- Page 1 and 2: 2010TMNATIONAL UNIVERSITYT H E U N

- Page 3: 2010N a t i o n a l U n i v e r s i

- Page 6 and 7: Note: the University reserves the r

- Page 8 and 9: Board of TrusteesMs. Jeanne Connell

- Page 10 and 11: Calendar and Class SchedulesSummer

- Page 12 and 13: Undergraduate Class ScheduleUndergr

- Page 14 and 15: LocationsCALIFORNIANEVADACitrus Hei

- Page 16 and 17: Location MapsTechnology & Health Sc

- Page 18 and 19: 10DepartmentsAcademic Affairs11355

- Page 20 and 21: Location MapsSan Bernardino Campus8

- Page 22 and 23: Southern California Campus Administ

- Page 24 and 25: Nevada Campus AdministrationMahvash

- Page 26 and 27: Degree Programs Offered at National

- Page 28 and 29: General Information20Mission Statem

- Page 30 and 31: General InformationTuition Tuition

- Page 32 and 33: Student Support ServicesMathematics

- Page 34 and 35: Student Support Services628-8988 or

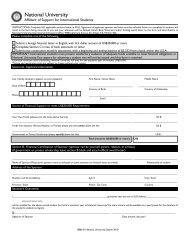

- Page 36 and 37: Student Support ServicesInternation

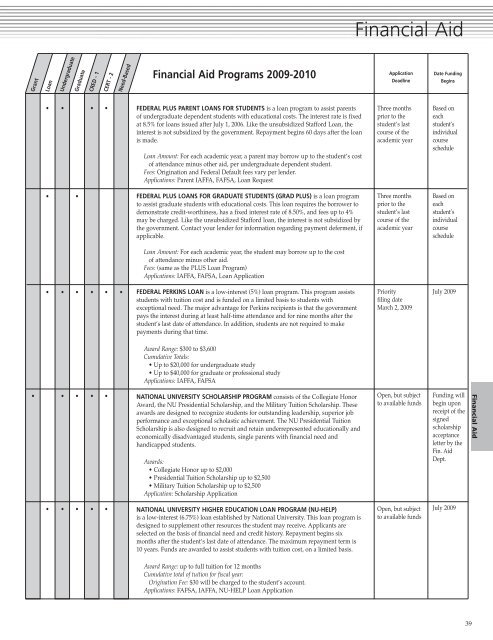

- Page 39 and 40: FinancialAidHow to Apply . . . . .

- Page 41 and 42: Financial AidType of Degree/Program

- Page 43 and 44: Financial Aidcommunity college and

- Page 45: Financial AidFinancial Aid Calendar

- Page 49 and 50: PoliciesandProceduresGeneral Polici

- Page 51 and 52: Policies and ProceduresUniversity r

- Page 53 and 54: Policies and Proceduresinstitutions

- Page 55 and 56: Policies and Procedures• Date of

- Page 57 and 58: Policies and Procedurestoward gradu

- Page 59 and 60: Policies and Proceduresfor enforcin

- Page 61 and 62: Policies and Proceduresalso on the

- Page 63 and 64: Academic Informationfor Undergradua

- Page 65 and 66: Academic Information for Undergradu

- Page 67 and 68: Academic Information for Undergradu

- Page 69 and 70: Academic Information for Undergradu

- Page 71 and 72: Academic Information for Undergradu

- Page 73: Academic Information for Undergradu

- Page 76 and 77: Academic Information for Graduate D

- Page 78 and 79: Academic Information for Graduate D

- Page 80 and 81: Academic Information for Graduate D

- Page 82 and 83: General EducationFaculty Advisors:P

- Page 84 and 85: General EducationPGM 202Sustainable

- Page 87 and 88: College of Lettersand SciencesDean,

- Page 89 and 90: Department of Artsand HumanitiesJan

- Page 91 and 92: College of Letters and SciencesMISS

- Page 93 and 94: College of Letters and SciencesRequ

- Page 95 and 96: College of Letters and SciencesPrep

- Page 97 and 98:

College of Letters and SciencesProg

- Page 99 and 100:

College of Letters and Sciencesinte

- Page 101 and 102:

College of Letters and SciencesEngl

- Page 103 and 104:

College of Letters and SciencesProg

- Page 105 and 106:

College of Letters and SciencesHIS

- Page 107 and 108:

College of Letters and Sciences•

- Page 109 and 110:

College of Letters and Sciencesrequ

- Page 111 and 112:

College of Letters and SciencesGLS

- Page 113 and 114:

College of Letters and Sciencesvalu

- Page 115 and 116:

College of Letters and SciencesRequ

- Page 117 and 118:

College of Letters and Sciencesprov

- Page 119 and 120:

College of Letters and Sciencesfirm

- Page 121 and 122:

College of Letters and SciencesMTH

- Page 123 and 124:

College of Letters and Sciencesorga

- Page 125 and 126:

College of Letters and Sciences(Not

- Page 127 and 128:

College of Letters and SciencesGLS

- Page 129 and 130:

College of Letters and Sciences•

- Page 131 and 132:

College of Letters and Sciencesfrom

- Page 133 and 134:

College of Letters and SciencesCore

- Page 135 and 136:

College of Letters and SciencesMCW

- Page 137 and 138:

College of Letters and Sciencesgove

- Page 139 and 140:

College of Letters and SciencesARB

- Page 141:

College of Letters and SciencesTHE

- Page 144 and 145:

Degree Programs OfferedUndergraduat

- Page 146 and 147:

School of Business and ManagementVI

- Page 148 and 149:

School of Business and Management14

- Page 150 and 151:

School of Business and ManagementPr

- Page 152 and 153:

School of Business and Managementbu

- Page 154 and 155:

School of Business and Management14

- Page 156 and 157:

School of Business and Management

- Page 158 and 159:

School of Business and Management15

- Page 160 and 161:

School of Business and Management15

- Page 162 and 163:

School of Business and ManagementSe

- Page 164 and 165:

School of Business and Management15

- Page 166 and 167:

School of Business and Management

- Page 168 and 169:

School of Business and Management16

- Page 171 and 172:

School of EducationDean, C. Kalani

- Page 173 and 174:

FacultyDepartment ofEducationalAdmi

- Page 175 and 176:

FacultyBernardo P. GallegosProfesso

- Page 177 and 178:

School of EducationBIO 330EES 335BI

- Page 179 and 180:

School of EducationThe Bachelor of

- Page 181 and 182:

School of EducationandAny two addit

- Page 183 and 184:

School of EducationThe Bachelor of

- Page 185 and 186:

School of Educationstudents in our

- Page 187 and 188:

School of Educationof applied behav

- Page 189 and 190:

School of Educationseveral groups o

- Page 191 and 192:

School of EducationFaculty Advisor

- Page 193 and 194:

School of EducationBasic Skills exa

- Page 195 and 196:

School of EducationNational Univers

- Page 197 and 198:

School of Education■ MASTER OF SC

- Page 199 and 200:

School of EducationCredential Appli

- Page 201 and 202:

School of EducationProgram Learning

- Page 203 and 204:

School of EducationProgram Learning

- Page 205 and 206:

School of EducationCREDENTIAL PROGR

- Page 207 and 208:

School of Educationstate-adopted ac

- Page 209 and 210:

School of Educationdepartmentalized

- Page 211 and 212:

School of EducationCo-requisites(3

- Page 213 and 214:

School of Education• Completion o

- Page 215 and 216:

School of EducationTED 615TED 605TE

- Page 217 and 218:

School of Education• Completion o

- Page 219 and 220:

School of Education3. Beginning and

- Page 221 and 222:

School of Educationadministrative r

- Page 223 and 224:

School of EducationProgram Learning

- Page 225 and 226:

School of Educationtasks and roles

- Page 227 and 228:

School of Educationand planning for

- Page 229 and 230:

School of EducationRecommendation f

- Page 231 and 232:

School of EducationCore Requirement

- Page 233 and 234:

School of Educationminutes maximum

- Page 235 and 236:

School of EducationEXC 603ASupervis

- Page 237 and 238:

School of EducationThe CTC mandates

- Page 239 and 240:

School of EducationNote: Upon succe

- Page 241 and 242:

School of Educationstages and their

- Page 243 and 244:

School of Engineeringand Technology

- Page 245 and 246:

Department of ComputerScience and I

- Page 247 and 248:

School of Engineering and Technolog

- Page 249 and 250:

School of Engineering and Technolog

- Page 251 and 252:

School of Engineering and Technolog

- Page 253 and 254:

School of Engineering and Technolog

- Page 255 and 256:

School of Engineering and Technolog

- Page 257 and 258:

School of Engineering and Technolog

- Page 259 and 260:

School of Engineering and Technolog

- Page 261 and 262:

School of Engineering and Technolog

- Page 263 and 264:

School of Engineering and Technolog

- Page 265 and 266:

School of Engineering and Technolog

- Page 267 and 268:

School of Healthand Human ServicesD

- Page 269 and 270:

School of Health and Human Services

- Page 271 and 272:

School of Health and Human Services

- Page 273 and 274:

School of Health and Human Services

- Page 275 and 276:

School of Health and Human Services

- Page 277 and 278:

School of Health and Human Services

- Page 279 and 280:

School of Health and Human Services

- Page 281 and 282:

School of Health and Human Services

- Page 283 and 284:

School of Health and Human Services

- Page 285:

School of Health and Human Services

- Page 288 and 289:

Degree Programs Offered and Faculty

- Page 290 and 291:

School of Media and Communication28

- Page 292 and 293:

School of Media and Communicationma

- Page 294 and 295:

School of Media and Communication28

- Page 296 and 297:

School of Media and Communication28

- Page 298 and 299:

School of Media and Communicationsp

- Page 300 and 301:

School of Media and Communicationwi

- Page 302 and 303:

Nevada ProgramsNational University

- Page 304 and 305:

Nevada ProgramsApplication Requirem

- Page 306 and 307:

Nevada Programs298work and grades o

- Page 308 and 309:

Nevada ProgramsTED 465BTED 465CTED

- Page 310 and 311:

Nevada ProgramsThe student teaching

- Page 312 and 313:

Nevada ProgramsStage 1: Students me

- Page 314 and 315:

Nevada ProgramsEXC 603EXC 604EXC 62

- Page 316 and 317:

Nevada Programstransferring from an

- Page 318 and 319:

Nevada Programsgrade point average

- Page 320 and 321:

Division of Extended LearningThe Di

- Page 322 and 323:

Division of Extended Learning314The

- Page 324 and 325:

Division of Extended LearningCTEX 1

- Page 326 and 327:

Division of Extended LearningThe sp

- Page 328 and 329:

Division of Extended Learning320Spe

- Page 330 and 331:

Division of Extended LearningUpon c

- Page 332 and 333:

Division of Extended Learning324ONL

- Page 334 and 335:

Division of Extended LearningOracle

- Page 336 and 337:

Division of Extended Learning328sci

- Page 338 and 339:

Division of Extended Learningand co

- Page 340 and 341:

Division of Extended Learningcreati

- Page 342 and 343:

Division of Extended Learning334HSX

- Page 344 and 345:

Division of Extended LearningHSX 19

- Page 346 and 347:

Division of Extended Learning338rel

- Page 348 and 349:

Division of Extended LearningPolymo

- Page 350 and 351:

Division of Extended LearningMUSX 1

- Page 352 and 353:

Division of Extended Learningimplem

- Page 354 and 355:

Division of Extended LearningTEDX 1

- Page 356 and 357:

National University Language Instit

- Page 358 and 359:

National University Language Instit

- Page 361 and 362:

CourseDescriptionsPrefix/Subject Ar

- Page 363 and 364:

Course DescriptionsABA - Applied Be

- Page 365 and 366:

Course Descriptionstheir strengths

- Page 367 and 368:

Course Descriptionsimmune response.

- Page 369 and 370:

Course Descriptionsvideo and the ro

- Page 371 and 372:

Course DescriptionsCED 694: Thesis(

- Page 373 and 374:

Course Descriptionsment. Students w

- Page 375 and 376:

Course Descriptionswill evaluate th

- Page 377 and 378:

Course Descriptionses employed in t

- Page 379 and 380:

Course Descriptionstional and seque

- Page 381 and 382:

Course DescriptionsDHH 603: Assessm

- Page 383 and 384:

Course DescriptionsECO 602: Global

- Page 385 and 386:

Course Descriptionsniques, skills,

- Page 387 and 388:

Course Descriptionscontinue to prac

- Page 389 and 390:

Course Descriptionsexamine the diff

- Page 391 and 392:

Course DescriptionsAn in-depth look

- Page 393 and 394:

Course Descriptions201/202)Examinat

- Page 395 and 396:

Course Descriptionsindividual needs

- Page 397 and 398:

Course DescriptionsTwo-month-long c

- Page 399 and 400:

Course Descriptionsproduce a 20-30

- Page 401 and 402:

Course Descriptionspreparation for

- Page 403 and 404:

Course Descriptionstice of law and

- Page 405 and 406:

Course DescriptionsLSS - Lean Six S

- Page 407 and 408:

Course Descriptionsemphasizes: clas

- Page 409 and 410:

Course Descriptionsscenes. Students

- Page 411 and 412:

Course Descriptionsadvertising medi

- Page 413 and 414:

Course Descriptionscomputer science

- Page 415 and 416:

Course Descriptionsprepress product

- Page 417 and 418:

Course Descriptionstherapeutic comm

- Page 419 and 420:

Course Descriptionscourse. PAD405 i

- Page 421 and 422:

Course Descriptionsbusiness practic

- Page 423 and 424:

Course Descriptionsdures, and spous

- Page 425 and 426:

Course Descriptionscontemporary lit

- Page 427 and 428:

Course Descriptionstures, demonstra

- Page 429 and 430:

Course Descriptionsdevelopment. Cou

- Page 431 and 432:

Course Descriptionsthemes. Introduc

- Page 433 and 434:

Course Descriptions(This course mus

- Page 435:

Course Descriptionsples and their a

- Page 438 and 439:

IndexLitigation Specialization.....

- Page 440 and 441:

Index432TOEFL .....................

- Page 442:

IndexSan Bernardino Campus.........