Catalog 73 - National University

Catalog 73 - National University

Catalog 73 - National University

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

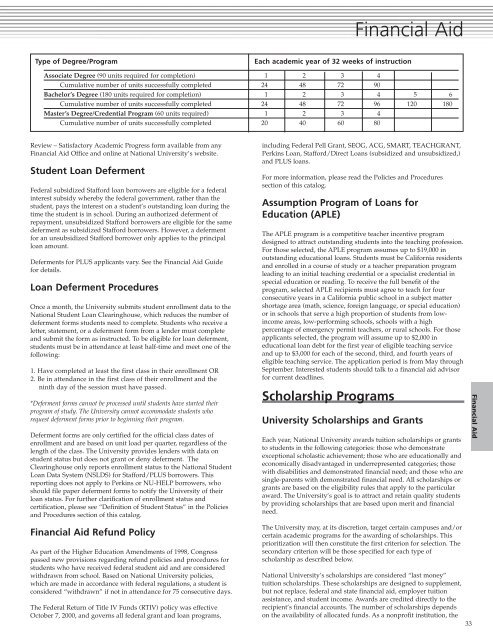

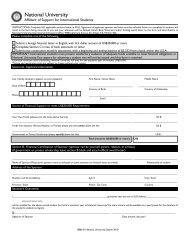

Financial AidType of Degree/ProgramEach academic year of 32 weeks of instructionAssociate Degree (90 units required for completion) 1 2 3 4Cumulative number of units successfully completed 24 48 72 90Bachelor’s Degree (180 units required for completion) 1 2 3 4 5 6Cumulative number of units successfully completed 24 48 72 96 120 180Master’s Degree/Credential Program (60 units required) 1 2 3 4Cumulative number of units successfully completed 20 40 60 80Review – Satisfactory Academic Progress form available from anyFinancial Aid Office and online at <strong>National</strong> <strong>University</strong>’s website.Student Loan DefermentFederal subsidized Stafford loan borrowers are eligible for a federalinterest subsidy whereby the federal government, rather than thestudent, pays the interest on a student’s outstanding loan during thetime the student is in school. During an authorized deferment ofrepayment, unsubsidized Stafford borrowers are eligible for the samedeferment as subsidized Stafford borrowers. However, a defermentfor an unsubsidized Stafford borrower only applies to the principalloan amount.Deferments for PLUS applicants vary. See the Financial Aid Guidefor details.Loan Deferment ProceduresOnce a month, the <strong>University</strong> submits student enrollment data to the<strong>National</strong> Student Loan Clearinghouse, which reduces the number ofdeferment forms students need to complete. Students who receive aletter, statement, or a deferment form from a lender must completeand submit the form as instructed. To be eligible for loan deferment,students must be in attendance at least half-time and meet one of thefollowing:1. Have completed at least the first class in their enrollment OR2. Be in attendance in the first class of their enrollment and theninth day of the session must have passed.*Deferment forms cannot be processed until students have started theirprogram of study. The <strong>University</strong> cannot accommodate students whorequest deferment forms prior to beginning their program.Deferment forms are only certified for the official class dates ofenrollment and are based on unit load per quarter, regardless of thelength of the class. The <strong>University</strong> provides lenders with data onstudent status but does not grant or deny deferment. TheClearinghouse only reports enrollment status to the <strong>National</strong> StudentLoan Data System (NSLDS) for Stafford/PLUS borrowers. Thisreporting does not apply to Perkins or NU-HELP borrowers, whoshould file paper deferment forms to notify the <strong>University</strong> of theirloan status. For further clarification of enrollment status andcertification, please see “Definition of Student Status” in the Policiesand Procedures section of this catalog.Financial Aid Refund PolicyAs part of the Higher Education Amendments of 1998, Congresspassed new provisions regarding refund policies and procedures forstudents who have received federal student aid and are consideredwithdrawn from school. Based on <strong>National</strong> <strong>University</strong> policies,which are made in accordance with federal regulations, a student isconsidered “withdrawn” if not in attendance for 75 consecutive days.The Federal Return of Title IV Funds (RTIV) policy was effectiveOctober 7, 2000, and governs all federal grant and loan programs,including Federal Pell Grant, SEOG, ACG, SMART, TEACHGRANT,Perkins Loan, Stafford/Direct Loans (subsidized and unsubsidized,)and PLUS loans.For more information, please read the Policies and Proceduressection of this catalog.Assumption Program of Loans forEducation (APLE)The APLE program is a competitive teacher incentive programdesigned to attract outstanding students into the teaching profession.For those selected, the APLE program assumes up to $19,000 inoutstanding educational loans. Students must be California residentsand enrolled in a course of study or a teacher preparation programleading to an initial teaching credential or a specialist credential inspecial education or reading. To receive the full benefit of theprogram, selected APLE recipients must agree to teach for fourconsecutive years in a California public school in a subject mattershortage area (math, science, foreign language, or special education)or in schools that serve a high proportion of students from lowincomeareas, low-performing schools, schools with a highpercentage of emergency permit teachers, or rural schools. For thoseapplicants selected, the program will assume up to $2,000 ineducational loan debt for the first year of eligible teaching serviceand up to $3,000 for each of the second, third, and fourth years ofeligible teaching service. The application period is from May throughSeptember. Interested students should talk to a financial aid advisorfor current deadlines.Scholarship Programs<strong>University</strong> Scholarships and GrantsEach year, <strong>National</strong> <strong>University</strong> awards tuition scholarships or grantsto students in the following categories: those who demonstrateexceptional scholastic achievement; those who are educationally andeconomically disadvantaged in underrepresented categories; thosewith disabilities and demonstrated financial need; and those who aresingle-parents with demonstrated financial need. All scholarships orgrants are based on the eligibility rules that apply to the particularaward. The <strong>University</strong>’s goal is to attract and retain quality studentsby providing scholarships that are based upon merit and financialneed.The <strong>University</strong> may, at its discretion, target certain campuses and/orcertain academic programs for the awarding of scholarships. Thisprioritization will then constitute the first criterion for selection. Thesecondary criterion will be those specified for each type ofscholarship as described below.<strong>National</strong> <strong>University</strong>’s scholarships are considered “last money”tuition scholarships. These scholarships are designed to supplement,but not replace, federal and state financial aid, employer tuitionassistance, and student income. Awards are credited directly to therecipient’s financial accounts. The number of scholarships dependson the availability of allocated funds. As a nonprofit institution, the33Financial Aid