Html - PUMA CATch up

Html - PUMA CATch up

Html - PUMA CATch up

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

p : 176 | c :8<br />

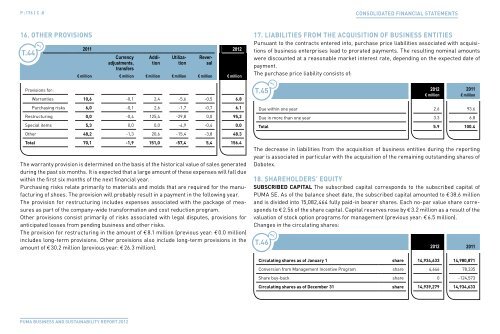

16. other provIsIons<br />

t.44 t.1<br />

Provisions for:<br />

2011 2012<br />

Currency<br />

adjustments,<br />

transfers<br />

Addition<br />

Utilization<br />

Reversal<br />

€ million € million € million € million € million € million<br />

Warranties 10,6 -0,1 2,4 -5,6 -0,5 6.8<br />

Purchasing risks 6,0 -0,1 2,6 -1,7 -0,7 6.1<br />

Restructuring 0,0 -0,4 125,4 -29,8 0,0 95,2<br />

Special items 5,3 0,0 0,0 -4,9 -0,4 0.0<br />

Other 48,2 -1,3 20,6 -15,4 -3,8 48.3<br />

total 70,1 -1,9 151,0 -57,4 5,4 156.4<br />

The warranty provision is determined on the basis of the historical value of sales generated<br />

during the past six months. It is expected that a large amount of these expenses will fall due<br />

within the first six months of the next financial year.<br />

Purchasing risks relate primarily to materials and molds that are required for the manufacturing<br />

of shoes. The provision will probably result in a payment in the following year.<br />

The provision for restructuring includes expenses associated with the package of measures<br />

as part of the company-wide transformation and cost reduction program.<br />

Other provisions consist primarily of risks associated with legal disputes, provisions for<br />

anticipated losses from pending business and other risks.<br />

The provision for restructuring in the amount of € 8.1 million (previous year: € 0.0 million)<br />

includes long-term provisions. Other provisions also include long-term provisions in the<br />

amount of € 30.2 million (previous year: € 26.3 million).<br />

<strong>PUMA</strong> BUsiness And sUstAinABility RePoRt 2012<br />

17. lIabIlItIes From the acQuIsItIon oF busIness entItIes<br />

Pursuant to the contracts entered into, purchase price liabilities associated with acquisitions<br />

of business enterprises lead to prorated payments. The resulting nominal amounts<br />

were discounted at a reasonable market interest rate, depending on the expected date of<br />

payment.<br />

The purchase price liability consists of:<br />

t.45 t.1<br />

CONsOlidated FiNaNCial statemeNts<br />

2012 2011<br />

€ million € million<br />

Due within one year 2.6 93.6<br />

Due in more than one year 3.3 6.8<br />

total 5.9 100.4<br />

The decrease in liabilities from the acquisition of business entities during the reporting<br />

year is associated in particular with the acquisition of the remaining outstanding shares of<br />

Dobotex.<br />

18. shareholDers’ eQuItY<br />

subscrIbeD capItal The subscribed capital corresponds to the subscribed capital of<br />

<strong>PUMA</strong> SE. As of the balance sheet date, the subscribed capital amounted to € 38.6 million<br />

and is divided into 15,082,464 fully paid-in bearer shares. Each no-par value share corresponds<br />

to € 2.56 of the share capital. Capital reserves rose by € 3.2 million as a result of the<br />

valuation of stock option programs for management (previous year: € 6.5 million).<br />

Changes in the circulating shares:<br />

t.46<br />

t.1<br />

2012 2011<br />

circulating shares as of January 1 share 14,934,633 14,980,871<br />

Conversion from Management Incentive Program share 4,646 78,335<br />

Share buy-back share 0 -124,573<br />

circulating shares as of December 31 share 14,939,279 14,934,633