Registration Document

Registration Document

Registration Document

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

P ◀ CONTENTS ▶<br />

Counterparty risk relating to customer accounts<br />

receivable is immaterial. Due to the Group’s geographic<br />

and segment spread, there is no concentration of risk<br />

on past due individual receivables which have not<br />

been impaired. Moreover, the Group has not observed<br />

any significant change in impacts relating to customer<br />

default during the year.<br />

The main counterparty risk is bank-related. The<br />

Group has limited its exposure to counterparty risk<br />

by diversifying its investments and limiting the<br />

concentration of risk held by each of its counterparties.<br />

Transactions are conducted with highly creditworthy<br />

counterparties taking into consideration country<br />

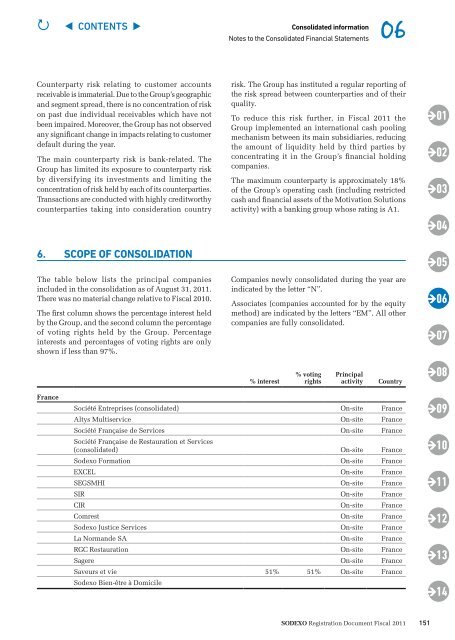

6. SCOPE OF CONSOLIDATION<br />

The table below lists the principal companies<br />

included in the consolidation as of August 31, 2011.<br />

There was no material change relative to Fiscal 2010.<br />

The first column shows the percentage interest held<br />

by the Group, and the second column the percentage<br />

of voting rights held by the Group. Percentage<br />

interests and percentages of voting rights are only<br />

shown if less than 97%.<br />

France<br />

Consolidated information 06<br />

Notes to the Consolidated Financial Statements<br />

risk. The Group has instituted a regular reporting of<br />

the risk spread between counterparties and of their<br />

quality.<br />

To reduce this risk further, in Fiscal 2011 the<br />

Group implemented an international cash pooling<br />

mechanism between its main subsidiaries, reducing<br />

the amount of liquidity held by third parties by<br />

concentrating it in the Group’s financial holding<br />

companies.<br />

The maximum counterparty is approximately 18%<br />

of the Group’s operating cash (including restricted<br />

cash and financial assets of the Motivation Solutions<br />

activity) with a banking group whose rating is A1.<br />

Companies newly consolidated during the year are<br />

indicated by the letter “N”.<br />

Associates (companies accounted for by the equity<br />

method) are indicated by the letters “EM”. All other<br />

companies are fully consolidated.<br />

% interest<br />

% voting<br />

rights<br />

Principal<br />

activity Country<br />

Société Entreprises (consolidated) On-site France<br />

Altys Multiservice On-site France<br />

Société Française de Services<br />

Société Française de Restauration et Services<br />

On-site France<br />

(consolidated) On-site France<br />

Sodexo Formation On-site France<br />

EXCEL On-site France<br />

SEGSMHI On-site France<br />

SIR On-site France<br />

CIR On-site France<br />

Comrest On-site France<br />

Sodexo Justice Services On-site France<br />

La Normande SA On-site France<br />

RGC Restauration On-site France<br />

Sagere On-site France<br />

Saveurs et vie<br />

Sodexo Bien-être à Domicile<br />

51% 51% On-site France<br />

Sodexo <strong>Registration</strong> <strong>Document</strong> Fiscal 2011<br />

151<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

09<br />

10<br />

11<br />

12<br />

13<br />

14