Registration Document

Registration Document

Registration Document

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

09<br />

10<br />

11<br />

12<br />

13<br />

14<br />

176<br />

07<br />

Information on the Issuer<br />

Notes to the Individual Company Financial Statements<br />

2.6 Retirement benefits<br />

Retirement benefit obligations due to active<br />

employees by law or under collective agreements<br />

are included in off balance sheet commitments.<br />

Commitments under complementary retirement<br />

plans are estimated using the projected unit credit<br />

method based on final salary and are also included<br />

in off balance sheet commitments, net of any plan<br />

assets.<br />

2.7 French tax consolidation<br />

Sodexo SA is the lead company in the French tax<br />

consolidation, and has sole liability for income<br />

taxes for the whole of this tax group. Each company<br />

included in the group tax election recognizes the<br />

income tax for which it would have been liable had<br />

there been no group tax election. Any income tax<br />

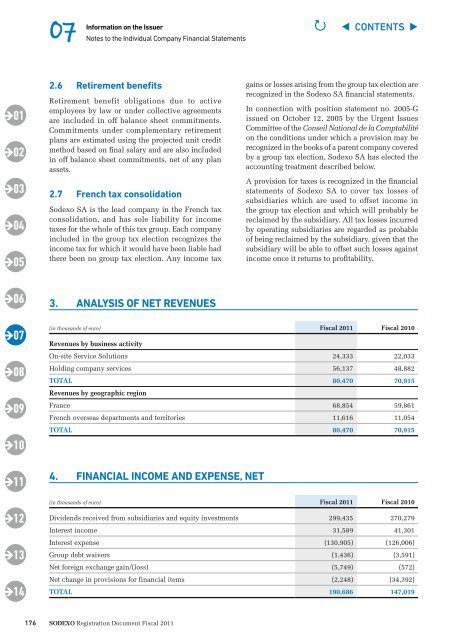

3. ANALYSIS OF NET REVENUES<br />

Sodexo <strong>Registration</strong> <strong>Document</strong> Fiscal 2011<br />

gains or losses arising from the group tax election are<br />

recognized in the Sodexo SA financial statements.<br />

In connection with position statement no. 2005-G<br />

issued on October 12, 2005 by the Urgent Issues<br />

Committee of the Conseil National de la Comptabilité<br />

on the conditions under which a provision may be<br />

recognized in the books of a parent company covered<br />

by a group tax election, Sodexo SA has elected the<br />

accounting treatment described below.<br />

A provision for taxes is recognized in the financial<br />

statements of Sodexo SA to cover tax losses of<br />

subsidiaries which are used to offset income in<br />

the group tax election and which will probably be<br />

reclaimed by the subsidiary. All tax losses incurred<br />

by operating subsidiaries are regarded as probable<br />

of being reclaimed by the subsidiary, given that the<br />

subsidiary will be able to offset such losses against<br />

income once it returns to profitability.<br />

(in thousands of euro) Fiscal 2011 Fiscal 2010<br />

Revenues by business activity<br />

On-site Service Solutions 24,333 22,033<br />

Holding company services 56,137 48,882<br />

ToTAL<br />

Revenues by geographic region<br />

80,470 70,915<br />

France 68,854 59,861<br />

French overseas departments and territories 11,616 11,054<br />

ToTAL 80,470 70,915<br />

4. FINANCIAL INCOME AND EXPENSE, NET<br />

P ◀ CONTENTS ▶<br />

(in thousands of euro) Fiscal 2011 Fiscal 2010<br />

Dividends received from subsidiaries and equity investments 299,435 270,279<br />

Interest income 31,589 41,301<br />

Interest expense (130,905) (126,006)<br />

Group debt waivers (1,436) (3,591)<br />

Net foreign exchange gain/(loss) (5,749) (572)<br />

Net change in provisions for financial items (2,248) (34,392)<br />

ToTAL 190,686 147,019