Registration Document

Registration Document

Registration Document

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

09<br />

10<br />

11<br />

12<br />

13<br />

14<br />

140<br />

06<br />

Consolidated information<br />

Notes to the Consolidated Financial Statements<br />

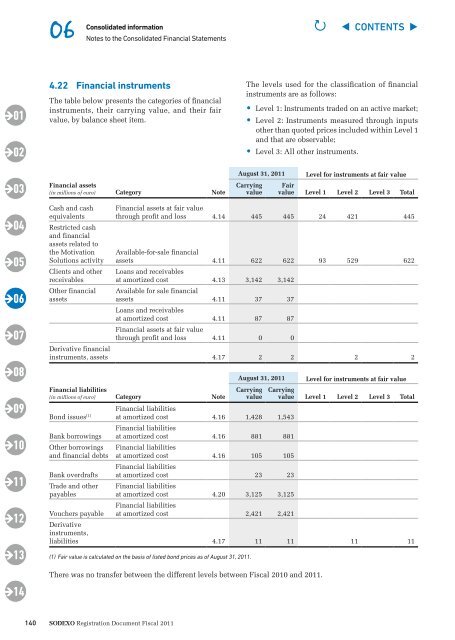

4.22 Financial instruments<br />

The table below presents the categories of financial<br />

instruments, their carrying value, and their fair<br />

value, by balance sheet item.<br />

Financial assets<br />

(in millions of euro) Category Note<br />

Cash and cash<br />

equivalents<br />

Restricted cash<br />

and financial<br />

assets related to<br />

the Motivation<br />

Solutions activity<br />

Clients and other<br />

receivables<br />

Other financial<br />

assets<br />

Sodexo <strong>Registration</strong> <strong>Document</strong> Fiscal 2011<br />

The levels used for the classification of financial<br />

instruments are as follows:<br />

• Level 1: Instruments traded on an active market;<br />

• Level 2: Instruments measured through inputs<br />

other than quoted prices included within Level 1<br />

and that are observable;<br />

• Level 3: All other instruments.<br />

August 31, 2011 Level for instruments at fair value<br />

Carrying<br />

value<br />

Fair<br />

value Level 1 Level 2 Level 3 Total<br />

Financial assets at fair value<br />

through profit and loss 4.14 445 445 24 421 445<br />

Available-for-sale financial<br />

assets<br />

Loans and receivables<br />

4.11 622 622 93 529 622<br />

at amortized cost<br />

Available for sale financial<br />

4.13 3,142 3,142<br />

assets<br />

Loans and receivables<br />

4.11 37 37<br />

at amortized cost<br />

Financial assets at fair value<br />

4.11 87 87<br />

through profit and loss 4.11 0 0<br />

Derivative financial<br />

instruments, assets 4.17 2 2 2 2<br />

Financial liabilities<br />

(in millions of euro) Category Note<br />

Bond issues (1)<br />

Bank borrowings<br />

Other borrowings<br />

and financial debts<br />

Bank overdrafts<br />

Trade and other<br />

payables<br />

Vouchers payable<br />

August 31, 2011 Level for instruments at fair value<br />

Carrying<br />

value<br />

Financial liabilities<br />

at amortized cost<br />

Financial liabilities<br />

4.16 1,428 1,543<br />

at amortized cost<br />

Financial liabilities<br />

4.16 881 881<br />

at amortized cost<br />

Financial liabilities<br />

4.16 105 105<br />

at amortized cost<br />

Financial liabilities<br />

23 23<br />

at amortized cost<br />

Financial liabilities<br />

4.20 3,125 3,125<br />

at amortized cost 2,421 2,421<br />

Carrying<br />

value Level 1 Level 2 Level 3 Total<br />

Derivative<br />

instruments,<br />

liabilities 4.17 11 11 11 11<br />

(1) Fair value is calculated on the basis of listed bond prices as of August 31, 2011.<br />

There was no transfer between the different levels between Fiscal 2010 and 2011.<br />

P ◀ CONTENTS ▶