Registration Document

Registration Document

Registration Document

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

09<br />

10<br />

11<br />

12<br />

13<br />

14<br />

142<br />

06<br />

Consolidated information<br />

Notes to the Consolidated Financial Statements<br />

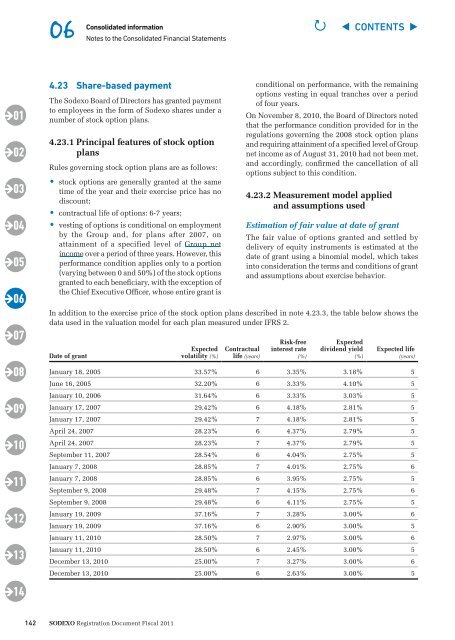

4.23 Share-based payment<br />

The Sodexo Board of Directors has granted payment<br />

to employees in the form of Sodexo shares under a<br />

number of stock option plans.<br />

4.23.1 Principal features of stock option<br />

plans<br />

Rules governing stock option plans are as follows:<br />

• stock options are generally granted at the same<br />

time of the year and their exercise price has no<br />

discount;<br />

• contractual life of options: 6-7 years;<br />

• vesting of options is conditional on employment<br />

by the Group and, for plans after 2007, on<br />

attainment of a specified level of Group net<br />

income over a period of three years. However, this<br />

performance condition applies only to a portion<br />

(varying between 0 and 50%) of the stock options<br />

granted to each beneficiary, with the exception of<br />

the Chief Executive Officer, whose entire grant is<br />

Sodexo <strong>Registration</strong> <strong>Document</strong> Fiscal 2011<br />

conditional on performance, with the remaining<br />

options vesting in equal tranches over a period<br />

of four years.<br />

On November 8, 2010, the Board of Directors noted<br />

that the performance condition provided for in the<br />

regulations governing the 2008 stock option plans<br />

and requiring attainment of a specified level of Group<br />

net income as of August 31, 2010 had not been met,<br />

and accordingly, confirmed the cancellation of all<br />

options subject to this condition.<br />

4.23.2 Measurement model applied<br />

and assumptions used<br />

Estimation of fair value at date of grant<br />

The fair value of options granted and settled by<br />

delivery of equity instruments is estimated at the<br />

date of grant using a binomial model, which takes<br />

into consideration the terms and conditions of grant<br />

and assumptions about exercise behavior.<br />

In addition to the exercise price of the stock option plans described in note 4.23.3, the table below shows the<br />

data used in the valuation model for each plan measured under IFRS 2.<br />

date of grant<br />

expected<br />

volatility (%)<br />

Contractual<br />

life (years)<br />

Risk-free<br />

interest rate<br />

(%)<br />

P ◀ CONTENTS ▶<br />

expected<br />

dividend yield<br />

(%)<br />

expected life<br />

(years)<br />

January 18, 2005 33.57% 6 3.35% 3.18% 5<br />

June 16, 2005 32.20% 6 3.33% 4.10% 5<br />

January 10, 2006 31.64% 6 3.33% 3.03% 5<br />

January 17, 2007 29.42% 6 4.18% 2.81% 5<br />

January 17, 2007 29.42% 7 4.18% 2.81% 5<br />

April 24, 2007 28.23% 6 4.37% 2.79% 5<br />

April 24, 2007 28.23% 7 4.37% 2.79% 5<br />

September 11, 2007 28.54% 6 4.04% 2.75% 5<br />

January 7, 2008 28.85% 7 4.01% 2.75% 6<br />

January 7, 2008 28.85% 6 3.95% 2.75% 5<br />

September 9, 2008 29.48% 7 4.15% 2.75% 6<br />

September 9, 2008 29.48% 6 4.11% 2.75% 5<br />

January 19, 2009 37.16% 7 3.28% 3.00% 6<br />

January 19, 2009 37.16% 6 2.90% 3.00% 5<br />

January 11, 2010 28.50% 7 2.97% 3.00% 6<br />

January 11, 2010 28.50% 6 2.45% 3.00% 5<br />

December 13, 2010 25.00% 7 3.27% 3.00% 6<br />

December 13, 2010 25.00% 6 2.63% 3.00% 5