Html - PUMA CATch up

Html - PUMA CATch up

Html - PUMA CATch up

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

p : 184 | c :8<br />

t.60 t.1<br />

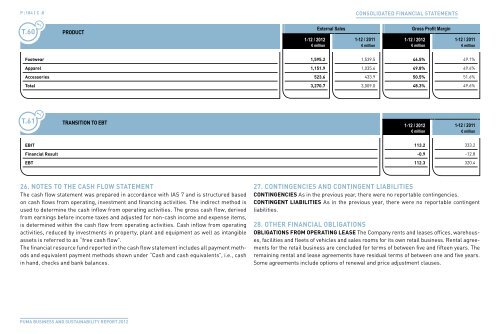

proDuct<br />

External Sales Gross Profit Margin<br />

1-12 / 2012 1-12 / 2011 1-12 / 2012 1-12 / 2011<br />

€ million € million € million € million<br />

Footwear 1,595.2 1,539.5 46.5% 49.1%<br />

apparel 1,151.9 1,035.6 49.8% 49.6%<br />

accessories 523.6 433.9 50.5% 51.6%<br />

total 3,270.7 3,009.0 48.3% 49.6%<br />

t.61<br />

t.1<br />

transItIon to ebt<br />

1-12 / 2012 1-12 / 2011<br />

€ million € million<br />

ebIt 113.2 333.2<br />

Financial result -0.9 -12.8<br />

ebt 112.3 320.4<br />

26. notes to the cash Flow statement<br />

The cash flow statement was prepared in accordance with IAS 7 and is structured based<br />

on cash flows from operating, investment and financing activities. The indirect method is<br />

used to determine the cash inflow from operating activities. The gross cash flow, derived<br />

from earnings before income taxes and adjusted for non-cash income and expense items,<br />

is determined within the cash flow from operating activities. Cash inflow from operating<br />

activities, reduced by investments in property, plant and equipment as well as intangible<br />

assets is referred to as “free cash flow”.<br />

The financial resource fund reported in the cash flow statement includes all payment methods<br />

and equivalent payment methods shown under “Cash and cash equivalents”, i.e., cash<br />

in hand, checks and bank balances.<br />

<strong>PUMA</strong> BUsiness And sUstAinABility RePoRt 2012<br />

CONsOlidated FiNaNCial statemeNts<br />

27. contIngencIes anD contIngent lIabIlItIes<br />

contIngencIes As in the previous year, there were no reportable contingencies.<br />

contIngent lIabIlItIes As in the previous year, there were no reportable contingent<br />

liabilities.<br />

28. other FInancIal oblIgatIons<br />

oblIgatIons From operatIng lease The Company rents and leases offices, warehouses,<br />

facilities and fleets of vehicles and sales rooms for its own retail business. Rental agreements<br />

for the retail business are concluded for terms of between five and fifteen years. The<br />

remaining rental and lease agreements have residual terms of between one and five years.<br />

Some agreements include options of renewal and price adjustment clauses.