Registration Document

Registration Document

Registration Document

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

P ◀ CONTENTS ▶<br />

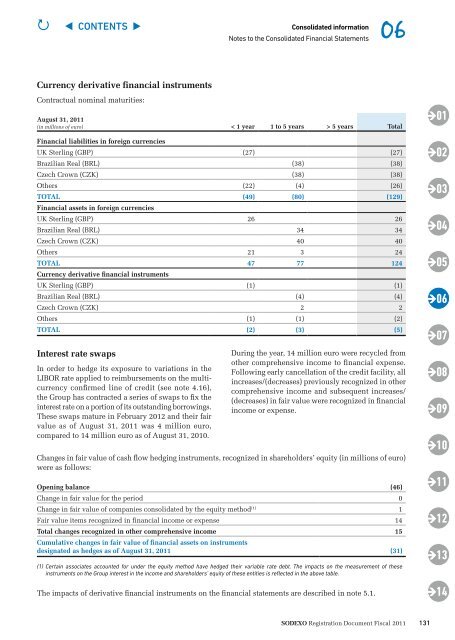

Currency derivative financial instruments<br />

Contractual nominal maturities:<br />

Consolidated information 06<br />

Notes to the Consolidated Financial Statements<br />

August 31, 2011<br />

(in millions of euro) < 1 year 1 to 5 years > 5 years Total<br />

Financial liabilities in foreign currencies<br />

UK Sterling (GBP) (27) (27)<br />

Brazilian Real (BRL) (38) (38)<br />

Czech Crown (CZK) (38) (38)<br />

Others (22) (4) (26)<br />

ToTAL (49) (80) (129)<br />

Financial assets in foreign currencies<br />

UK Sterling (GBP) 26 26<br />

Brazilian Real (BRL) 34 34<br />

Czech Crown (CZK) 40 40<br />

Others 21 3 24<br />

ToTAL 47 77 124<br />

Currency derivative financial instruments<br />

UK Sterling (GBP) (1) (1)<br />

Brazilian Real (BRL) (4) (4)<br />

Czech Crown (CZK) 2 2<br />

Others (1) (1) (2)<br />

ToTAL (2) (3) (5)<br />

Interest rate swaps<br />

In order to hedge its exposure to variations in the<br />

LIBOR rate applied to reimbursements on the multicurrency<br />

confirmed line of credit (see note 4.16),<br />

the Group has contracted a series of swaps to fix the<br />

interest rate on a portion of its outstanding borrowings.<br />

These swaps mature in February 2012 and their fair<br />

value as of August 31, 2011 was 4 million euro,<br />

compared to 14 million euro as of August 31, 2010.<br />

During the year, 14 million euro were recycled from<br />

other comprehensive income to financial expense.<br />

Following early cancellation of the credit facility, all<br />

increases/(decreases) previously recognized in other<br />

comprehensive income and subsequent increases/<br />

(decreases) in fair value were recognized in financial<br />

income or expense.<br />

Changes in fair value of cash flow hedging instruments, recognized in shareholders’ equity (in millions of euro)<br />

were as follows:<br />

opening balance (46)<br />

Change in fair value for the period 0<br />

Change in fair value of companies consolidated by the equity method (1) 1<br />

Fair value items recognized in financial income or expense 14<br />

Total changes recognized in other comprehensive income<br />

Cumulative changes in fair value of financial assets on instruments<br />

15<br />

designated as hedges as of August 31, 2011 (31)<br />

(1) Certain associates accounted for under the equity method have hedged their variable rate debt. The impacts on the measurement of these<br />

instruments on the Group interest in the income and shareholders’ equity of these entities is reflected in the above table.<br />

The impacts of derivative financial instruments on the financial statements are described in note 5.1.<br />

Sodexo <strong>Registration</strong> <strong>Document</strong> Fiscal 2011<br />

131<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

09<br />

10<br />

11<br />

12<br />

13<br />

14