Html - PUMA CATch up

Html - PUMA CATch up

Html - PUMA CATch up

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

p : 166 | c :8<br />

8. DeFerreD taxes<br />

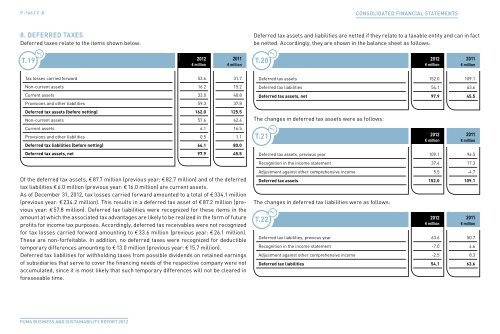

Deferred taxes relate to the items shown below:<br />

t.19 t.1<br />

t.20 t.1<br />

2012 2011<br />

€ million € million<br />

Tax losses carried forward 53.6 31.7<br />

Non-current assets 16.2 15.2<br />

Current assets 33.0 40.8<br />

Provisions and other liabilities 59.3 37.8<br />

Deferred tax assets (before netting) 162.0 125.5<br />

Non-current assets 57.6 62.4<br />

Current assets 6.1 16.5<br />

Provisions and other liabilities 0.5 1.1<br />

Deferred tax liabilities (before netting) 64.1 80.0<br />

Deferred tax assets, net 97.9 45.5<br />

Of the deferred tax assets, € 87.7 million (previous year: € 82.7 million) and of the deferred<br />

tax liabilities € 6.0 million (previous year: € 16.0 million) are current assets.<br />

As of December 31, 2012, tax losses carried forward amounted to a total of € 334.1 million<br />

(previous year: € 234.2 million). This results in a deferred tax asset of € 87.2 million (previous<br />

year: € 57.8 million). Deferred tax liabilities were recognized for these items in the<br />

amount at which the associated tax advantages are likely to be realized in the form of future<br />

profits for income tax purposes. Accordingly, deferred tax receivables were not recognized<br />

for tax losses carried forward amounting to € 33.6 million (previous year: € 26.1 million).<br />

These are non-forfeitable. In addition, no deferred taxes were recognized for deductible<br />

temporary differences amounting to € 13.0 million (previous year: € 15.7 million).<br />

Deferred tax liabilities for withholding taxes from possible dividends on retained earnings<br />

of subsidiaries that serve to cover the financing needs of the respective company were not<br />

accumulated, since it is most likely that such temporary differences will not be cleared in<br />

foreseeable time.<br />

<strong>PUMA</strong> BUsiness And sUstAinABility RePoRt 2012<br />

Deferred tax assets and liabilities are netted if they relate to a taxable entity and can in fact<br />

be netted. Accordingly, they are shown in the balance sheet as follows:<br />

2012 2011<br />

€ million € million<br />

Deferred tax assets 152.0 109.1<br />

Deferred tax liabilities 54.1 63.6<br />

Deferred tax assets, net 97.9 45.5<br />

The changes in deferred tax assets were as follows:<br />

t.21 t.1<br />

2012 2011<br />

€ million € million<br />

Deferred tax assets, previous year 109.1 96.5<br />

Recognition in the income statement 37.4 17.3<br />

Adjustment against other comprehensive income 5.5 -4.7<br />

Deferred tax assets 152.0 109.1<br />

The changes in deferred tax liabilities were as follows:<br />

t.22<br />

t.1<br />

CONsOlidated FiNaNCial statemeNts<br />

2012 2011<br />

€ million € million<br />

Deferred tax liabilities, previous year 63.6 50.7<br />

Recognition in the income statement -7.0 4.6<br />

Adjustment against other comprehensive income -2.5 8.3<br />

Deferred tax liabilities 54.1 63.6