Annual Report 2010 - Ministry of Finance and Planning

Annual Report 2010 - Ministry of Finance and Planning

Annual Report 2010 - Ministry of Finance and Planning

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

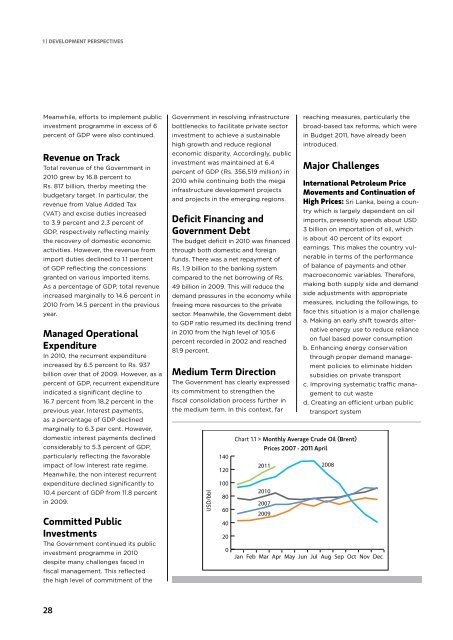

1 | DEVELOPMENT PERSPECTIVESMeanwhile, efforts to implement publicinvestment programme in excess <strong>of</strong> 6percent <strong>of</strong> GDP were also continued.Revenue on TrackTotal revenue <strong>of</strong> the Government in<strong>2010</strong> grew by 16.8 percent toRs. 817 billion, therby meeting thebudgetary target. In particular, therevenue from Value Added Tax(VAT) <strong>and</strong> excise duties increasedto 3.9 percent <strong>and</strong> 2.3 percent <strong>of</strong>GDP, respectively reflecting mainlythe recovery <strong>of</strong> domestic economicactivities. However, the revenue fromimport duties declined to 1.1 percent<strong>of</strong> GDP reflecting the concessionsgranted on various imported items.As a percentage <strong>of</strong> GDP, total revenueincreased marginally to 14.6 percent in<strong>2010</strong> from 14.5 percent in the previousyear.Managed OperationalExpenditureIn <strong>2010</strong>, the recurrent expenditureincreased by 6.5 percent to Rs. 937billion over that <strong>of</strong> 2009. However, as apercent <strong>of</strong> GDP, recurrent expenditureindicated a significant decline to16.7 percent from 18.2 percent in theprevious year. Interest payments,as a percentage <strong>of</strong> GDP declinedmarginally to 6.3 per cent. However,domestic interest payments declinedconsiderably to 5.3 percent <strong>of</strong> GDP,particularly reflecting the favorableimpact <strong>of</strong> low interest rate regime.Meanwhile, the non interest recurrentexpenditure declined significantly to10.4 percent <strong>of</strong> GDP from 11.8 percentin 2009.Committed PublicInvestmentsThe Government continued its publicinvestment programme in <strong>2010</strong>despite many challenges faced infiscal management. This reflectedthe high level <strong>of</strong> commitment <strong>of</strong> theGovernment in resolving infrastructurebottlenecks to facilitate private sectorinvestment to achieve a sustainablehigh growth <strong>and</strong> reduce regionaleconomic disparity. Accordingly, publicinvestment was maintained at 6.4percent <strong>of</strong> GDP (Rs. 356,519 million) in<strong>2010</strong> while continuing both the megainfrastructure development projects<strong>and</strong> projects in the emerging regions.Deficit Financing <strong>and</strong>Government DebtThe budget deficit in <strong>2010</strong> was financedthrough both domestic <strong>and</strong> foreignfunds. There was a net repayment <strong>of</strong>Rs. 1.9 billion to the banking systemcompared to the net borrowing <strong>of</strong> Rs.49 billion in 2009. This will reduce thedem<strong>and</strong> pressures in the economy whilefreeing more resources to the privatesector. Meanwhile, the Government debtto GDP ratio resumed its declining trendin <strong>2010</strong> from the high level <strong>of</strong> 105.6percent recorded in 2002 <strong>and</strong> reached81.9 percent.Medium Term DirectionThe Government has clearly expressedits commitment to strengthen thefiscal consolidation process further inthe medium term. In this context, farUSD/bbl1401<strong>2010</strong>0806040200reaching measures, particularly thebroad-based tax reforms, which werein Budget 2011, have already beenintroduced.Major ChallengesChart 1.1 > Monthly Average Crude Oil (Brent)Prices 2007 - 2011 April2011<strong>2010</strong>20072009International Petroleum PriceMovements <strong>and</strong> Continuation <strong>of</strong>High Prices: Sri Lanka, being a countrywhich is largely dependent on oilimports, presently spends about USD3 billion on importation <strong>of</strong> oil, whichis about 40 percent <strong>of</strong> its exportearnings. This makes the country vulnerablein terms <strong>of</strong> the performance<strong>of</strong> balance <strong>of</strong> payments <strong>and</strong> othermacroeconomic variables. Therefore,making both supply side <strong>and</strong> dem<strong>and</strong>side adjustments with appropriatemeasures, including the followings, t<strong>of</strong>ace this situation is a major challenge.a. Making an early shift towards alternativeenergy use to reduce relianceon fuel based power consumptionb. Enhancing energy conservationthrough proper dem<strong>and</strong> managementpolicies to eliminate hiddensubsidies on private transportc. Improving systematic traffic managementto cut wasted. Creating an efficient urban publictransport system2008Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec28