Entire Document - Chris Hani District Municipality

Entire Document - Chris Hani District Municipality

Entire Document - Chris Hani District Municipality

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

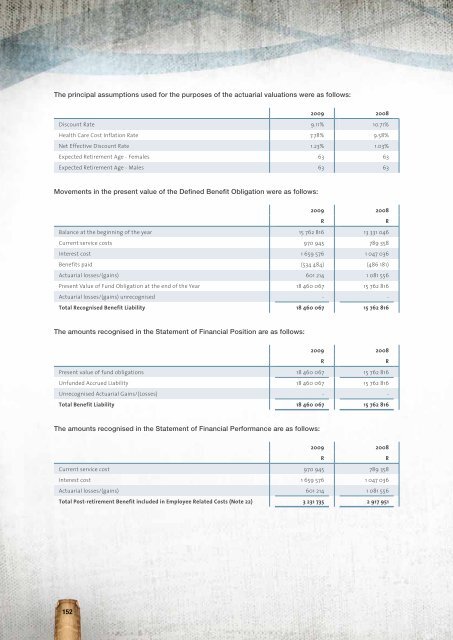

The principal assumptions used for the purposes of the actuarial valuations were as follows:<br />

2009 2008<br />

Discount Rate 9.11% 10.71%<br />

Health Care Cost Inflation Rate 7.78% 9.58%<br />

Net Effective Discount Rate 1.23% 1.03%<br />

Expected Retirement Age - Females 63 63<br />

Expected Retirement Age - Males 63 63<br />

Movements in the present value of the Defined Benefit Obligation were as follows:<br />

2009 2008<br />

R<br />

R<br />

Balance at the beginning of the year 15 762 816 13 331 046<br />

Current service costs 970 945 789 358<br />

Interest cost 1 659 576 1 047 036<br />

Benefits paid (534 484) (486 181)<br />

Actuarial losses/(gains) 601 214 1 081 556<br />

Present Value of Fund Obligation at the end of the Year 18 460 067 15 762 816<br />

Actuarial losses/(gains) unrecognised - -<br />

Total Recognised Benefit Liability 18 460 067 15 762 816<br />

The amounts recognised in the Statement of Financial Position are as follows:<br />

2009 2008<br />

R<br />

R<br />

Present value of fund obligations 18 460 067 15 762 816<br />

Unfunded Accrued Liability 18 460 067 15 762 816<br />

Unrecognised Actuarial Gains/(Losses) - -<br />

Total Benefit Liability 18 460 067 15 762 816<br />

The amounts recognised in the Statement of Financial Performance are as follows:<br />

2009 2008<br />

R<br />

R<br />

Current service cost 970 945 789 358<br />

Interest cost 1 659 576 1 047 036<br />

Actuarial losses/(gains) 601 214 1 081 556<br />

Total Post-retirement Benefit included in Employee Related Costs (Note 22) 3 231 735 2 917 951<br />

152