Registration Document

Registration Document

Registration Document

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

P ◀ CONTENTS ▶<br />

The expected life of the options is incorporated into<br />

the binomial model based on beneficiary behavior<br />

expected over the contractual life of the options<br />

and based on historical data, and is not necessarily<br />

indicative of future exercises.<br />

The expected volatility is based on the assumption<br />

that volatility calculated using regression analysis<br />

of daily returns over the five- or six-year period<br />

(the expected life of the options) prior to the date<br />

of grant, excluding the share price fluctuations of<br />

September 2002, is an indicator of future trends.<br />

Effective for plans granted in 2008, the expected<br />

volatility is based on a weighted average of the<br />

historical volatility of the shares observed over<br />

five years and the implicit volatility expected in the<br />

marketplace.<br />

The risk-free interest rate is the rate on Government<br />

bonds (with reference to Iboxx rates in the euro zone)<br />

for a maturity similar to the life of the options.<br />

The assumptions with respect to the exercise<br />

behavior of grantees used in determining the fair<br />

value of the options are also based on historical<br />

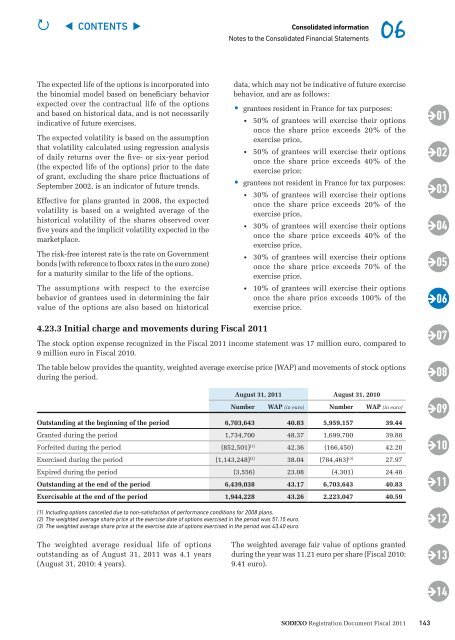

4.23.3 Initial charge and movements during Fiscal 2011<br />

Consolidated information 06<br />

Notes to the Consolidated Financial Statements<br />

data, which may not be indicative of future exercise<br />

behavior, and are as follows:<br />

• grantees resident in France for tax purposes:<br />

• 50% of grantees will exercise their options<br />

once the share price exceeds 20% of the<br />

exercise price,<br />

• 50% of grantees will exercise their options<br />

once the share price exceeds 40% of the<br />

exercise price;<br />

• grantees not resident in France for tax purposes:<br />

• 30% of grantees will exercise their options<br />

once the share price exceeds 20% of the<br />

exercise price,<br />

• 30% of grantees will exercise their options<br />

once the share price exceeds 40% of the<br />

exercise price,<br />

• 30% of grantees will exercise their options<br />

once the share price exceeds 70% of the<br />

exercise price,<br />

• 10% of grantees will exercise their options<br />

once the share price exceeds 100% of the<br />

exercise price.<br />

The stock option expense recognized in the Fiscal 2011 income statement was 17 million euro, compared to<br />

9 million euro in Fiscal 2010.<br />

The table below provides the quantity, weighted average exercise price (WAP) and movements of stock options<br />

during the period.<br />

August 31, 2011 August 31, 2010<br />

Number WAP (in euro) Number WAP (in euro)<br />

outstanding at the beginning of the period 6,703,643 40.83 5,959,157 39.44<br />

Granted during the period 1,734,700 48.37 1,699,700 39.88<br />

Forfeited during the period (852,501) (1) 42.36 (166,450) 42.20<br />

Exercised during the period (1,143,248) (2) 38.04 (784,463) (3) 27.97<br />

Expired during the period (3,556) 23.08 (4,301) 24.48<br />

outstanding at the end of the period 6,439,038 43.17 6,703,643 40.83<br />

exercisable at the end of the period 1,944,228 43.26 2,223,047 40.59<br />

(1) Including options cancelled due to non-satisfaction of performance conditions for 2008 plans.<br />

(2) The weighted average share price at the exercise date of options exercised in the period was 51.15 euro.<br />

(3) The weighted average share price at the exercise date of options exercised in the period was 43.40 euro.<br />

The weighted average residual life of options<br />

outstanding as of August 31, 2011 was 4.1 years<br />

(August 31, 2010: 4 years).<br />

The weighted average fair value of options granted<br />

during the year was 11.21 euro per share (Fiscal 2010:<br />

9.41 euro).<br />

Sodexo <strong>Registration</strong> <strong>Document</strong> Fiscal 2011<br />

143<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

09<br />

10<br />

11<br />

12<br />

13<br />

14