Entire Document - Chris Hani District Municipality

Entire Document - Chris Hani District Municipality

Entire Document - Chris Hani District Municipality

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

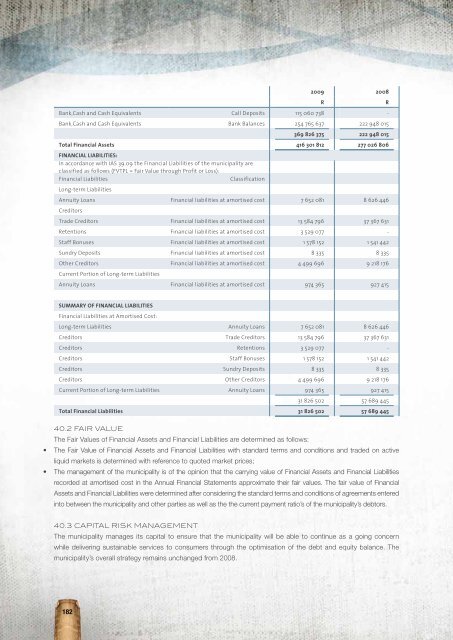

2009 2008<br />

Bank,Cash and Cash Equivalents Call Deposits 115 060 738 -<br />

Bank,Cash and Cash Equivalents Bank Balances 254 765 637 222 948 015<br />

R<br />

369 826 375 222 948 015<br />

Total Financial Assets 416 301 812 277 026 806<br />

FINANCIAL LIABILITIES:<br />

In accordance with IAS 39.09 the Financial Liabilities of the municipality are<br />

classified as follows (FVTPL = Fair Value through Profit or Loss):<br />

Financial Liabilities<br />

Classification<br />

Long-term Liabilities<br />

Annuity Loans Financial liabilities at amortised cost 7 652 081 8 626 446<br />

Creditors<br />

Trade Creditors Financial liabilities at amortised cost 13 584 796 37 367 631<br />

Retentions Financial liabilities at amortised cost 3 529 077 -<br />

Staff Bonuses Financial liabilities at amortised cost 1 578 152 1 541 442<br />

Sundry Deposits Financial liabilities at amortised cost 8 335 8 335<br />

Other Creditors Financial liabilities at amortised cost 4 499 696 9 218 176<br />

Current Portion of Long-term Liabilities<br />

Annuity Loans Financial liabilities at amortised cost 974 365 927 415<br />

R<br />

SUMMARY OF FINANCIAL LIABILITIES<br />

Financial Liabilities at Amortised Cost:<br />

Long-term Liabilities Annuity Loans 7 652 081 8 626 446<br />

Creditors Trade Creditors 13 584 796 37 367 631<br />

Creditors Retentions 3 529 077 -<br />

Creditors Staff Bonuses 1 578 152 1 541 442<br />

Creditors Sundry Deposits 8 335 8 335<br />

Creditors Other Creditors 4 499 696 9 218 176<br />

Current Portion of Long-term Liabilities Annuity Loans 974 365 927 415<br />

31 826 502 57 689 445<br />

Total Financial Liabilities 31 826 502 57 689 445<br />

40.2 Fair Value<br />

The Fair Values of Financial Assets and Financial Liabilities are determined as follows:<br />

• The Fair Value of Financial Assets and Financial Liabilities with standard terms and conditions and traded on active<br />

liquid markets is determined with reference to quoted market prices;<br />

• The management of the municipality is of the opinion that the carrying value of Financial Assets and Financial Liabilities<br />

recorded at amortised cost in the Annual Financial Statements approximate their fair values. The fair value of Financial<br />

Assets and Financial Liabilities were determined after considering the standard terms and conditions of agreements entered<br />

into between the municipality and other parties as well as the the current payment ratio’s of the municipality’s debtors.<br />

40.3 Capital Risk Management<br />

The municipality manages its capital to ensure that the municipality will be able to continue as a going concern<br />

while delivering sustainable services to consumers through the optimisation of the debt and equity balance. The<br />

municipality’s overall strategy remains unchanged from 2008.<br />

182