- Page 1 and 2:

Fiscal 2011 Registration Document

- Page 3 and 4:

Registration Document Fiscal 2011 T

- Page 5 and 6:

P ◀ CONTENTS ▶ Message from Mic

- Page 7 and 8:

P ◀ CONTENTS ▶ History 01 01 Ou

- Page 9 and 10:

P ◀ CONTENTS ▶ The Fundamental

- Page 11 and 12:

P ◀ CONTENTS ▶ OUR MISSION Our

- Page 13 and 14:

P ◀ CONTENTS ▶ ‡ Our ambition

- Page 15 and 16:

P ◀ CONTENTS ▶ Titre Our Group

- Page 17 and 18:

P ◀ CONTENTS ▶ SODEXO HAS THREE

- Page 19 and 20:

P ◀ CONTENTS ▶ OUR AWARDS Sodex

- Page 21 and 22:

P ◀ CONTENTS ▶ 2. EMPLOYEES AND

- Page 23 and 24:

P ◀ CONTENTS ▶ DIVIDENDS PAID O

- Page 25 and 26:

P ◀ CONTENTS ▶ Titre Quality 1

- Page 27 and 28:

P ◀ CONTENTS ▶ Quality of Life

- Page 29 and 30:

P ◀ CONTENTS ▶ diverse data sou

- Page 31 and 32:

P ◀ CONTENTS ▶ commitments unde

- Page 33 and 34:

P ◀ CONTENTS ▶ The high economi

- Page 35 and 36:

P ◀ CONTENTS ▶ Democratic Repub

- Page 37 and 38:

P ◀ CONTENTS ▶ 5.3 Achievements

- Page 39 and 40:

P ◀ CONTENTS ▶ 6.2 Market trend

- Page 41 and 42:

P ◀ CONTENTS ▶ 8. EDUCATION 21.

- Page 43 and 44:

P ◀ CONTENTS ▶ Liceo Franco Arg

- Page 45 and 46:

P ◀ CONTENTS ▶ Quality of Life

- Page 47 and 48:

P ◀ CONTENTS ▶ themselves, enha

- Page 49 and 50:

P ◀ CONTENTS ▶ 4. PUBLIC BENEFI

- Page 51 and 52:

P ◀ CONTENTS ▶ Development of n

- Page 53 and 54:

P ◀ CONTENTS ▶ Economic and Soc

- Page 55 and 56:

P ◀ CONTENTS ▶ On the strength

- Page 57 and 58:

P ◀ CONTENTS ▶ The proportion o

- Page 59 and 60:

P ◀ CONTENTS ▶ Non-site manager

- Page 61 and 62:

P ◀ CONTENTS ▶ 2.2.8 Social and

- Page 63 and 64:

P ◀ CONTENTS ▶ 3. EMPLOYMENT IN

- Page 65 and 66:

P ◀ CONTENTS ▶ The Better Tomor

- Page 67 and 68:

P ◀ CONTENTS ▶ 2. WE DO The Bet

- Page 69 and 70:

P ◀ CONTENTS ▶ 2.2 Supporting L

- Page 71 and 72: P ◀ CONTENTS ▶ chemical sourcin

- Page 73 and 74: P ◀ CONTENTS ▶ EXAMPLES OF A BE

- Page 75 and 76: P ◀ CONTENTS ▶ Titre Consolidat

- Page 77 and 78: P ◀ CONTENTS ▶ 1.2 Operating pr

- Page 79 and 80: P ◀ CONTENTS ▶ 2. FISCAL 2011 F

- Page 81 and 82: P ◀ CONTENTS ▶ 2.2.2 Currency e

- Page 83 and 84: P ◀ CONTENTS ▶ Partnership to b

- Page 85 and 86: P ◀ CONTENTS ▶ 2.2.4 Motivation

- Page 87 and 88: P ◀ CONTENTS ▶ Net cash used in

- Page 89 and 90: P ◀ CONTENTS ▶ In the medium te

- Page 91 and 92: P ◀ CONTENTS ▶ Consolidated inf

- Page 93 and 94: P ◀ CONTENTS ▶ LIABILITIES AND

- Page 95 and 96: P ◀ CONTENTS ▶ Consolidated inf

- Page 97 and 98: P ◀ CONTENTS ▶ Consolidated inf

- Page 99 and 100: P ◀ CONTENTS ▶ Companies in whi

- Page 101 and 102: P ◀ CONTENTS ▶ of the date of a

- Page 103 and 104: P ◀ CONTENTS ▶ ownership by the

- Page 105 and 106: P ◀ CONTENTS ▶ tested for impai

- Page 107 and 108: P ◀ CONTENTS ▶ If benefits unde

- Page 109 and 110: P ◀ CONTENTS ▶ 2.22.3 Income ta

- Page 111 and 112: P ◀ CONTENTS ▶ Fiscal 2010 (in

- Page 113 and 114: P ◀ CONTENTS ▶ 4.2 Finance inco

- Page 115 and 116: P ◀ CONTENTS ▶ 4.5 Property, pl

- Page 117 and 118: P ◀ CONTENTS ▶ (in millions of

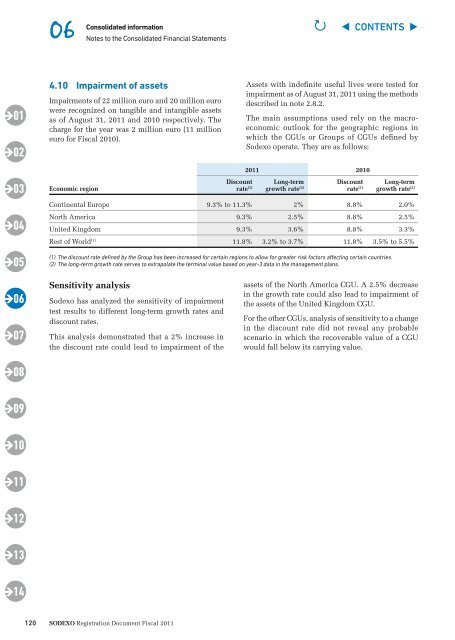

- Page 119 and 120: P ◀ CONTENTS ▶ 4.8 Client inves

- Page 121: P ◀ CONTENTS ▶ The table below

- Page 125 and 126: P ◀ CONTENTS ▶ 4.11.4 details o

- Page 127 and 128: P ◀ CONTENTS ▶ Consolidated inf

- Page 129 and 130: P ◀ CONTENTS ▶ For borrowings o

- Page 131 and 132: P ◀ CONTENTS ▶ 2011. These two

- Page 133 and 134: P ◀ CONTENTS ▶ Currency derivat

- Page 135 and 136: P ◀ CONTENTS ▶ Amounts shown in

- Page 137 and 138: P ◀ CONTENTS ▶ Consolidated inf

- Page 139 and 140: P ◀ CONTENTS ▶ 4.19 Provisions

- Page 141 and 142: P ◀ CONTENTS ▶ 4.21 Deferred ta

- Page 143 and 144: P ◀ CONTENTS ▶ Financial assets

- Page 145 and 146: P ◀ CONTENTS ▶ The expected lif

- Page 147 and 148: P ◀ CONTENTS ▶ Consolidated inf

- Page 149 and 150: P ◀ CONTENTS ▶ 4.26.2 Principal

- Page 151 and 152: P ◀ CONTENTS ▶ 5.1.1 Analysis o

- Page 153 and 154: P ◀ CONTENTS ▶ Counterparty ris

- Page 155 and 156: P ◀ CONTENTS ▶ France Consolida

- Page 157 and 158: P ◀ CONTENTS ▶ Africa Consolida

- Page 159 and 160: P ◀ CONTENTS ▶ europe Consolida

- Page 161 and 162: P ◀ CONTENTS ▶ Asia, Pacific, M

- Page 163 and 164: P ◀ CONTENTS ▶ Consolidated inf

- Page 165 and 166: P ◀ CONTENTS ▶ ‡ Supplemental

- Page 167 and 168: P ◀ CONTENTS ▶ ISo Code Countri

- Page 169 and 170: P ◀ CONTENTS ▶ Growth in the Mo

- Page 171 and 172: P ◀ CONTENTS ▶ At the same time

- Page 173 and 174:

P ◀ CONTENTS ▶ Information Titr

- Page 175 and 176:

P ◀ CONTENTS ▶ 2. BALANCE SHEET

- Page 177 and 178:

P ◀ CONTENTS ▶ 2.1.2 Property,

- Page 179 and 180:

P ◀ CONTENTS ▶ 5. EXCEPTIONAL I

- Page 181 and 182:

P ◀ CONTENTS ▶ Information on t

- Page 183 and 184:

P ◀ CONTENTS ▶ 13.2 Changes in

- Page 185 and 186:

P ◀ CONTENTS ▶ extendable on ap

- Page 187 and 188:

P ◀ CONTENTS ▶ 18. RELATED PART

- Page 189 and 190:

P ◀ CONTENTS ▶ Information on t

- Page 191 and 192:

P ◀ CONTENTS ▶ 26. CONSOLIDATIO

- Page 193 and 194:

P ◀ CONTENTS ▶ (in thousands of

- Page 195 and 196:

P ◀ CONTENTS ▶ III - Specific v

- Page 197 and 198:

P ◀ CONTENTS ▶ Information on t

- Page 199 and 200:

P ◀ CONTENTS ▶ (in euro) employ

- Page 201 and 202:

P ◀ CONTENTS ▶ Titre Legal 1Inf

- Page 203 and 204:

P ◀ CONTENTS ▶ 1.6 Registration

- Page 205 and 206:

P ◀ CONTENTS ▶ Legal Informatio

- Page 207 and 208:

P ◀ CONTENTS ▶ 2.4.2 Share owne

- Page 209 and 210:

P ◀ CONTENTS ▶ 2.5.2 Internatio

- Page 211 and 212:

P ◀ CONTENTS ▶ Shareholders - T

- Page 213 and 214:

P ◀ CONTENTS ▶ 2.3 Publication

- Page 215 and 216:

P ◀ CONTENTS ▶ 8. BENEFITS OF B

- Page 217 and 218:

P ◀ CONTENTS ▶ ADJUSTED SODEXO

- Page 219 and 220:

P ◀ CONTENTS ▶ ‡ Capital 1. S

- Page 221 and 222:

P ◀ CONTENTS ▶ 3. STOCK MARKET

- Page 223 and 224:

P ◀ CONTENTS ▶ Titre Corporate

- Page 225 and 226:

P ◀ CONTENTS ▶ 1.1 Composition

- Page 227 and 228:

P ◀ CONTENTS ▶ • Board Member

- Page 229 and 230:

P ◀ CONTENTS ▶ Other positions

- Page 231 and 232:

P ◀ CONTENTS ▶ Peter Thompson B

- Page 233 and 234:

P ◀ CONTENTS ▶ 2.3 Mission of t

- Page 235 and 236:

P ◀ CONTENTS ▶ The Audit Commit

- Page 237 and 238:

P ◀ CONTENTS ▶ Board has begun

- Page 239 and 240:

P ◀ CONTENTS ▶ 3.2 Group Polici

- Page 241 and 242:

P ◀ CONTENTS ▶ 3.2.5 Informatio

- Page 243 and 244:

P ◀ CONTENTS ▶ Executive Commit

- Page 245 and 246:

P ◀ CONTENTS ▶ 3.8.1 The risk i

- Page 247 and 248:

P ◀ CONTENTS ▶ Corporate Govern

- Page 249 and 250:

P ◀ CONTENTS ▶ Corporate Govern

- Page 251 and 252:

P ◀ CONTENTS ▶ ‡ Compensation

- Page 253 and 254:

P ◀ CONTENTS ▶ SUMMARY OF COMPE

- Page 255 and 256:

P ◀ CONTENTS ▶ 2. COMPENSATION

- Page 257 and 258:

P ◀ CONTENTS ▶ Total compensati

- Page 259 and 260:

P ◀ CONTENTS ▶ expiration date

- Page 261 and 262:

P ◀ CONTENTS ▶ expiration date

- Page 263 and 264:

P ◀ CONTENTS ▶ expiration date

- Page 265 and 266:

P ◀ CONTENTS ▶ exercise price (

- Page 267 and 268:

P ◀ CONTENTS ▶ Name date of Boa

- Page 269 and 270:

P ◀ CONTENTS ▶ ‡ Audit fees (

- Page 271 and 272:

P ◀ CONTENTS ▶ Combined Annual

- Page 273 and 274:

P ◀ CONTENTS ▶ It is therefore

- Page 275 and 276:

P ◀ CONTENTS ▶ trading sessions

- Page 277 and 278:

P ◀ CONTENTS ▶ Combined Annual

- Page 279 and 280:

P ◀ CONTENTS ▶ Combined annual

- Page 281 and 282:

P ◀ CONTENTS ▶ Combined Annual

- Page 283 and 284:

P ◀ CONTENTS ▶ Combined Annual

- Page 285 and 286:

P ◀ CONTENTS ▶ Combined Annual

- Page 287 and 288:

P ◀ CONTENTS ▶ Combined Annual

- Page 289 and 290:

P ◀ CONTENTS ▶ Combined Annual

- Page 291 and 292:

P ◀ CONTENTS ▶ Titre Glossary 1

- Page 293 and 294:

P ◀ CONTENTS ▶ Intensity risk R

- Page 295 and 296:

P ◀ CONTENTS ▶ P ◀ CONTENTS

- Page 297 and 298:

P ◀ CONTENTS ▶ Responsibility f

- Page 299 and 300:

P ◀ CONTENTS ▶ Titre Reconcilia

- Page 301 and 302:

P ◀ CONTENTS ▶ Reconciliation t

- Page 303 and 304:

PEFC/10-31-1190 FCBA/08-00860A Publ