Registration Document

Registration Document

Registration Document

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

09<br />

10<br />

11<br />

12<br />

13<br />

14<br />

98<br />

06<br />

Consolidated information<br />

Notes to the Consolidated Financial Statements<br />

As of that date, the Group decided to no longer<br />

use the official exchange rate published by the<br />

Venezuelan government, namely USD 1 = 4.3<br />

bolivar. The financial statements for the year<br />

ended August 31, 2010 of subsidiaries operating in<br />

Venezuela have consequently been translated at the<br />

rate of USD 1 = 8.25 bolivar, or 1 euro = 10.46 bolivar<br />

corresponding to the last observable quotation on<br />

the parallel currency market, and for the year ended<br />

August 31, 2011, at the rate of USD 1 USD = 9.39<br />

bolivar, or 1 euro = 13.57 bolivar, which is the rate<br />

observed for recent transactions.<br />

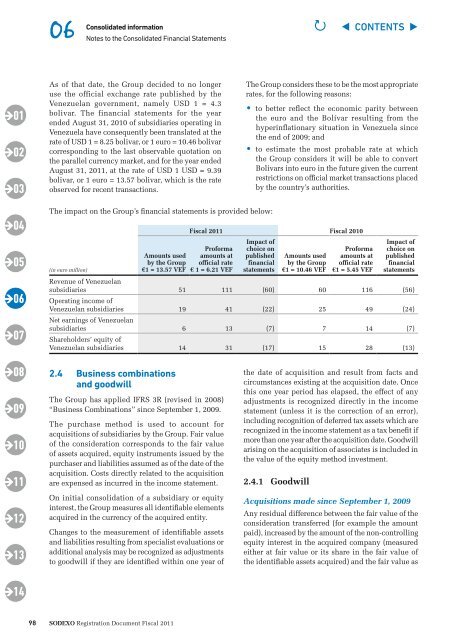

The impact on the Group’s financial statements is provided below:<br />

(in euro million)<br />

Amounts used<br />

by the Group<br />

€1 = 13.57 VeF<br />

Sodexo <strong>Registration</strong> <strong>Document</strong> Fiscal 2011<br />

The Group considers these to be the most appropriate<br />

rates, for the following reasons:<br />

• to better reflect the economic parity between<br />

the euro and the Bolívar resulting from the<br />

hyperinflationary situation in Venezuela since<br />

the end of 2009; and<br />

• to estimate the most probable rate at which<br />

the Group considers it will be able to convert<br />

Bolivars into euro in the future given the current<br />

restrictions on official market transactions placed<br />

by the country’s authorities.<br />

Fiscal 2011 Fiscal 2010<br />

Proforma<br />

amounts at<br />

official rate<br />

€ 1 = 6.21 VeF<br />

Impact of<br />

choice on<br />

published<br />

financial<br />

statements<br />

Amounts used<br />

by the Group<br />

€1 = 10.46 VeF<br />

Proforma<br />

amounts at<br />

official rate<br />

€1 = 5.45 VeF<br />

Impact of<br />

choice on<br />

published<br />

financial<br />

statements<br />

Revenue of Venezuelan<br />

subsidiaries<br />

Operating income of<br />

51 111 (60) 60 116 (56)<br />

Venezuelan subsidiaries<br />

Net earnings of Venezuelan<br />

19 41 (22) 25 49 (24)<br />

subsidiaries<br />

Shareholders’ equity of<br />

6 13 (7) 7 14 (7)<br />

Venezuelan subsidiaries 14 31 (17) 15 28 (13)<br />

2.4 Business combinations<br />

and goodwill<br />

The Group has applied IFRS 3R (revised in 2008)<br />

“Business Combinations” since September 1, 2009.<br />

The purchase method is used to account for<br />

acquisitions of subsidiaries by the Group. Fair value<br />

of the consideration corresponds to the fair value<br />

of assets acquired, equity instruments issued by the<br />

purchaser and liabilities assumed as of the date of the<br />

acquisition. Costs directly related to the acquisition<br />

are expensed as incurred in the income statement.<br />

On initial consolidation of a subsidiary or equity<br />

interest, the Group measures all identifiable elements<br />

acquired in the currency of the acquired entity.<br />

Changes to the measurement of identifiable assets<br />

and liabilities resulting from specialist evaluations or<br />

additional analysis may be recognized as adjustments<br />

to goodwill if they are identified within one year of<br />

the date of acquisition and result from facts and<br />

circumstances existing at the acquisition date. Once<br />

this one year period has elapsed, the effect of any<br />

adjustments is recognized directly in the income<br />

statement (unless it is the correction of an error),<br />

including recognition of deferred tax assets which are<br />

recognized in the income statement as a tax benefit if<br />

more than one year after the acquisition date. Goodwill<br />

arising on the acquisition of associates is included in<br />

the value of the equity method investment.<br />

2.4.1 Goodwill<br />

P ◀ CONTENTS ▶<br />

Acquisitions made since September 1, 2009<br />

Any residual difference between the fair value of the<br />

consideration transferred (for example the amount<br />

paid), increased by the amount of the non-controlling<br />

equity interest in the acquired company (measured<br />

either at fair value or its share in the fair value of<br />

the identifiable assets acquired) and the fair value as