Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

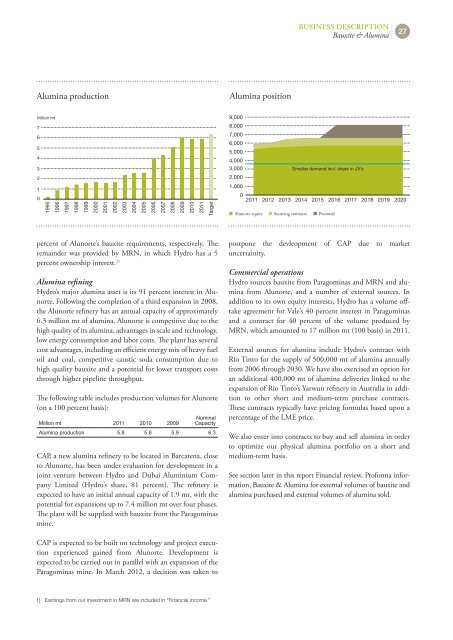

Alumina production<br />

Million mt<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

percent of Alunorte’s bauxite requirements, respectively. The<br />

remainder was provided by MRN, in which <strong>Hydro</strong> has a 5<br />

percent ownership interest. 1)<br />

Alumina refining<br />

<strong>Hydro</strong>’s major alumina asset is its 91 percent interest in Alunorte.<br />

following the completion of a third expansion in 2008,<br />

the Alunorte refinery has an annual capacity of approximately<br />

6.3 million mt of alumina. Alunorte is competitive due to the<br />

high quality of its alumina, advantages in scale and technology,<br />

low energy consumption and labor costs. The plant has several<br />

cost advantages, including an efficient energy mix of heavy fuel<br />

oil and coal, competitive caustic soda consumption due to<br />

high quality bauxite and a potential for lower transport costs<br />

through higher pipeline throughput.<br />

The following table includes production volumes for Alunorte<br />

(on a 100 percent basis):<br />

Million mt 2011 2010 2009<br />

Nominal<br />

Capacity<br />

Alumina production 5.8 5.8 5.9 6.3<br />

CAP, a new alumina refinery to be located in Barcarena, close<br />

to Alunorte, has been under evaluation for development in a<br />

joint venture between <strong>Hydro</strong> and Dubai Aluminium Company<br />

Limited (<strong>Hydro</strong>’s share, 81 percent). The refinery is<br />

expected to have an initial annual capacity of 1.9 mt, with the<br />

potential for expansions up to 7.4 million mt over four phases.<br />

The plant will be supplied with bauxite from the Paragominas<br />

mine.<br />

CAP is expected to be built on technology and project execution<br />

experienced gained from Alunorte. Development is<br />

expected to be carried out in parallel with an expansion of the<br />

Paragominas mine. In March 2012, a decision was taken to<br />

1) Earnings from our investment in MRN are included in “Financial income.”<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

Target<br />

Alumina position<br />

9,000<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

2011 2012<br />

Alunorte equity<br />

2013<br />

BusIness DesCrIptIon<br />

Bauxite & Alumina<br />

2014<br />

Sourcing contracts<br />

Smelter demand incl. share in JV’s<br />

2015<br />

2016<br />

Potential<br />

2017<br />

2018<br />

2019<br />

27<br />

2020<br />

postpone the devleopment of CAP due to market<br />

uncertainity.<br />

Commercial operations<br />

<strong>Hydro</strong> sources bauxite from Paragominas and MRN and alumina<br />

from Alunorte, and a number of external sources. In<br />

addition to its own equity interests, <strong>Hydro</strong> has a volume offtake<br />

agreement for vale’s 40 percent interest in Paragominas<br />

and a contract for 40 percent of the volume produced by<br />

MRN, which amounted to 17 million mt (100 basis) in 2011.<br />

External sources for alumina include <strong>Hydro</strong>’s contract with<br />

Rio Tinto for the supply of 500,000 mt of alumina annually<br />

from 2006 through 2030. We have also exercised an option for<br />

an additional 400,000 mt of alumina deliveries linked to the<br />

expansion of Rio Tinto’s yarwun refinery in Australia in addition<br />

to other short and medium-term purchase contracts.<br />

These contracts typically have pricing formulas based upon a<br />

percentage of the LME price.<br />

We also enter into contracts to buy and sell alumina in order<br />

to optimize our physical alumina portfolio on a short and<br />

medium-term basis.<br />

See section later in this report financial review, Proforma information,<br />

Bauxite & Alumina for external volumes of bauxite and<br />

alumina purchased and external volumes of alumina sold.