Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

102<br />

FINANCIAL AND OPERATING PERFORMANCE<br />

Cash flow and liquidity<br />

<strong>Hydro</strong> expects that cash from continuing operations, together with its liquidity holdings and available credit facilities, will be<br />

sufficient to cover planned capital expenditures, operational requirements, and financing activities in 2012.<br />

1) Excluding amounts relating to the Vale Aluminium acquisition.<br />

Long-term borrowing and funding requirements<br />

Norsk <strong>Hydro</strong> ASA has a USD 1.7 billion revolving multi-currency credit facility with a syndicate of international banks,<br />

maturing in July 2014. There was no borrowing under the facility as of December 31, 2011. See note 30 to the consolidated<br />

financial statements for additional information.<br />

Planned capital expenditures and other potential financing requirements in 2012 will be covered by internally generated funds<br />

in addition to external funding.<br />

<strong>Hydro</strong> has the ambition over time to access the national and international bond markets as its primary source for external<br />

funding of long-term capital requirements. The revolving facility will continue to serve primarily as a back-up for unforeseen<br />

funding requirements and will therefore be maintained as a reserve.<br />

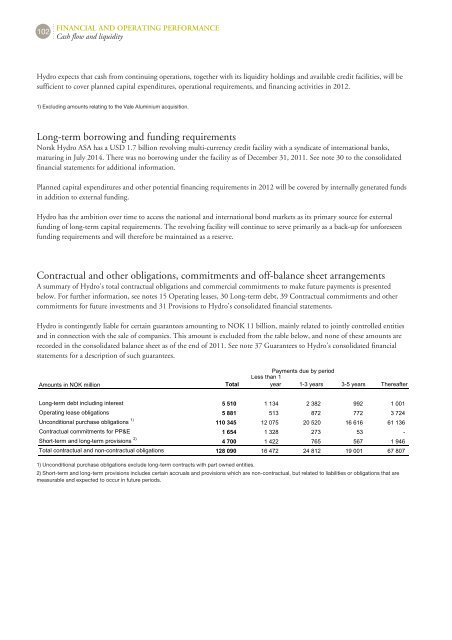

Contractual and other obligations, commitments and off-balance sheet arrangements<br />

A summary of <strong>Hydro</strong>'s total contractual obligations and commercial commitments to make future payments is presented<br />

below. For further information, see notes 15 Operating leases, 30 Long-term debt, 39 Contractual commitments and other<br />

commitments for future investments and 31 Provisions to <strong>Hydro</strong>'s consolidated financial statements.<br />

<strong>Hydro</strong> is contingently liable for certain guarantees amounting to NOK 11 billion, mainly related to jointly controlled entities<br />

and in connection with the sale of companies. This amount is excluded from the table below, and none of these amounts are<br />

recorded in the consolidated balance sheet as of the end of 2011. See note 37 Guarantees to <strong>Hydro</strong>'s consolidated financial<br />

statements for a description of such guarantees.<br />

Amounts in NOK million Total<br />

Payments due by period<br />

Less than 1<br />

year 13 years 35 years Thereafter<br />

Longterm debt including interest 5 510 1 134 2 382 992 1 001<br />

Operating lease obligations 5 881 513 872 772 3 724<br />

Unconditional purchase obligations 1)<br />

110 345 12 075 20 520 16 616 61 136<br />

Contractual commitments for PP&E 1 654 1 328 273 53 <br />

Shortterm and longterm provisions 2)<br />

4 700 1 422 765 567 1 946<br />

Total contractual and noncontractual obligations 128 090 16 472 24 812 19 001 67 807<br />

1) Unconditional purchase obligations exclude long-term contracts with part owned entities.<br />

2) Short-term and long-term provisions includes certain accruals and provisions which are non-contractual, but related to liabilities or obligations that are<br />

measurable and expected to occur in future periods.