Html - PUMA CATch up

Html - PUMA CATch up

Html - PUMA CATch up

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

p : 175 | c :8<br />

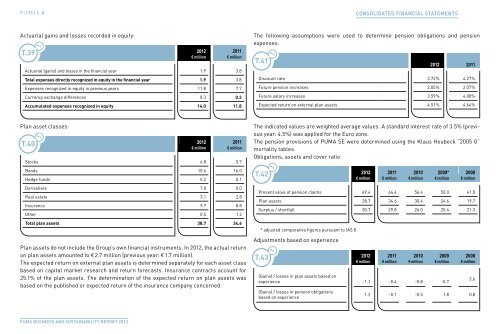

Actuarial gains and losses recorded in equity:<br />

t.39 t.1<br />

Plan asset classes:<br />

2012 2011<br />

€ million € million<br />

Actuarial (gains) and losses in the financial year 1.9 3.8<br />

total expenses directly recognized in equity in the financial year 1.9 3.8<br />

Expenses recognized in equity in previous years 11.8 7.7<br />

Currency exchange differences 0.3 0.3<br />

accumulated expenses recognized in equity 14.0 11.8<br />

t.40 t.1<br />

2012 2011<br />

€ million € million<br />

Stocks 6.8 5.7<br />

Bonds 10.6 16.0<br />

Hedge funds 0.2 0.1<br />

Derivatives 7.8 0.0<br />

Real estate 3.1 2.8<br />

Insurance 9.7 8.8<br />

Other 0.5 1.2<br />

total plan assets 38.7 34.6<br />

Plan assets do not include the Gro<strong>up</strong>’s own financial instruments. In 2012, the actual return<br />

on plan assets amounted to € 2.7 million (previous year: € 1.7 million).<br />

The expected return on external plan assets is determined separately for each asset class<br />

based on capital market research and return forecasts. Insurance contracts account for<br />

25.1% of the plan assets. The determination of the expected return on plan assets was<br />

based on the published or expected return of the insurance company concerned.<br />

<strong>PUMA</strong> BUsiness And sUstAinABility RePoRt 2012<br />

The following assumptions were used to determine pension obligations and pension<br />

expenses:<br />

t.41 t.1<br />

2012 2011<br />

Discount rate 3.72 % 4.27 %<br />

Future pension increases 2.05 % 2.07 %<br />

Future salary increases 3.59 % 4.08 %<br />

Expected return on external plan assets 4.51 % 4.64 %<br />

The indicated values are weighted average values. A standard interest rate of 3.5% (previous<br />

year: 4.5%) was applied for the Euro zone.<br />

The pension provisions of <strong>PUMA</strong> SE were determined using the Klaus Heubeck “2005 G”<br />

mortality tables.<br />

Obligations, assets and cover ratio<br />

t.42 t.1<br />

2012 2011 2010 2009* 2008<br />

€ million € million € million € million € million<br />

Present value of pension claims 69.4 64.4 56.4 50.0 41.0<br />

Plan assets 38.7 34.6 30.4 24.6 19.7<br />

Surplus / shortfall 30.7 29.8 26.0 25.4 21.3<br />

* adjusted comparative figures pursuant to IAS 8<br />

Adjustments based on experience<br />

t.43<br />

t.1<br />

2012 2011 2010 2009 2008<br />

€ million € million € million € million € million<br />

(Gains) / losses in plan assets based on<br />

experience -1.1 -0.4 -0.8 -0.7<br />

(Gains) / losses in pension obligations<br />

based on experience<br />

CONsOlidated FiNaNCial statemeNts<br />

2.6<br />

1.2 -0.1 -0.5 1.8 0.8