- Page 2 and 3:

Business and sustainaBility RepoRt

- Page 4 and 5:

Content 5 PUMA.Creative 77 Creative

- Page 6 and 7:

“ OUR MISSION IS TO BECOME the mo

- Page 8 and 9:

p : 7 | C : 1 To our ShareholderS f

- Page 10 and 11:

p : 9 | C : 1 To our ShareholderS T

- Page 12 and 13:

PUMAVision “ ThE pROpER USE of sc

- Page 14 and 15:

p : 13 | C : 2 TM PUMAvision Fair H

- Page 16 and 17:

p : 15 | C : 2 PUMAVision STakEhOld

- Page 18 and 19:

p : 17 | C : 2 PUMAVision AwARDS AN

- Page 20 and 21:

p : 19 | C : 2 PUMAVision PUMA’s

- Page 22 and 23:

p : 21 | C : 2 f.5 t.1 > POTENTiAL

- Page 24 and 25:

p : 23 | C : 2 PUMAVision RETAiL TR

- Page 26 and 27:

p : 25 | C : 2 PUMAVision ORgANiZAT

- Page 28 and 29:

p : 27 | C : 2 PUMAVision CHARiTY C

- Page 30 and 31:

p : 29 | C : 2 PUMAVision SUSTAiNAB

- Page 32 and 33:

p : 31 | C : 2 PUMAVision TOTAL wOR

- Page 34 and 35:

p : 33 | C : 2 TURNOvER PUMAVision

- Page 36 and 37:

“ The world as we have creaTed iT

- Page 38 and 39:

p : 37 | c : 3 PUMA.SAfe puma.safe

- Page 40 and 41:

p : 39 | c : 3 PUMA.SAfe The puma p

- Page 42 and 43:

p : 41 | c : 3 PUMA.SAfe more susTa

- Page 44 and 45:

p : 43 | c : 3 PUMA.SAfe Prof. Dr.

- Page 46 and 47:

p : 45 | c : 3 PUMA.SAfe puma ends

- Page 48 and 49:

p : 47 | c : 3 PUMA.SAfe T.19 t.1 2

- Page 50 and 51:

p : 49 | c : 3 PUMA.SAfe t.20 T.22

- Page 52 and 53:

p : 51 | c : 3 PUMA.SAfe that decre

- Page 54 and 55:

p : 53 | c : 3 PUMA.SAfe tion durin

- Page 56 and 57:

p : 55 | c : 3 PUMA.SAfe chemicals

- Page 58 and 59:

p : 57 | c : 3 PUMA.SAfe and sustai

- Page 60 and 61:

p : 59 | c : 3 PUMA.SAfe PUMA audit

- Page 62 and 63:

p : 61 | c : 3 PUMA.SAfe Another ke

- Page 64 and 65:

p : 63 | c : 3 PUMA.SAfe facTory au

- Page 66 and 67:

p : 65 | c : 3 PUMA.SAfe For the fi

- Page 68 and 69:

p : 67 | c : 3 PUMA.SAfe T.25 t.1 2

- Page 70 and 71:

p : 69 | c : 3 PUMA.SAfe f.16 t.1 f

- Page 72 and 73:

“ Be the change that you wish to

- Page 74 and 75:

p : 73 | c : 4 PUMA BUsiness And sU

- Page 76 and 77:

p : 75 | c : 4 puma.peace PUMA.PeAc

- Page 78 and 79:

puma.creative Creative Art Network

- Page 80 and 81:

p : 79 | c : 5 PUMA BUsiness And sU

- Page 82 and 83:

p : 81 | c : 5 the oasis Pietra Bre

- Page 84 and 85:

p : 83 | c : 5 A large range of int

- Page 86 and 87:

P : 85 | C : 5 PUMAviSion PUMA BUSi

- Page 88 and 89:

“ At PUMA, we Are driven to look

- Page 90 and 91:

P : 89 | c : 6 brAnd StrAtegy FOLLO

- Page 92 and 93:

P : 91 | c : 6 PUMA BUsiness And sU

- Page 94 and 95:

P : 93 | c : 6 rUnning Exceptional

- Page 96 and 97:

P : 95 | c : 6 MotorSPort 1. puma u

- Page 98 and 99:

P : 97 | c : 6 PUMA BUsiness And sU

- Page 100 and 101:

P : 99 | c : 6 Spreading the puma v

- Page 102 and 103:

P : 101 | c : 6 FitneSS Join in the

- Page 104 and 105:

P : 103 | c : 6 LiFeStyLe 1. Spread

- Page 106 and 107:

Financial Year 2012 ManageMent Repo

- Page 108 and 109:

p : 107 | c : 2 overview 2012 2012

- Page 110 and 111:

p : 109 | c : 2 general economic co

- Page 112 and 113:

p : 111 | c : 2 These measures will

- Page 114 and 115:

p : 113 | c : 2 € million 3,500 3

- Page 116 and 117:

p : 115 | c : 2 F.7 t.1 € million

- Page 118 and 119:

p : 117 | c : 2 € million 1,600 1

- Page 120 and 121:

P : 119 | C : 2 Earnings bEforE tax

- Page 122 and 123:

p : 121 | c : 2 F.14 t.1 € millio

- Page 124 and 125:

p : 123 | c : 2 pUMa BUsiness and s

- Page 126 and 127:

p : 125 | c : 2 F.17 t.1 gross cash

- Page 128 and 129:

p : 127 | c : 2 t.4 t.1 pUMa BUsine

- Page 130 and 131:

p : 129 | c : 2 We are well positio

- Page 132 and 133:

P : 131 | C : 2 emPloyees number of

- Page 134 and 135:

p : 133 | c : 2 managing directors

- Page 136 and 137:

p : 135 | c : 2 risk and opportunit

- Page 138 and 139:

p : 137 | c : 2 ensure that PUMA pr

- Page 140 and 141:

p : 139 | c : 2 main Features oF th

- Page 142 and 143:

p : 141 | c : 2 pUMa BUsiness and s

- Page 144 and 145:

p : 143 | c : 2 Effective implement

- Page 146 and 147:

p : 145 | c : 2 fied applicants. If

- Page 148 and 149:

31 December 2012 Consolidated Finan

- Page 150 and 151:

p : 149 | c :8 t.1 assets consolIDa

- Page 152 and 153:

p : 151 | c :8 t.3 t.1 After tax Ta

- Page 154 and 155:

p : 153 | c :8 t.5 t.1 Subscribed R

- Page 156 and 157:

p : 155 | c :8 notes to the consolI

- Page 158 and 159:

p : 157 | c :8 The surplus of the a

- Page 160 and 161:

p : 159 | c :8 60. Brandon Services

- Page 162 and 163:

p : 161 | c :8 cash flow from that

- Page 164 and 165:

p : 163 | c :8 proDuct Development

- Page 166 and 167:

p : 165 | c :8 The age structure of

- Page 168 and 169:

p : 167 | c :8 9. propertY, plant a

- Page 170 and 171: p : 169 | c :8 12. other non-curren

- Page 172 and 173: p : 171 | c :8 The table below show

- Page 174 and 175: p : 173 | c :8 Net income by measur

- Page 176 and 177: p : 175 | c :8 Actuarial gains and

- Page 178 and 179: p : 177 | c :8 capItal reserve The

- Page 180 and 181: p : 179 | c :8 Changes in the “SO

- Page 182 and 183: p : 181 | c :8 Income from associat

- Page 184 and 185: p : 183 | c :8 Investments and depr

- Page 186 and 187: p : 185 | c :8 Total expenses resul

- Page 188 and 189: p : 187 | c :8 The following overvi

- Page 190: p : 189 | c :8 statutorY auDItor’

- Page 193 and 194: p : 192 | c : 9 managIng DIrectors

- Page 195 and 196: p : 194 | c : 9 CFAO S.A., Sèvres/

- Page 197 and 198: p : 196 | c : 9 report bY the aDmIn

- Page 199 and 200: p : 198 | c : 9 4/24/2012), Jean-Fr

- Page 202 and 203: grI InDex Global Reporting Initiati

- Page 204 and 205: p : 203 | c : 10 Indicator (Core/Ad

- Page 206 and 207: p : 205 | c : 10 Indicator (Core/Ad

- Page 208 and 209: p : 207 | c : 10 Indicator (Core/Ad

- Page 210 and 211: p : 209 | c : 10 Indicator (Core/Ad

- Page 212 and 213: p : 211 | c : 10 Indicator (Core/Ad

- Page 214 and 215: p : 213 | c : 10 Indicator (Core/Ad

- Page 216: p : 215 | c : 10 Indicator (Core/Ad

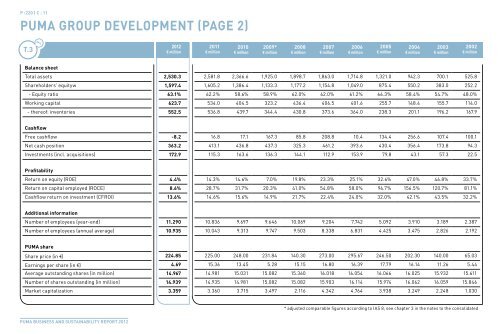

- Page 219: p : 218 | c : 11 puma Year-on-Year