, and case studies in corporatefinance.FIN 690: Guided Study(Prerequisite: FIN 609A)This course is individual study under direction ofthe instructor. It requires prior approval of appropriateacademic department.FSC – Forensic SciencesFSC 620: Advanced CriminalisticsThis class surveys physical evidence with an introductionto the operation of a forensic science laboratoryand an overview of many of the analytical toolsused in the criminalistics laboratory. Principles ofchain of custody; and role of forensic scientist asexpert witness.FSC 621: Digital EvidenceThis course will provide broad perspective on theory,technique and practice of digital evidence investigation.Different types of digital related crime,including fraud, stalking, identity theft, and internetrelated crimes. Chain of custody and current legalissues on digital evidence.FSC 622: Law and Criminal ProcedureThis course is an examination of the foundation forunderstanding Constitutional laws. The course willcover various sections of the Constitution and howlaw enforcement officials may obtain evidence, andconduct a search and seizure.FSC 623: Fingerprint AnalysisIntroduction to basic principles and techniques offingerprints as applied to crime scenes, forensic evidence,identification, and court presentation.Methods of recognition, proper collection of knownand latent fingerprints, processing, classification andcomparison. Courtroom presentations will be discussed.FSC 630: Forensic Pathology IForensic terminology, anatomy, and physiology ofthe human body with emphasis on the understandingof the underlying pathology of sudden, unexpecteddeaths encountered in forensics, SuddenInfant Death Syndrome (SIDS), methods personalidentification and different types of injuries withtheir characteristic features and mechanisms ofdeath.FSC 631: Major Case InvestigationA study of investigative techniques that are utilizedin felony crimes of violence and crimes against property,including homicide, rape, arson, assault andbattery, robbery, burglary, and grand theft. Examinesthe completion of such cases from the initial crimescene through investigation and adjudication.FSC 632: Trace EvidenceThe principles and methods of the macroscopicexaminations and the microscopic, chemical, andinstrumental analysis of trace and patterned evidence.Hair, fibers, glass, soil, paint, GSR, arson,explosives, fingerprint, and other patterned evidencewill be covered in this class. The principles of chainof custody will be studied.FSC 633: Advanced Forensic ToxicologyA comprehensive study of general principles andfundamentals of forensic toxicology, poisons, action,toxicity, and samples required for toxicologicalanalysis with methods of collection, preservationand analysis. Details of the methods employed foranalysis, such as color test, microdiffusion,Chromatography, mass spectrometry, GC-MS,radioimmunoassay (RIA).CourseDescriptions383

- Page 1 and 2:

2010TMNATIONAL UNIVERSITYT H E U N

- Page 3:

2010N a t i o n a l U n i v e r s i

- Page 6 and 7:

Note: the University reserves the r

- Page 8 and 9:

Board of TrusteesMs. Jeanne Connell

- Page 10 and 11:

Calendar and Class SchedulesSummer

- Page 12 and 13:

Undergraduate Class ScheduleUndergr

- Page 14 and 15:

LocationsCALIFORNIANEVADACitrus Hei

- Page 16 and 17:

Location MapsTechnology & Health Sc

- Page 18 and 19:

10DepartmentsAcademic Affairs11355

- Page 20 and 21:

Location MapsSan Bernardino Campus8

- Page 22 and 23:

Southern California Campus Administ

- Page 24 and 25:

Nevada Campus AdministrationMahvash

- Page 26 and 27:

Degree Programs Offered at National

- Page 28 and 29:

General Information20Mission Statem

- Page 30 and 31:

General InformationTuition Tuition

- Page 32 and 33:

Student Support ServicesMathematics

- Page 34 and 35:

Student Support Services628-8988 or

- Page 36 and 37:

Student Support ServicesInternation

- Page 39 and 40:

FinancialAidHow to Apply . . . . .

- Page 41 and 42:

Financial AidType of Degree/Program

- Page 43 and 44:

Financial Aidcommunity college and

- Page 45 and 46:

Financial AidFinancial Aid Calendar

- Page 47 and 48:

Financial AidGrantLoanUndergraduate

- Page 49 and 50:

PoliciesandProceduresGeneral Polici

- Page 51 and 52:

Policies and ProceduresUniversity r

- Page 53 and 54:

Policies and Proceduresinstitutions

- Page 55 and 56:

Policies and Procedures• Date of

- Page 57 and 58:

Policies and Procedurestoward gradu

- Page 59 and 60:

Policies and Proceduresfor enforcin

- Page 61 and 62:

Policies and Proceduresalso on the

- Page 63 and 64:

Academic Informationfor Undergradua

- Page 65 and 66:

Academic Information for Undergradu

- Page 67 and 68:

Academic Information for Undergradu

- Page 69 and 70:

Academic Information for Undergradu

- Page 71 and 72:

Academic Information for Undergradu

- Page 73:

Academic Information for Undergradu

- Page 76 and 77:

Academic Information for Graduate D

- Page 78 and 79:

Academic Information for Graduate D

- Page 80 and 81:

Academic Information for Graduate D

- Page 82 and 83:

General EducationFaculty Advisors:P

- Page 84 and 85:

General EducationPGM 202Sustainable

- Page 87 and 88:

College of Lettersand SciencesDean,

- Page 89 and 90:

Department of Artsand HumanitiesJan

- Page 91 and 92:

College of Letters and SciencesMISS

- Page 93 and 94:

College of Letters and SciencesRequ

- Page 95 and 96:

College of Letters and SciencesPrep

- Page 97 and 98:

College of Letters and SciencesProg

- Page 99 and 100:

College of Letters and Sciencesinte

- Page 101 and 102:

College of Letters and SciencesEngl

- Page 103 and 104:

College of Letters and SciencesProg

- Page 105 and 106:

College of Letters and SciencesHIS

- Page 107 and 108:

College of Letters and Sciences•

- Page 109 and 110:

College of Letters and Sciencesrequ

- Page 111 and 112:

College of Letters and SciencesGLS

- Page 113 and 114:

College of Letters and Sciencesvalu

- Page 115 and 116:

College of Letters and SciencesRequ

- Page 117 and 118:

College of Letters and Sciencesprov

- Page 119 and 120:

College of Letters and Sciencesfirm

- Page 121 and 122:

College of Letters and SciencesMTH

- Page 123 and 124:

College of Letters and Sciencesorga

- Page 125 and 126:

College of Letters and Sciences(Not

- Page 127 and 128:

College of Letters and SciencesGLS

- Page 129 and 130:

College of Letters and Sciences•

- Page 131 and 132:

College of Letters and Sciencesfrom

- Page 133 and 134:

College of Letters and SciencesCore

- Page 135 and 136:

College of Letters and SciencesMCW

- Page 137 and 138:

College of Letters and Sciencesgove

- Page 139 and 140:

College of Letters and SciencesARB

- Page 141:

College of Letters and SciencesTHE

- Page 144 and 145:

Degree Programs OfferedUndergraduat

- Page 146 and 147:

School of Business and ManagementVI

- Page 148 and 149:

School of Business and Management14

- Page 150 and 151:

School of Business and ManagementPr

- Page 152 and 153:

School of Business and Managementbu

- Page 154 and 155:

School of Business and Management14

- Page 156 and 157:

School of Business and Management

- Page 158 and 159:

School of Business and Management15

- Page 160 and 161:

School of Business and Management15

- Page 162 and 163:

School of Business and ManagementSe

- Page 164 and 165:

School of Business and Management15

- Page 166 and 167:

School of Business and Management

- Page 168 and 169:

School of Business and Management16

- Page 171 and 172:

School of EducationDean, C. Kalani

- Page 173 and 174:

FacultyDepartment ofEducationalAdmi

- Page 175 and 176:

FacultyBernardo P. GallegosProfesso

- Page 177 and 178:

School of EducationBIO 330EES 335BI

- Page 179 and 180:

School of EducationThe Bachelor of

- Page 181 and 182:

School of EducationandAny two addit

- Page 183 and 184:

School of EducationThe Bachelor of

- Page 185 and 186:

School of Educationstudents in our

- Page 187 and 188:

School of Educationof applied behav

- Page 189 and 190:

School of Educationseveral groups o

- Page 191 and 192:

School of EducationFaculty Advisor

- Page 193 and 194:

School of EducationBasic Skills exa

- Page 195 and 196:

School of EducationNational Univers

- Page 197 and 198:

School of Education■ MASTER OF SC

- Page 199 and 200:

School of EducationCredential Appli

- Page 201 and 202:

School of EducationProgram Learning

- Page 203 and 204:

School of EducationProgram Learning

- Page 205 and 206:

School of EducationCREDENTIAL PROGR

- Page 207 and 208:

School of Educationstate-adopted ac

- Page 209 and 210:

School of Educationdepartmentalized

- Page 211 and 212:

School of EducationCo-requisites(3

- Page 213 and 214:

School of Education• Completion o

- Page 215 and 216:

School of EducationTED 615TED 605TE

- Page 217 and 218:

School of Education• Completion o

- Page 219 and 220:

School of Education3. Beginning and

- Page 221 and 222:

School of Educationadministrative r

- Page 223 and 224:

School of EducationProgram Learning

- Page 225 and 226:

School of Educationtasks and roles

- Page 227 and 228:

School of Educationand planning for

- Page 229 and 230:

School of EducationRecommendation f

- Page 231 and 232:

School of EducationCore Requirement

- Page 233 and 234:

School of Educationminutes maximum

- Page 235 and 236:

School of EducationEXC 603ASupervis

- Page 237 and 238:

School of EducationThe CTC mandates

- Page 239 and 240:

School of EducationNote: Upon succe

- Page 241 and 242:

School of Educationstages and their

- Page 243 and 244:

School of Engineeringand Technology

- Page 245 and 246:

Department of ComputerScience and I

- Page 247 and 248:

School of Engineering and Technolog

- Page 249 and 250:

School of Engineering and Technolog

- Page 251 and 252:

School of Engineering and Technolog

- Page 253 and 254:

School of Engineering and Technolog

- Page 255 and 256:

School of Engineering and Technolog

- Page 257 and 258:

School of Engineering and Technolog

- Page 259 and 260:

School of Engineering and Technolog

- Page 261 and 262:

School of Engineering and Technolog

- Page 263 and 264:

School of Engineering and Technolog

- Page 265 and 266:

School of Engineering and Technolog

- Page 267 and 268:

School of Healthand Human ServicesD

- Page 269 and 270:

School of Health and Human Services

- Page 271 and 272:

School of Health and Human Services

- Page 273 and 274:

School of Health and Human Services

- Page 275 and 276:

School of Health and Human Services

- Page 277 and 278:

School of Health and Human Services

- Page 279 and 280:

School of Health and Human Services

- Page 281 and 282:

School of Health and Human Services

- Page 283 and 284:

School of Health and Human Services

- Page 285:

School of Health and Human Services

- Page 288 and 289:

Degree Programs Offered and Faculty

- Page 290 and 291:

School of Media and Communication28

- Page 292 and 293:

School of Media and Communicationma

- Page 294 and 295:

School of Media and Communication28

- Page 296 and 297:

School of Media and Communication28

- Page 298 and 299:

School of Media and Communicationsp

- Page 300 and 301:

School of Media and Communicationwi

- Page 302 and 303:

Nevada ProgramsNational University

- Page 304 and 305:

Nevada ProgramsApplication Requirem

- Page 306 and 307:

Nevada Programs298work and grades o

- Page 308 and 309:

Nevada ProgramsTED 465BTED 465CTED

- Page 310 and 311:

Nevada ProgramsThe student teaching

- Page 312 and 313:

Nevada ProgramsStage 1: Students me

- Page 314 and 315:

Nevada ProgramsEXC 603EXC 604EXC 62

- Page 316 and 317:

Nevada Programstransferring from an

- Page 318 and 319:

Nevada Programsgrade point average

- Page 320 and 321:

Division of Extended LearningThe Di

- Page 322 and 323:

Division of Extended Learning314The

- Page 324 and 325:

Division of Extended LearningCTEX 1

- Page 326 and 327:

Division of Extended LearningThe sp

- Page 328 and 329:

Division of Extended Learning320Spe

- Page 330 and 331:

Division of Extended LearningUpon c

- Page 332 and 333:

Division of Extended Learning324ONL

- Page 334 and 335:

Division of Extended LearningOracle

- Page 336 and 337:

Division of Extended Learning328sci

- Page 338 and 339:

Division of Extended Learningand co

- Page 340 and 341: Division of Extended Learningcreati

- Page 342 and 343: Division of Extended Learning334HSX

- Page 344 and 345: Division of Extended LearningHSX 19

- Page 346 and 347: Division of Extended Learning338rel

- Page 348 and 349: Division of Extended LearningPolymo

- Page 350 and 351: Division of Extended LearningMUSX 1

- Page 352 and 353: Division of Extended Learningimplem

- Page 354 and 355: Division of Extended LearningTEDX 1

- Page 356 and 357: National University Language Instit

- Page 358 and 359: National University Language Instit

- Page 361 and 362: CourseDescriptionsPrefix/Subject Ar

- Page 363 and 364: Course DescriptionsABA - Applied Be

- Page 365 and 366: Course Descriptionstheir strengths

- Page 367 and 368: Course Descriptionsimmune response.

- Page 369 and 370: Course Descriptionsvideo and the ro

- Page 371 and 372: Course DescriptionsCED 694: Thesis(

- Page 373 and 374: Course Descriptionsment. Students w

- Page 375 and 376: Course Descriptionswill evaluate th

- Page 377 and 378: Course Descriptionses employed in t

- Page 379 and 380: Course Descriptionstional and seque

- Page 381 and 382: Course DescriptionsDHH 603: Assessm

- Page 383 and 384: Course DescriptionsECO 602: Global

- Page 385 and 386: Course Descriptionsniques, skills,

- Page 387 and 388: Course Descriptionscontinue to prac

- Page 389: Course Descriptionsexamine the diff

- Page 393 and 394: Course Descriptions201/202)Examinat

- Page 395 and 396: Course Descriptionsindividual needs

- Page 397 and 398: Course DescriptionsTwo-month-long c

- Page 399 and 400: Course Descriptionsproduce a 20-30

- Page 401 and 402: Course Descriptionspreparation for

- Page 403 and 404: Course Descriptionstice of law and

- Page 405 and 406: Course DescriptionsLSS - Lean Six S

- Page 407 and 408: Course Descriptionsemphasizes: clas

- Page 409 and 410: Course Descriptionsscenes. Students

- Page 411 and 412: Course Descriptionsadvertising medi

- Page 413 and 414: Course Descriptionscomputer science

- Page 415 and 416: Course Descriptionsprepress product

- Page 417 and 418: Course Descriptionstherapeutic comm

- Page 419 and 420: Course Descriptionscourse. PAD405 i

- Page 421 and 422: Course Descriptionsbusiness practic

- Page 423 and 424: Course Descriptionsdures, and spous

- Page 425 and 426: Course Descriptionscontemporary lit

- Page 427 and 428: Course Descriptionstures, demonstra

- Page 429 and 430: Course Descriptionsdevelopment. Cou

- Page 431 and 432: Course Descriptionsthemes. Introduc

- Page 433 and 434: Course Descriptions(This course mus

- Page 435: Course Descriptionsples and their a

- Page 438 and 439: IndexLitigation Specialization.....

- Page 440 and 441:

Index432TOEFL .....................

- Page 442:

IndexSan Bernardino Campus.........