Html - PUMA CATch up

Html - PUMA CATch up

Html - PUMA CATch up

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

p : 172 | c :8<br />

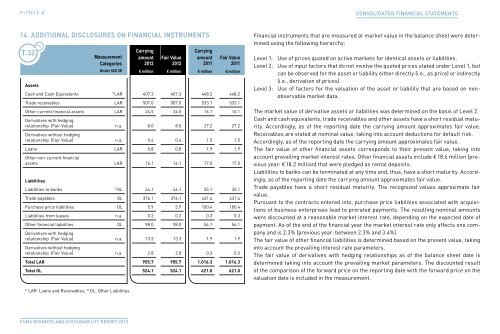

14. aDDItIonal DIsclosures on FInancIal Instruments Financial instruments that are measured at market value in the balance sheet were determined<br />

using the following hierarchy:<br />

t.32<br />

t.1<br />

Measurement<br />

Categories<br />

Under IAS 39<br />

Carrying<br />

Carrying<br />

amount Fair Value amount Fair Value<br />

2012 2012 2011 2011<br />

€ million € million € million € million<br />

assets<br />

Cash and Cash Equivalents 1) LAR 407.3 407.3 448.2 448.2<br />

Trade receivables LAR 507.0 507.0 533.1 533.1<br />

Other current financial assets LAR 24.5 24.5 16.1 16.1<br />

Derivatives with hedging<br />

relationship (Fair Value)<br />

Derivatives without hedging<br />

relationship (Fair Value)<br />

n.a.<br />

n.a.<br />

Loans LAR 0.8 0.8 1.9 1.9<br />

Other non-current financial<br />

assets LAR 16.1 16.1 17.0 17.0<br />

liabilities<br />

Liabilities to banks 2) OL 44.1 44.1 35.1 35.1<br />

Trade payables OL 376.1 376.1 431.4 431.4<br />

Purchase price liabilities OL 5.9 5.9 100.4 100.4<br />

Liabilities from leases n.a. 0.2 0.2 0.3 0.3<br />

Other financial liabilities. OL 98.0 98.0 54.1 54.1<br />

Derivatives with hedging<br />

relationship (Fair Value)<br />

Derivatives without hedging<br />

relationship (Fair Value)<br />

n.a.<br />

n.a.<br />

total lar 955.7 955.7 1.016.3 1.016.3<br />

total ol 524.1 524.1 621.0 621.0<br />

1) LAR: Loans and Receivables; 2) OL: Other Liabilities<br />

<strong>PUMA</strong> BUsiness And sUstAinABility RePoRt 2012<br />

8.0<br />

0.4<br />

13.3<br />

2.8<br />

8.0<br />

0.4<br />

13.3<br />

2.8<br />

27.2<br />

1.5<br />

1.9<br />

0.3<br />

27.2<br />

1.5<br />

1.9<br />

0.3<br />

CONsOlidated FiNaNCial statemeNts<br />

Level 1: Use of prices quoted on active markets for identical assets or liabilities.<br />

Level 2: Use of input factors that do not involve the quoted prices stated under Level 1, but<br />

can be observed for the asset or liability either directly (i.e., as price) or indirectly<br />

(i.e., derivation of prices).<br />

Level 3: Use of factors for the valuation of the asset or liability that are based on nonobservable<br />

market data.<br />

The market value of derivative assets or liabilities was determined on the basis of Level 2.<br />

Cash and cash equivalents, trade receivables and other assets have a short residual maturity.<br />

Accordingly, as of the reporting date the carrying amount approximates fair value.<br />

Receivables are stated at nominal value, taking into account deductions for default risk.<br />

Accordingly, as of the reporting date the carrying amount approximates fair value.<br />

The fair value of other financial assets corresponds to their present value, taking into<br />

account prevailing market interest rates. Other financial assets include € 18.6 million (previous<br />

year: € 18.2 million) that were pledged as rental deposits.<br />

Liabilities to banks can be terminated at any time and, thus, have a short maturity. Accordingly,<br />

as of the reporting date the carrying amount approximates fair value.<br />

Trade payables have a short residual maturity. The recognized values approximate fair<br />

value.<br />

Pursuant to the contracts entered into, purchase price liabilities associated with acquisitions<br />

of business enterprises lead to prorated payments. The resulting nominal amounts<br />

were discounted at a reasonable market interest rate, depending on the expected date of<br />

payment. As of the end of the financial year the market interest rate only affects one company<br />

and is 2.3% (previous year: between 2.3% and 3.4%).<br />

The fair value of other financial liabilities is determined based on the present value, taking<br />

into account the prevailing interest rate parameters.<br />

The fair value of derivatives with hedging relationships as of the balance sheet date is<br />

determined taking into account the prevailing market parameters. The discounted result<br />

of the comparison of the forward price on the reporting date with the forward price on the<br />

valuation date is included in the measurement.