Risk Management and Value Creation in ... - Arabictrader.com

Risk Management and Value Creation in ... - Arabictrader.com

Risk Management and Value Creation in ... - Arabictrader.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Capital Structure <strong>in</strong> Banks 213<br />

lated, is all of the economic capital allocated by that approach. 373 “Gross<strong>in</strong>g<br />

up” 374 the s<strong>in</strong>gle allocated amounts by the percentage of unallocated economic<br />

capital also does not really address the problem, because it provides<br />

the wrong <strong>in</strong>centives. For <strong>in</strong>stance, it would <strong>in</strong>dicate higher benefits from<br />

reduc<strong>in</strong>g economic capital by shedd<strong>in</strong>g bus<strong>in</strong>ess units or transactions than<br />

would actually appear to be the case.<br />

The suggested approach for the three types of risk <strong>and</strong> the consideration<br />

of correlations between these types of risk calculates the marg<strong>in</strong>al economic<br />

capital, which is sensible for determ<strong>in</strong><strong>in</strong>g whether a transaction creates value<br />

or not. However, because we basically use proxies for the “with or without”<br />

approach to do so, the aggregation <strong>and</strong> allocation problem, as <strong>in</strong>dicated, is<br />

unresolved.<br />

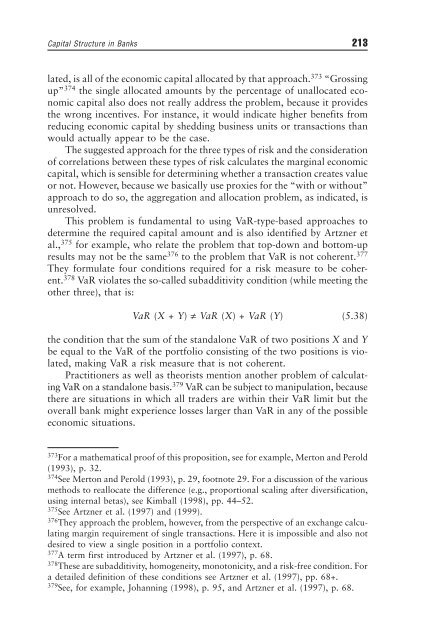

This problem is fundamental to us<strong>in</strong>g VaR-type-based approaches to<br />

determ<strong>in</strong>e the required capital amount <strong>and</strong> is also identified by Artzner et<br />

al., 375 for example, who relate the problem that top-down <strong>and</strong> bottom-up<br />

results may not be the same 376 to the problem that VaR is not coherent. 377<br />

They formulate four conditions required for a risk measure to be coherent.<br />

378 VaR violates the so-called subadditivity condition (while meet<strong>in</strong>g the<br />

other three), that is:<br />

VaR (X + Y) ≠ VaR (X) + VaR (Y) (5.38)<br />

the condition that the sum of the st<strong>and</strong>alone VaR of two positions X <strong>and</strong> Y<br />

be equal to the VaR of the portfolio consist<strong>in</strong>g of the two positions is violated,<br />

mak<strong>in</strong>g VaR a risk measure that is not coherent.<br />

Practitioners as well as theorists mention another problem of calculat<strong>in</strong>g<br />

VaR on a st<strong>and</strong>alone basis. 379 VaR can be subject to manipulation, because<br />

there are situations <strong>in</strong> which all traders are with<strong>in</strong> their VaR limit but the<br />

overall bank might experience losses larger than VaR <strong>in</strong> any of the possible<br />

economic situations.<br />

373 For a mathematical proof of this proposition, see for example, Merton <strong>and</strong> Perold<br />

(1993), p. 32.<br />

374 See Merton <strong>and</strong> Perold (1993), p. 29, footnote 29. For a discussion of the various<br />

methods to reallocate the difference (e.g., proportional scal<strong>in</strong>g after diversification,<br />

us<strong>in</strong>g <strong>in</strong>ternal betas), see Kimball (1998), pp. 44–52.<br />

375 See Artzner et al. (1997) <strong>and</strong> (1999).<br />

376 They approach the problem, however, from the perspective of an exchange calculat<strong>in</strong>g<br />

marg<strong>in</strong> requirement of s<strong>in</strong>gle transactions. Here it is impossible <strong>and</strong> also not<br />

desired to view a s<strong>in</strong>gle position <strong>in</strong> a portfolio context.<br />

377 A term first <strong>in</strong>troduced by Artzner et al. (1997), p. 68.<br />

378 These are subadditivity, homogeneity, monotonicity, <strong>and</strong> a risk-free condition. For<br />

a detailed def<strong>in</strong>ition of these conditions see Artzner et al. (1997), pp. 68+.<br />

379 See, for example, Johann<strong>in</strong>g (1998), p. 95, <strong>and</strong> Artzner et al. (1997), p. 68.