Entire Document - Chris Hani District Municipality

Entire Document - Chris Hani District Municipality

Entire Document - Chris Hani District Municipality

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Compensation from third parties for items of property, plant and equipment that were impaired, lost or given up is<br />

included in surplus or deficit when the compensation becomes receivable.<br />

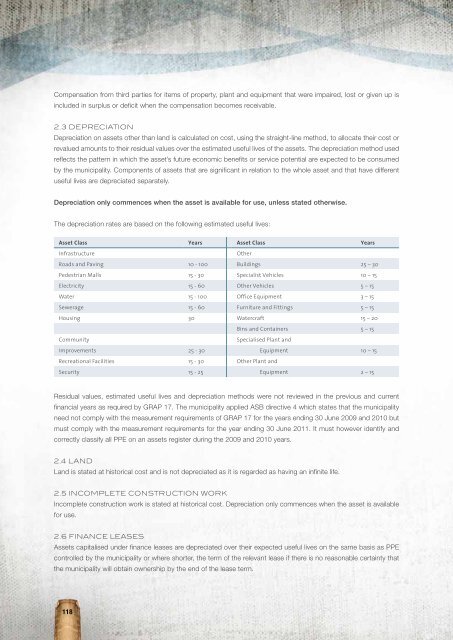

2.3 Depreciation<br />

Depreciation on assets other than land is calculated on cost, using the straight-line method, to allocate their cost or<br />

revalued amounts to their residual values over the estimated useful lives of the assets. The depreciation method used<br />

reflects the pattern in which the asset’s future economic benefits or service potential are expected to be consumed<br />

by the municipality. Components of assets that are significant in relation to the whole asset and that have different<br />

useful lives are depreciated separately.<br />

Depreciation only commences when the asset is available for use, unless stated otherwise.<br />

The depreciation rates are based on the following estimated useful lives:<br />

Asset Class Years Asset Class Years<br />

Infrastructure<br />

Other<br />

Roads and Paving 10 - 100 Buildings 25 – 30<br />

Pedestrian Malls 15 - 30 Specialist Vehicles 10 – 15<br />

Electricity 15 - 60 Other Vehicles 5 – 15<br />

Water 15 - 100 Office Equipment 3 – 15<br />

Sewerage 15 - 60 Furniture and Fittings 5 – 15<br />

Housing 30 Watercraft 15 – 20<br />

Bins and Containers 5 – 15<br />

Community<br />

Specialised Plant and<br />

Improvements 25 - 30 Equipment 10 – 15<br />

Recreational Facilities 15 - 30 Other Plant and<br />

Security 15 - 25 Equipment 2 – 15<br />

Residual values, estimated useful lives and depreciation methods were not reviewed in the previous and current<br />

financial years as required by GRAP 17. The municipality applied ASB directive 4 which states that the municipality<br />

need not comply with the measurement requirements of GRAP 17 for the years ending 30 June 2009 and 2010 but<br />

must comply with the measurement requirements for the year ending 30 June 2011. It must however identify and<br />

correctly classify all PPE on an assets register during the 2009 and 2010 years.<br />

2.4 Land<br />

Land is stated at historical cost and is not depreciated as it is regarded as having an infinite life.<br />

2.5 Incomplete Construction Work<br />

Incomplete construction work is stated at historical cost. Depreciation only commences when the asset is available<br />

for use.<br />

2.6 Finance Leases<br />

Assets capitalised under finance leases are depreciated over their expected useful lives on the same basis as PPE<br />

controlled by the municipality or where shorter, the term of the relevant lease if there is no reasonable certainty that<br />

the municipality will obtain ownership by the end of the lease term.<br />

118